- Pressure is mounting on Suzlon Energy share price as investors book profit. However, there's a momentum strong enough to keep it afloat.

Profit booking has sent Suzlon Energy share price for the third straight session on Tuesday, declining by 4.27% as of this writing. The company’s upside is supported by a strong order book, with 5.6 Gigawatts in the works. In addition, its strong Q4 results have provided proof of a strong growth impetus and strengthened investor confidence in its business model. Also, its Wind Turbine Generation grew by 23% in the last quarter, underlining its capacity to deliver on the fast-growing order book.

Suzlon Energy (NSE: SUZLON) currently has over $10 billion worth of assets under management, with an installed wind capacity of about 15 Gigawatts. The company reported revenues of Rs 1,881 crore in Q4 FY2025, up from Rs 245 crore a year earlier and gave a guidance projecting a 60% growth in FY 2026. That provides a strong basis for continuation of the upside by Suzlon Energy share price in the medium-term.

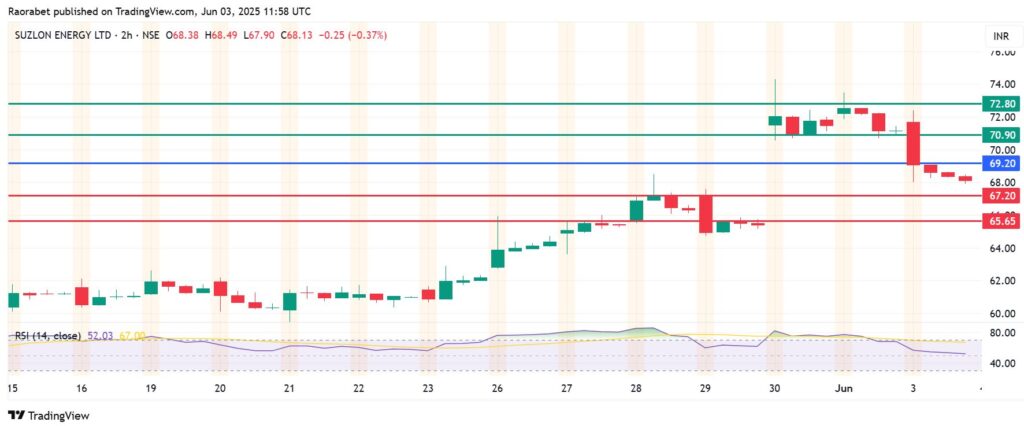

Meanwhile, despite its recent declines, the stock still trades above the 9, 20 and 50-day Exponential Moving Average (EMA) level, pointing to an near-term bullish undercurrent. In addition, the Average Directional Index (ADX) is at 25 on the daily chart, suggesting the strong upward strength. However, the stock’s upside will likely be limited by the rising appetite to book profit after rising by 21% in the last month.

Suzlon Energy Share Price Prediction

Suzlon Energy share price pivot mark is at Rs 69.20 and the momentum favours the sellers to be in control. The stock will likely find its first support at Rs 67.20. A stronger downward momentum will break below that level and potentially send the price lower to test Rs 65.65.

Alternatively, breaking above Rs 69.20 will signal the onset of bullish control, with the next barrier likely to be at Rs 70.90. Breaking above that level will invalidate the downside narrative. Also, an extended control by the sellers could extend gains and test Rs 72.80.