- Tesla's FSD version 14 has investors excited as it shows improvements that bring Tesla closer to broader rollout of self-driving cars.

- Tesla's valuation is increasingly decoupling from car sales numbers as investors focus more on tech integration

- Rising competition from China pose an existential risk

Tesla’s stock (NASDAQ: TSLA) has been really strong lately, with a clear upward trend since late November. It’s doing way better than the S&P 500 and Nasdaq, which have been struggling. Many investors are feeling upbeat about Tesla because of what the company is doing, not just what the market is doing.

Why Tesla Stock is Rallying

Investors are starting to see Tesla as more than just a car company. They think of it as a tech leader in self-driving cars and robots. The company’s Full Self-Driving (FSD) software is getting better, and the rollout of version 14 has people excited. The data shows that the number of miles driven between times when a driver has to step in is way up, so people think Tesla is close to making real self-driving cars. Testing those driverless robotaxis in some cities has people talking, too. It seems like Tesla could change the way the world transports.

For many investors, Tesla’s massive valuation is no longer justified solely by its auto sales, but by the burgeoning potential of its Full Self-Driving (FSD) technology, the pending launch of its Robotaxi service, and the development of the Optimus humanoid robot.

New All-Time Highs Before Year-End?

Whether Tesla can hit a new high before the end of the year depends on how the market does and if some key things happen soon. The current price action indicates a strong bullish bias, pushing the stock close to its all-time high of approximately $479, set in late 2024.

A sustained ‘Santa Rally’ effect in the final weeks of December, coupled with any significant, positive news flow, such as a major FSD regulatory breakthrough or an unexpected boost in Q4 delivery numbers, could certainly provide the necessary thrust.

Potential Risks to Tesla Stock Price

There are still risks to consider. Increased competition, particularly from Chinese companies offering less expensive choices, could put pressure on profits and market share. A drop in deliveries in key areas points to possible demand issues, which could get worse if the economy slows down.

Valuation concerns persist, with the stock trading at elevated multiples relative to earnings, leaving it vulnerable to corrections if autonomy milestones disappoint. Regulatory scrutiny on safety features and execution risks in scaling robotaxi operations add further uncertainty. Geopolitical factors and supply chain disruptions could also weigh on performance.

Tesla Stock Price Prediction

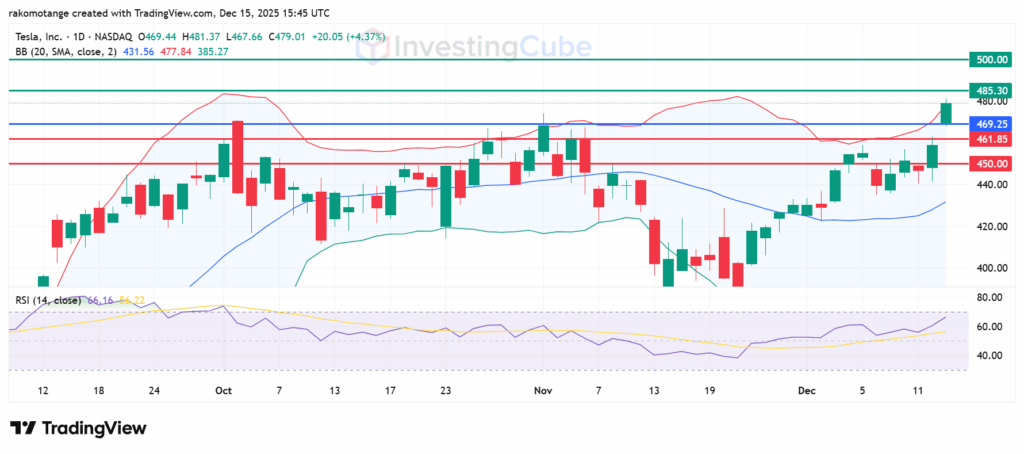

The momentum on Tesla stock price is bullish with the RSI at 66 favouring the upside without being overbought. Key resistance is near the upper Bollinger Band level at $385.30. If TSLA price manages to flip that into a support, it could target the psychological barrier at $500. The pivot is at $469.25 but if it goes down, there’s support at $461.85, below which the upside narrative will be invalid and the downtrend could extend to test the next support at $450.

Tesla stock price daily chart on December 15, 2025,with key resistance and support levels created on TradingView

Tesla’s stock is up because people are excited about self-driving improvements and robotaxi tests, so the focus is moving to AI. This means the stock isn’t so tied to EV sales anymore, and it’s doing better than the S&P 500 and Nasdaq.

The biggest risk is that the stock is expensive compared to how it’s doing right now. The stock price expects a lot of growth from future projects like Robotaxi and Optimus, but those aren’t proven yet. If those projects are delayed or don’t work out, the stock could drop a lot, very fast.

The main risks are competition from Chinese EV companies, lower demand, an expensive valuation, rules on self-driving, and possible delays in growing the robotaxi business.