- Kotak Bank reported a 6.76% YoY drop in standalone net profits for F1 2026, equivalent below median analysts' forecast.

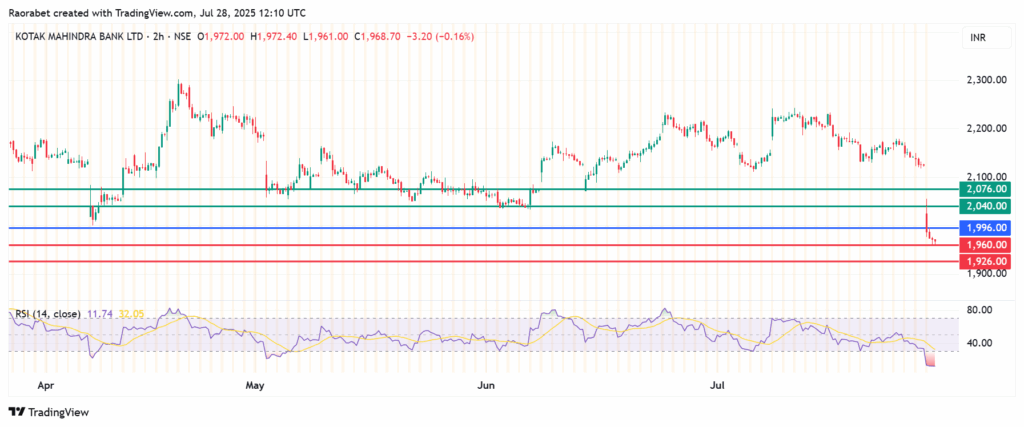

Weak quarterly results sent Kotak Bank share price nosediving on Monday, with the stock down by more than 7% in late afternoon session, and trading at ₹1,970 after gapping down. Action below the psychological ₹2,000 support signifies a sour sentiment that could see the stock experience an extended decline in the coming days. The downtrend is linked to weak quarterly earnings results which has spooked investors.

Kotak Mahindra Bank (NSE: KOTAKBANK) reported standalone net profits of ₹3,282 crore for F1 2026, equivalent to a 6.76% year-on-year decline and below analysts’ forecasts. A key concern will be that the decline came despite the bank posting a 6% YoY jump in Net Interest Income (NII) to ₹7,259 crore. That signals deeper-lying business model weakness that could get worse if the Reserve Bank of India (RBI) slashes interest rates. With today’s loss, the stock is on course to register the worst day of the year, and that could exacerbate the current bearish sentiment.

On positive note, the Kotak Bank saw its deposit and loan book grow significantly during the reported quarter, pointing to a strong customer base. Loans grew by 18.5% YoY and about 4.4% on a quarterly basis, signaling that the bank’s core lending business remains on the growth path. Also, Current Account Savings Account (CASA)ratio declined slightly to 44.6%, it remains one of the highest among private lenders. Furthermore, deposits grew to by about 20% on an annual basis, significantly higher than the industry average.

Kotak Bank Share Price Prediction

Kotan Bank share price pivot mark is at ₹1,996 and the momentum signals a likely extension of the downside below that level. With the sellers in control, the coin will likely have its initial support at ₹1,960. However, a stronger momentum will break below that level and could push the action lower and test ₹1,926.

On the other hand, going above ₹1,996 will favour the buyers to take control. If that happens, Kotan Bank share price could encounter the first resistance at ₹2,040. Breaking above that level will invalidate the downside narrative and could clear the path to test ₹2,076 in extension.