- TCS share price is in a transition: revenue growth may soften, but profitability could improve, if it offsets BSNL with new business.

TCS share price closed Thursday’s session down by 0.3%, extending a downtrend that has seen it drop 0.76% in the last five sessions. The stock was at ₹ 3,382 at the end of the session and its year-to-date returns of -17% affirms the bearish hold. Tata Consultancy Services (NSE: TCS) weak standing is driven by poor Q1 expectations and on the macroeconomic friont, the delays in the India-US trade negotiations.

All eyes will likely be on its post-market earnings, which could have a ripple effect in the broader. India’s IT stocks have a significant volume of Foreign Institutional Investments (FII) due to their global exposure and links to dollar earnings, and TCS earnings will likely inform FII posture for the remainder of the week.

The low earnings expectations is primarily driven by the wind-down of the BSNL project. The project brought the company about ₹15,000 crore and significantly boosted its revenues in recent quarters. However, on the positive side, BSNL had lower margins and involved substantial expenditure on third-party software and equipment. Therefore the closure of that business could ultimately result in more profitability.

Furthermore, investors will wait to hear the progress made by TCS towards getting substitute deals in developed markets. On the flipside, unless new deals prove strong enough to match or exceed BSNL, TCS stock price could come under rising downward pressure.

TCS Share Price Prediction

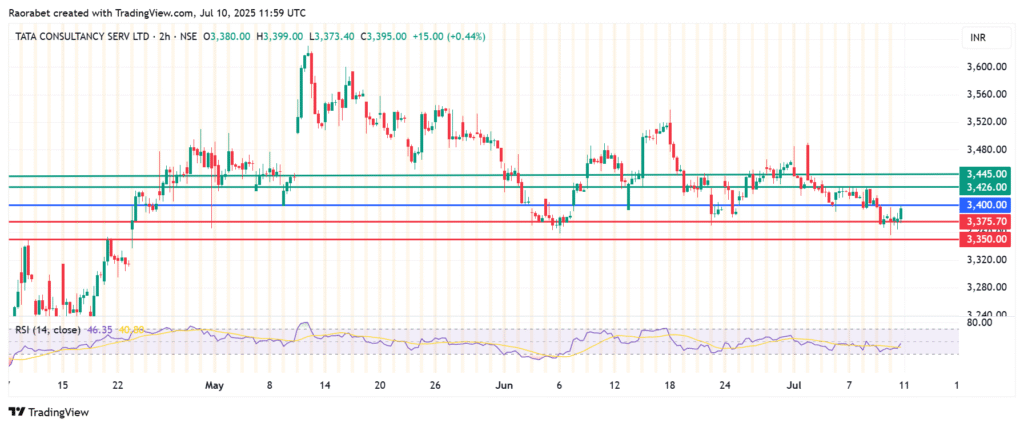

TCS share price pivots at ₹3,400 and action below that level signals control by the sellers. The stock will likely find initial support at ₹3,375. However, a stronger momentum could extend the downside and test ₹3,350.

Alternatively, going above ₹3,400 will invite the buyers to take control. With that, the upiside could extend to encounter the first resistance at ₹3,426. Breaking above that level will invalidate the downside narrative. In addition, such momentum could strengthen the upside and test ₹3,445 in extension.