- Stock markets are currently experiencing increased pressure on trade uncertainty. However, Barclays, JP Morgan and IBM stocks are looking up.

Each of Barclays, JP Morgan, and IBM stocks have a catalyst that favours their upside today. Generally, we have earnings reports and sector strength in play today. These could lead to gains today or soon after. The three stocks are worth keeping an eye on in this unpredictable market because their year-to-date performances have been impressive.

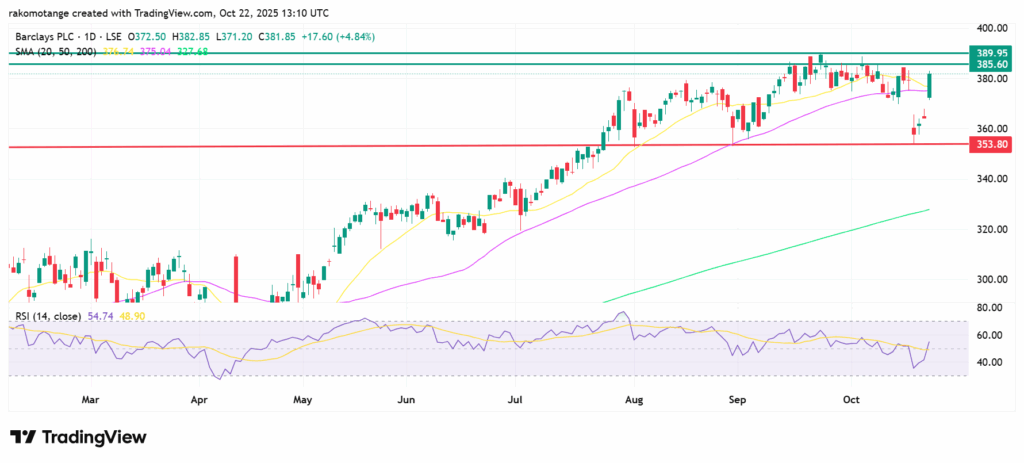

Barclays Share price

Barclays is doing well this morning, mostly because of a strong earnings announcement for the third quarter. Reports indicate that Barclays made £7.2 billion in total income, which is well above the £7 billion that internal analysts had expected. According to financial news outlets like City AM, that’s an impressive 9% increase over last year, which shows that company is doing well.

But the real kicker that gets investors excited is that Barclays (LSE: BARC) wants to switch to a quarterly share buyback program, starting with a new £500 million buyback. When a company buys back shares, it shows that it believes in its future growth. This lowers the number of shares outstanding, which is usually a bullish sign that shareholder returns will go up.

Barclays Technical Analysis

Things look mixed on the technical side. Barclays stock price has a generally positive long-term trend, as seen by the price being above the rising 200-day Simple Moving Average (SMA). This is usually taken as a classic long-term signal. Having said that, the most recent short-term activity has been neutral to bearish, with the price going below the 20-day and 50-day SMAs.

Key resistance is likely to be in the 385.60p to 389.95p range. If BARC breaks cleanly above, it could mean that the larger uptrend is starting again. The most immediate support level is likely to be close to the previous trading range low, which is at 353.80p. It will need to hold this level if the stock goes back down after today’s rise.

BARC stock daily chart. Source: TradingView

JP Morgan Share price

On Tuesday, JP Morgan’s stock price closed at $297.10, down 1.74%, with 5.7 million shares traded. But this is probably just a break after a great run, and there are reasons to think that things may pick up or perhaps get better by the end of the week. The bank’s most recent Q3 earnings were great, bringing in $46.43 billion. Since there isn’t any bad news today, this could be a good time to look for investors looking for bargains.

CEO Jamie Dimon’s comments on the economy’s strength have kept investors’ spirits up. The stock is doing better than the S&P 500, with a year-to-date gain of 26.57% compared to the S&P 500’s 14.52%. If the market moves in favor of financials amid the ongoing trade talks, JPM might rise back to its highs.

JP Morgan Technical Analysis

JP Morgan Chase stock price is currently above the rising 50-day and 200-day SMAs, which is an indication that the long-term trend is healthy. It has, however, lately fallen below the 20-day SMA, which is a mixed short-term signal.

The main resistance is around $310. If this level breaks, it would be a strong positive sign that the stock is going to keep going. The initial zone of solid support, however, is close to $294.15. If the stock price goes down, it’s very important to hold this level. The major trend support will probably come in substantially lower, around $286.90.

JP Morgan stock daily chart. Source: TradingView

IBM Share price

IBM is the old tech company that is reinventing itself with AI. According to TradingView charts, it closed at $282.05 on Tuesday, down 0.56% on a volume of 4.08 million shares. But here’s the good news. The company’s earnings are due today, and if they surpass expectations like they did in Q2, we should see gains in after hours.

The hope of a possible earnings beat, which is based on optimism before earnings and strong demand for AI-driven solutions, is also key reason for surges before the market opens.

Meanwhile, analysts are excited about IBM’s efforts on GenAI and hybrid cloud, especially since the company’s revenue grew by 5% in constant currency last quarter.

IBM Technical Analysis

From a technological point of view, IBM looks like it will go up. According to TradingView charts, it recently broke over the 20-day moving average. Its 50-day moving average at $269 is higher than its 200-day moving average at $260.3, which is a bullish sign. Support will likely come around $272.50 and resistance could come around $301.40 (the 52-week high). Happy trading!

IBM stock daily chart. Source: TradingView

Barclays’ stock is expected to gain due to a strong earnings in Q3 which exceeded analysts’ expectations. Also, the announcement of a new £500 million share buyback program and trading above the rising 200-day Simple Moving Average (SMA), support a long-term uptrend.

IBM’s gains could come from its AI and hybrid cloud emphasis, potentially shining in today’s earnings report. Also, its gains in enterprise tech have keep it relevant.

Traders should focus on the $316 level, near the recent 52-week high as the major resistance level. On the other hand, immediate support for the stock is likely to be around $297.55.