- In today's top stock article, we discuss how Tesla, Nvidia and Eli Lilly stocks have it going for them despite a jittery market sentiment.

The stock market is today at a crossroads as investors weigh the implications of an impactful tariff ruling by the US Supreme Court. Also, there have been murmurs of a potential market bubble created by tech stocks. Nonetheless, Nvidia, Tesla and Eli Lilly stocks stand a good chance of defying the odds.

Nvidia Stock Prediction

This morning, based on pre-market data, Nvidia Corporation (NASDAQ: NVDA) was up significantly in the pre-market. That momentum arrives even as market jitters and profit taking in the tech sector sent stocks skidding earlier this week.

The thing that’s driving them is this continuous, insatiable demand for their specialized chips, especially from data centers building out AI infrastructure. And any indication of positive commentary from an analyst or some general risk-on sentiment returning to tech will likely send this stock higher.

Analysts at Goldman point out that Nvidia has been leading the surge, with AI capex eating 94% of Big Tech cash flows and note that such a streak doesn’t tend to last.

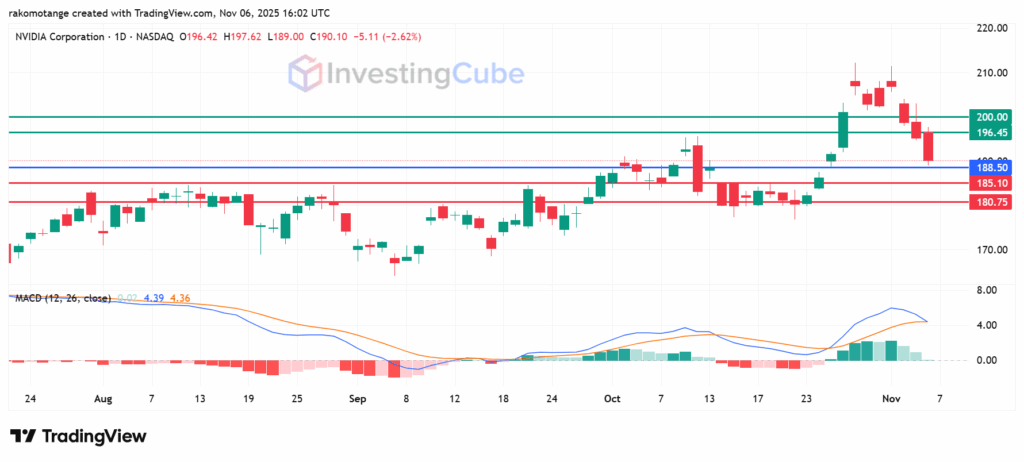

NVDA Price Forecast

NVDA’s long-term outlook looks solid, with rising moving averages and a strong MACD keeping the bullish trend intact, even if the stock’s been bouncing around lately. There’s key support around $188, below which the next two will likely be in the $180-$185 range. On the flip side, resistance sits up near $196, but a stronger momentum could see it retest the psychological $200. If NVDA pushes past that, the bulls really get going again.

Nvidia stock on the daily chart with MACD as of November 6, 2025. Source: TradingView

Tesla Stock Price

Today’s likely gain has little to do with any specific, immediate company news and a lot more about a sentiment-driven bounce and return of risk appetite after some recent profit-taking. Tesla (NASDAQ: TSLA) is still the world’s leading electric car company despite competition, and any macro data showing consumer resilience or dovishness from the Fed can spur on a rally.

Elon Musk’s podcast blitz, teasing 1,000 Bay Area units by year-end as noted in CNBC’s November 3 coverage, has Deutsche Bank hiking targets to $470, a 3% upside from Friday’s close. Also, there’s the sentiment bubbling under caused by expectations that the $1 trillion compensation package proposed for Musk will win shareholder’s vote. Add in EV rebound sentiment amid falling rates (Fed cuts still on deck for 2025, per Reuters polls), and Tesla’s primed for a significant leap.

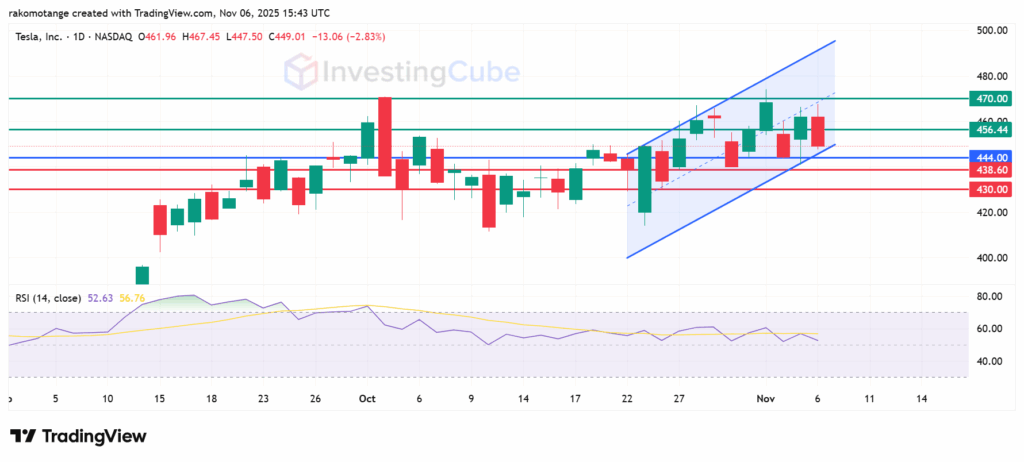

Tesla Stock Forecast

TSLA is moving up in a steady channel, which tells us it’s doing well for now. But, the RSI hints that the stock might be losing some steam. If it dips, watch for support around $430-$438. On the upside, initil resistance will likely be at $456, with the second one likely at $470. If TSLA can push past that, expect the climb to keep going, with a new high of $480 becoming the level to beat.

Tesla stock on the daily chart with RSI as of November 6, 2025. Source: TradingView

Eli Lilly and Company (LLY)

Breakthrough drug development is the foundation of Eli Lilly’s success, in contrast to the cyclical forces propelling the tech titans. According to Disfold’s most recent S&P rankings, Lilly is the wildcard from the healthcare sector, slipping into the top 20 by market capitalization with a healthy $832 billion valuation as of yesterday’s close.

But most notably, the staggering potential of its obesity drug currently in the experimental stages has kept investor enthusiasm at an all-time high. On Tuesday morning, Investing.com reported that the tests showed that the actions proved, in mid-stage trial, to significantly reduce weight among patients. Clinical success in trials is the lifeblood of pharmaceutical valuation, and the market is re-pricing LLY based on the multi-billion-dollar opportunity in the obesity and diabetes market.

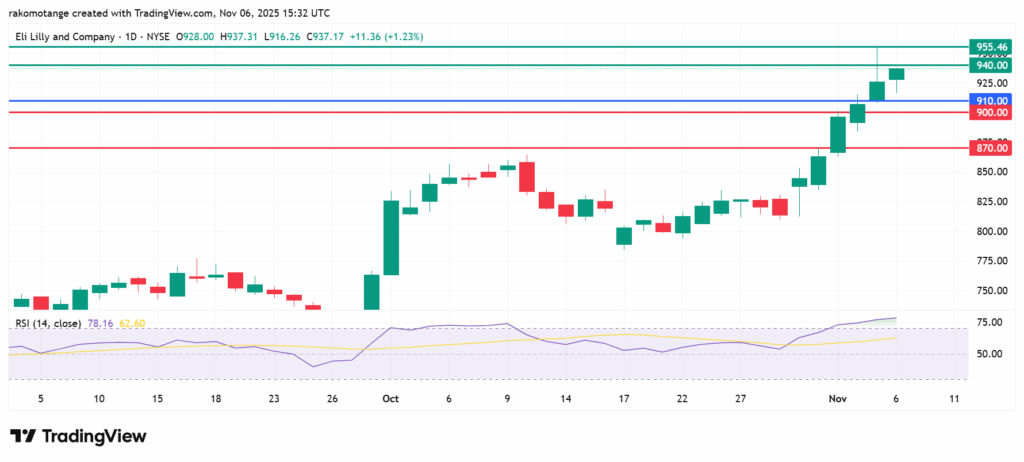

Eli Lilly Stock Chart

Away from tech, Eli Lilly (NYSE: LLY) stock is on a serious upswing, sitting pretty above its major moving averages. There’s a lot of buying going on because of some good news about the company. The 14-day RSI at 77 shows it’s a Buy, but it’s also overbought, so it might run out of steam soon. It seems to have good support around the $870 – $900 range, with the pivot at $910.

Primary resistance will likely be at $940, but an extended control by the buyers could push it higher to test the all-time high of $955. If it can’t break through that, it might just level off for a bit.

Eli Lilly stock on the daily chart with RSI as of November 6, 2025. Source: TradingView

Eli Lilly’s surge is driven by the promising results from its experimental obesity drug trials. This potential breakthrough represents a multi-billion-dollar market opportunity, boosting investor confidence in the stock.

As the dominant global EV player, Tesla is highly sensitive to broad market sentiment and risk appetite. Its stock often shoots up way more than others when the market’s doing well or even when there’s just a bit of good news floating around primarily because of high expectations of AI integration.

Nvidia has established itself as an AI powerhouse, dominating with cutting-edge GPUs that fuel data centers and machine learning innovations. Its unmatched ecosystem keeps it ahead, drawing investors eager for exposure to the explosive growth, even during periods of market uncertainty.