- Tech giants, Nvidia, Microsoft and Google have fresh impetus backed by earnings reports that beat forecasts amidst increased capex.

The IT sector is driving the current market, as shown by major indices including S&P 500 and Dow Jones Index achieving record highs one after the other. Three stocks, Nvidia (NASDAQ: NVDA), Microsoft (NASDAQ: MSFT), and Google (Alphabet), are signaling readiness to break out. The key factors in play include the continuing AI hype, the thaw in trade rhetoric between Trump and Xi, and the Fed’s support. below, we discuss why these stocks are likely to be among top gainers in the near-term.

Nvidia

Nvidia’s Graphic Processing Units (GPUs) are the most important pieces of hardware for almost all major AI projects across the world. The stock has been on an incredible ride, and it recently made history by becoming the first company to have a market value of more than $5 trillion.

In the last 24 hours data came out signaling increased capital expenditure (capex) by top tech companies. For example, Microsoft’s Azure grew by 39% and Alphabet’s cloud backlog grew. These numbers directly affect GPU purchases. Also, industry whispers say that Blackwell chips will still be “supply-constrained into 2026,” and the U.S.-China semiconductor diplomacy takes away a long-term problem.

Technical Analysis

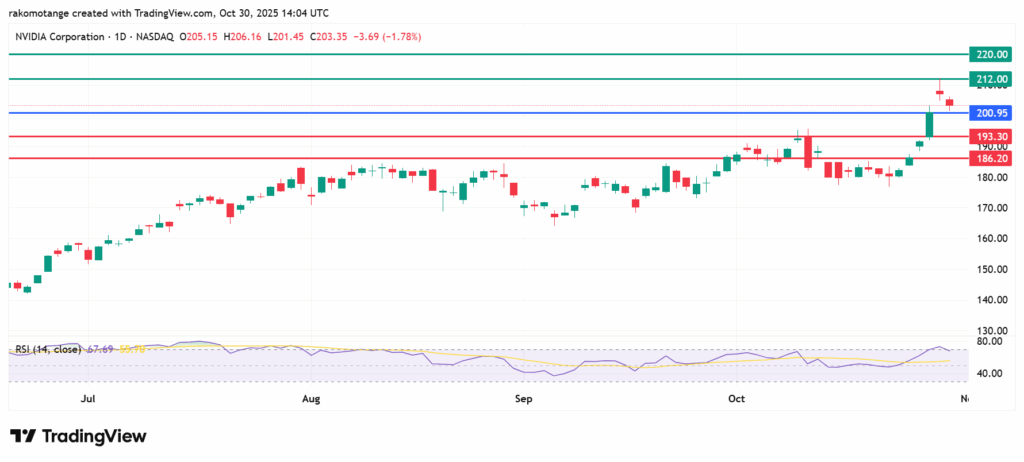

Based on the current technical indicators, NVDA stock price is clearly a “Strong Buy” with a favorable trend in place. The 14-day Relative Strength Index (RSI) is high at about 67, which shows significant buying interest, but it is getting close to being overbought. Initial resistance will likely be at previous highs of $212. Flipping that into a support could see the stock test $220.

The primary support is at the $200 psychological mark. Breaking below that level could see the stock retest the previous breakout level of $193.30. An extended control by the buyers could send the stock lower to test $186.20., which is another clue that the market is going up.

Nvidia stock daily chart with key resistance and support levels. Source: TradingView

Alphabet

Google (Alphabet) is made yesterday night’s earnings into a spectacular show. Its quarterly revenue reached $102.3 billion, a 16% increase from a similar quarter last year. In addition that figure was $2.2 billion more than expected. Also, its EPS of $2.87 was $0.61 higher than what most analysts thought it would be.

But the big news was Google Cloud, which had $15.2 billion in sales, a 34% increase, and a 24% operating profit. That was the division’s first quarter ever with a profit, which is a big deal. TipRanks analysts quickly gave the stock “Strong Buy” upgrade, saying that the $155 billion backlog screams AI monetization. The stock jumped 7% before in the premarket session, setting the stage for likely uptrend later in the day.

Technical snapshot

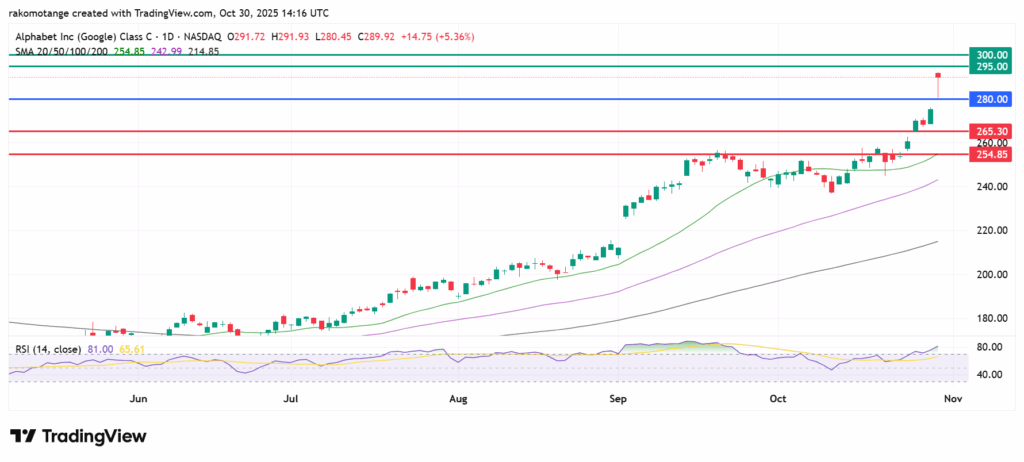

The 14-period RSI for GOOGL is 81.00 which is bullish but screaming overbought in a confirmed rally. The first level of resistance is likely to be at $295, just above yesterday’s highs. If it breaks through that level, it could go up to test the psychological $300. The pivot is at $280, with initial support at $265. A break below that level could potentially see Alphabet stock price test the 20-day SMA at $254.85.

Alphabet stock daily chart. Source: TradingView

Microsoft

Microsoft (NASDAQ: MSFT) stock outlook today hinges on the old saying, “sell the news, buy the dip.” The company’s conference call was lit up by Azure’s 39% growth, which was more than the 37% predicted, and Copilot adoption numbers. However, a $3.1 billion charge from OpenAI and higher capital expenditures guidance caused a 2–4% drop after hours. But you have to look at this small drop in context. Microsoft’s Q1 revenue of $78 billion, an 18% rise over the same time last year, was more than expected.

By morning, CNBC anchors were dubbing it “a strong start to FY26,” and the 50-day moving average at $525 drew in dip-buyers. The same cloud tailwinds that help Alphabet and Nvidia also help Azure’s profitability. The volume before the market opens is already leaning toward green, and X threads are talking about how the charge is just a one-time noise event in a multi-year AI buildout.

Technical Analysis

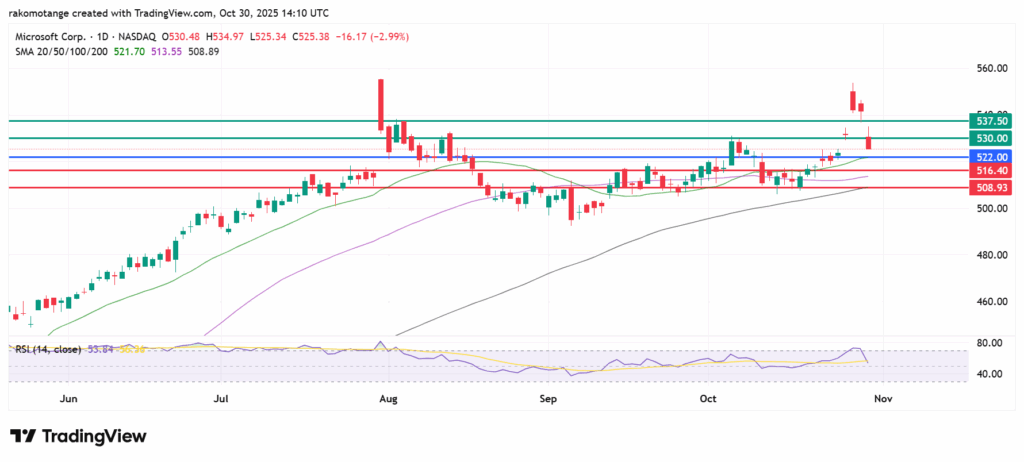

From a technical point of view, Microsoft stock still has a “Strong Buy” rating. An RSI of 53 shows that its momentum is likely to stay on the upside trajectory. Microsoft stock price is also staying above its 20, 50, 100 and 200-day moving averages, adding support to the bullish view.

The resistance at the $530 is an important level to keep an eye on for today’s move. A strong break above this figure could give the market the push it needs to test the next resistance level at $537.50. Primary support is at $522 pivot, marginally above the 20-day SMA. The next one is likely at around the $516.40 level. The stronger support base is at $508.93, which should cushion against any pullbacks.

Microsoft stock daily chart with key resistance and support levels. Source: TradingView

The primary catalyst is the AI Revolution, fueled by massive spending on cloud infrastructure and AI models, as evidenced by recent earnings.

Nvidia is the top producer of high-performance GPUs which are central to the AI industry’s growth. Therefore, increased capex signals more income.

There is a positive sentiment after the company became the first to hit $5T market cap milestone. Also, there is a significant capex boom and strong Blackwell demand into 2026.