- Tesla stock price is down by more than 6% in the last month but there's a sentiment shift that could turn attention away from sales figures.

- Immediate catalysts include Elon Musk's new pay package deal and excitement around AI investments.

- Upcoming risks include an impending end to EV subsidies in key markets like the US and China.

After enduring a challenging period that saw its stock price decline by more than 6% over the last month, Tesla (NASDAQ: TSLA) appears to be exhibiting signs of renewed upward momentum. In its most recent trading session saw it close at $419, up 0.39% intraday, marking the second successive day of gains.

This is up from a low of $391 on November 21, about a 7% rise in four sessions, but still below the November high of $440. These changes show how sensitive Tesla is to the market, and it raises the question of whether this could be the start of a bigger recovery.

The Key Fundamental Drivers at Play

The recent stock movement is due to the push and pull between the challenges of making cars and the opportunities for growth. On the plus side, the market is closely watching Tesla’s long-term tech projects. Advances in self-driving software and the chance to launch the Tesla Bot and Robotaxi programs are central to the optimistic view.

At its core, Tesla’s appeal rests on robust revenue growth, with Q3 2025 marking record figures despite a 31% profit dip to rising costs and fading regulatory credits. Earnings per share stands at $1.46 trailing twelve months, supporting a market cap of $1.396 trillion, though the forward P/E of 287.49 signals high expectations for innovation.

Positive catalysts include shareholder approval of CEO Elon Musk’s new pay package and analyst upgrades, with Stifel raising its target to $508 because of Tesla’s risk-taking in self-driving tech. Deliveries beat expectations in Q3, according to company reports, boosting hopes for a recovery into 2026. But these strengths need to offset falling sales in Europe, which are down 50% recently.

The Underlying Risks and Outlook

While AI offers big long-term opportunities, investors should be aware of immediate risks. The main risk is the very high valuation. With a Price-to-Earnings (P/E) ratio much higher than the car industry average, the stock is trading on future growth expectations, leaving little room for mistakes.

Also, intensifying competition from legacy automakers, tariff-induced cost pressures, and consumer weakness could cap upside, potentially revisiting $400 supports. Morgan Stanley’s November outlook tempers enthusiasm with policy uncertainties.

Furthermore, policy changes are a real concern. As noted by firms like Mizuho, expected cuts or expirations of electric vehicle (EV) subsidies in major markets like the U.S. and China in 2026 could put more pressure on sales and profits.

Tesla Stock Chart

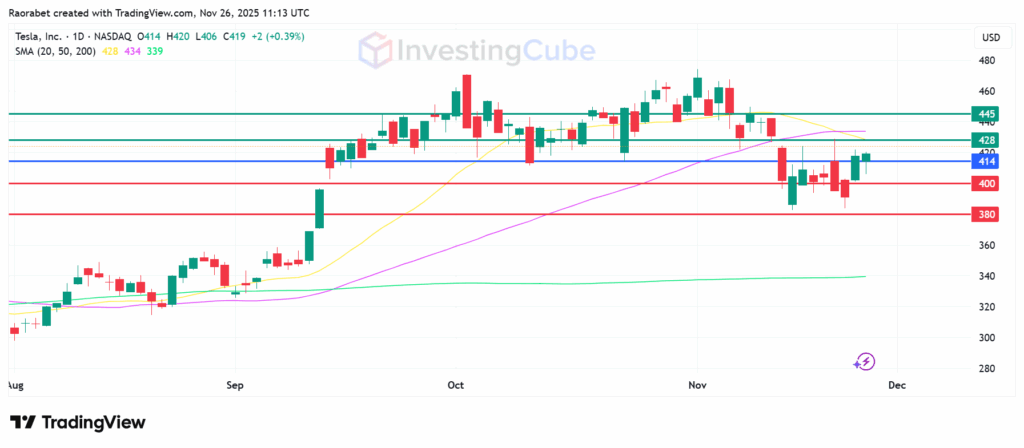

The short-term trend is having a hard time getting over the 50-day Simple Moving Average (SMA), which is an important landmark for medium-term momentum. There’s initial support around $363, and it is very important that the price doesn’t drop below this to avoid a bigger fall.

If it does break below $400, we might see it go down toward the 200-day SMA, which is around $339. On the flip side, the stock is facing resistance between $428 and $445. If it can break above this range, and especially past its recent high, it would confirm a continued upward trend.

Tesla stock price daily chart on November 26, 2025, with key support and resistance levels. Created on TradingView

Record Q3 revenue and ongoing excitement about Full Self-Driving are big factors. Earnings per share hit $1.46, and some analysts are targeting $508, even though profits have dipped due to costs.

A high P/E ratio suggests investors expect fast growth. So, the stock doesn’t have much room for error and could drop sharply if there are any problems with operations or earnings.

The anticipated reduction or expiration of EV subsidies in major markets like China and the U.S. could directly reduce consumer incentives. That could hurt demand and put added strain on Tesla’s sales.