- Tesla stock price is in a see-saw with investors weighing the implications of Elon Musk's political ambitions against robotaxi growth plans.

Tesla stock price returned to the upside on Thursday, retesting the psychological $300 mark. The EV maker has been under pressure in recent days as investors disapprove of CEO Elon Musk’s political maneuvers. On the flip side, Musk’s comments regarding robotaxi service expansion over the weekend has strengthened investor enthusiasm. Also Musk stated that a second rollout is planned to hit the Bay Area in San Francisco, California once the state authorities’ approval.

However, while the robotaxi expansion fuels enthusiasm, weak sales have teamed up with governance concerns to pull in the opposite direction. Tesla (NASDAQ: TSLA) reported a 13% drop in Q2 deliveries amid tightening competition in its key markets of China and Europe. The decline was partly attributed to Musk’s tenure at DOGE. Furthermore, the company is losing its leadership in the Chinese EV market, where BYD’s Q1 sales proved that point. Also, BYD’s fast charging technology gives it an edge.

Meanwhile, its not all smooth sailing for Tesla in the robotaxi business. National Highway Traffic Safety Administration has opened investigations into multiple incidents involving the autonomously driven vehicle. These include incidents such as driving on the wrong lane, erratic breaking and exceeding speed limits. Some critics have argued that Tesla’s use of camera-only sensor system predisposes the robotaxis to such faults. These factors combined will likely exert downward pressure on Tesla stock price.

Tesla Stock Price Prediction

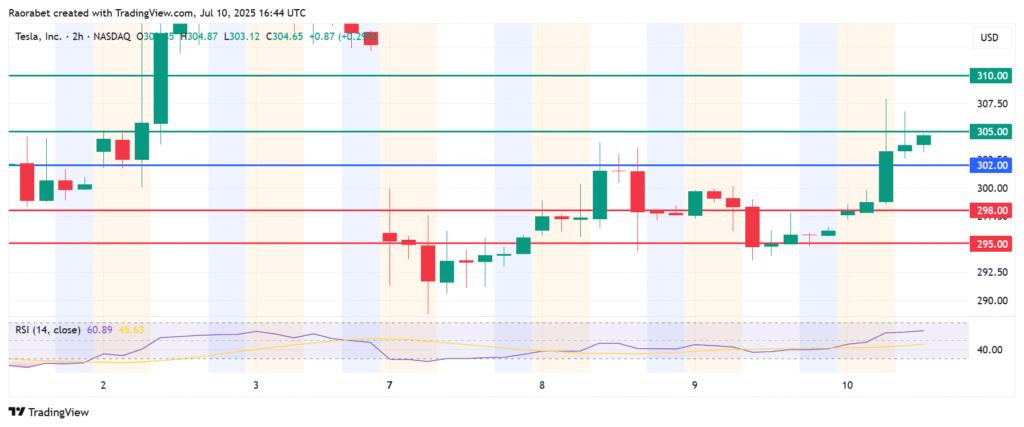

The momentum on Tesla stock price calls for further upside above $300. That will likely see initial resistance established at $305. However, an extended control by the buyers will breach that barrier and test $310.

Conversely, going below $300 will favour the sellers to take control. In that case, TSLA price is likely to go lower and find the first support at $298. Breaking below that level will invalidate the upside narrative. Furthermore, the resulting momentum could go on to test $295 in extension.