- UnitedHealth reported a strong double-digit revenue growth in challenging environment in Q3 2025. We discuss what this means for its outlook.

UnitedHealth Group (NYSE: UNH) just reported its earnings for the third quarter of 2025, and they show a blend of strength and calm confidence that we’ve come to expect from the company. The company’s official financials show that revenues were $113.2 billion, a strong 12% increase from the same period last year. This was primarily driven by UnitedHealthcare’s 16% jump to $87.1 billion.

The main reason for the growth was the rise of Medicare and state programs, which now support 50.1 million people, up almost 800,000 from last year. Optum brought in $69.2 billion, which is an 8% increase, with its pharmacy division leading the way. Meanwhile, the Group’s adjusted EPS was $2.92, which was more than 6% more than what analysts projected. GAAP, on the other hand, was $2.59, which was lower than expected because of operational noise.

What do the Earnings tell us?

Stephen Hemsley, the CEO, hailed the last quarter as a “solid execution” on the way to “durable growth” into 2026. This time, there were no major cyberattack scars, so the results were just showing off operational strength.

The Optum services division is still a strong driver of growth. However, the insurance arm, UnitedHealthcare, is dealing with rising medical costs and the effects of policies like the Inflation Reduction Act, which has hurt its operating margin. Even though the industry is facing some tough times, the management’s ability to deal with the problems and still raise the full-year prediction is a solid sign of their deep strategic moat.

Post-Earnings Outlook

There may not have been any fireworks, but the stock’s outlook after results is still bullish. Shares rose by 1.5% in premarket trading to roughly $367.80, ignoring a small revenue miss. TipRanks analysts have give the UnitedHealth stock a Moderate Buy rating because they like the raised full-year outlook to at least $16.25 adjusted EPS, which is higher than the $16.22 average.

Generally, Wall Street thinks UNH is a steady climber in healthcare, thanks to stable policies and acquisitions like Amedisys. Sure, regulatory problems or rate hikes could hurt, but this beat could be a “buy the dip” opportunity for long-term investors. If you want to go in, it’s less about the drama and more about the steady dividend yield going up.

UnitedHealth Stock Technical Outlook

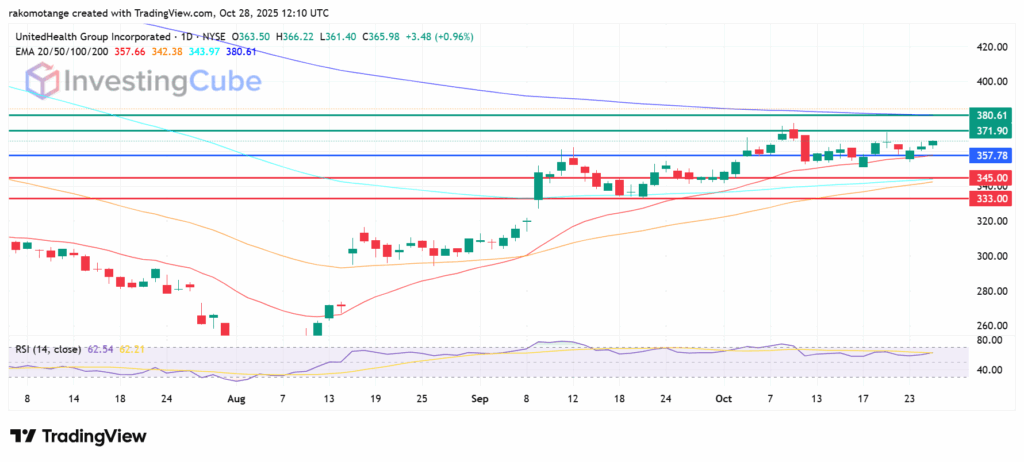

UnitedHealth stock price is above its 20-day EMA at $357.66 and its pivot at $357.78, which shows that the stock is likely to keep going higher. Primary support is at 345.00, and a break below that level could clear the way to test $333, which has been a stable support for the last month.

Traders should keep an eye on the immediate resistance level at $371.90. If the price stays above this level, it could breach the $380 mark and potentially set the stage to test important psychological and long-term resistance level at $400. RSI is at 62, is bullish, and presents an opportunity to run without the risk of being overbought

UnitedHealth stock price daily chart and EMA indicators. Source: TradingView

Yes. Most analysts have a moderate buy rating on the stock, and its technical setup above key moving averages signals likely control by the bulls.

Revenue growth was primarily driven by UnitedHealthcare division’s 16% growth in subscriptions, which saw the number of users grow by about 800k during the quarter.

Investors were upbeat after the medical industry giant reported revenues of $113.2 billion and EPS of $2.92, with both metrics beating analysts’ consensus figures despite a challenging operating environment.