- Tesla shareholders are set to vote on Elon Musk’s $1 trillion pay plan.

- Some big investors support it, while others say it’s too large and risky.

- The result could shape Tesla’s future leadership and investor confidence.

Tesla‘s share price advances by 17.81 points, or 4.01%, as the market awaits the results of Tesla shareholders voting on several proposals. Such proposals could reshape the future of the EV market and also let Elon Musk become the world’s first trillionaire.

The voting takes place at Tesla’s Austin, Texas factory. It ends tonight, and shareholders hold a meeting to announce the outcome. There are around 14 questions on the ballot, but only one question grabs the most attention, which is the proposed $1 trillion performance award for Musk.

This award would keep Elon Musk as Tesla’s CEO for at least another 7.5 years. Musk would be required to meet the 12 different market caps and milestones in operations mentioned in the proposal. Under these conditions, Musk would be able to amass $1 trillion over time.

Tesla’s board has already approved a massive CEO performance award for Elon Musk. It includes 12 stock-based milestones spread over 10 years. If approved, the goal is ambitious, reaching an $8.5 trillion market cap by 2035.

To unleash each stage, Tesla must hit huge operational targets: delivering 20 million cars, 1 million humanoid bots, and 1 million robotaxis, along with meeting earnings and other performance goals.

Right now, Tela’s market cap sits around $1.5 trillion. For comparison, Nvidia recently became the first company ever to surpass $5 trillion in value.

Under Musk’s proposed plan, he earns 1% voting rights for each milestone Tesla achieves. If the company manages to hit the ambitious $8.5 trillion market cap and all operational goals, Musk’s total stake could reach 12%, translating to roughly $1 trillion in compensation.

However, he wouldn’t actually receive the economic benefits of those shares for at least 7.5 years, ensuring he remains committed to Tesla over the long term.

This massive compensation plan has divided opinions; some call it a visionary reward for success, while others see it as excessive. Let’s look at both sides of the argument.

Debate Over Tesla’s $1 Trillion CEO Pay Plan:

Shareholders will also vote on several other proposals, including board member elections and a new equity incentive plan. But the spotlight is firmly on the CEO’s performance award. It’s the most controversial item on the ballot.

Some major investors have come against this controversial item in the proposal, including the Norway Sovereign Wealth Fund, the California Public Employees’ Retirement System (CalPERS), and proxy advisory firms ISS and Glass Lewis.

Officials at Norges Bank Investment Management, explaining their vote against the Musk payment plan, say:

While we appreciate the significant value created under Mr.Musk’s visionary role, we are concerned about the total size of the award, dilution and lack of mitigation of key person risk-consitent with our views on executive compensation

On the supportive side are Schwab Asset Management, ARK Invest, and the Florida State Board of Administration, all considering that the plan is a reward for Tesla’s strong growth. Cathie Wood, the ARK Invest CEO, said:

Elon Musk is the most productive human being on earth. And a human being who attracts incredible talent – people who want to solve the world’s hardest problems. This is a win-win for all of us if Elon succeeds this time

Elon Musk himself has a totally different answer when asked if he would leave Tesla if they voted him down. He said, according to the SEC:

Let’s just say I’m not going to build a robot army if I can be easily kicked out by activist investors. No way,

Tesla Share Price Prediction:

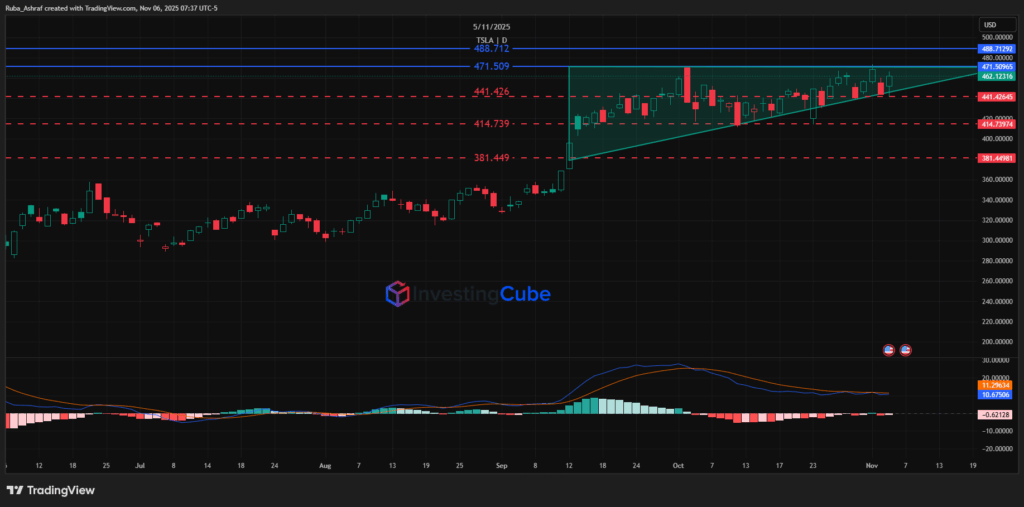

Looking at the daily chart, the price action forms an ascending triangle, which indicates that the bullish trend is intact and buyers are gaining strength. This suggests a potential price increase.

A sustained holding above 441.426 could give the share strength to test the horizontal line of the triangle at 471.509. A clear day close above the resistance level of 471.509 could pave the way toward 488.712, the high of 18 December 2024.

On the downside, if buyers lose their strength above 441.426, the bullish momentum would over toward lower levels. A clear close below 441.426 could pave the way toward 414.739, and then the second support at 381.449.

The MACD on the daily chart doesn’t indicate a clear momentum, as investors are waiting for the voting outcome. We can say that the buyer and seller currently have the same power until a new catalyst.

Based on technical indicators such as the moving average and RSI, the daily move is a strong buy.

Most of the technical indicators for Tesla are indicating a strong buy signal on daily analysis.

According to the Fibonacci retracement indicator, the pivot point is 464.31.