- Rolls Royce share price has been on a strong uptrend, with a bulging order book whose crown Jewel is a £9 billion UK defence contract.

Investors are upbeat about the company’s prospects after it reported another set of strong earnings last quarter. As per the earnings results released at the end of July, the company generated £17.8 billion in revenue for the FY 2024, translating to a 16% growth. In addition, it saw a 57% jump in consolidated net profits which came in at £2.5 billion. Furthermore, it announced a £1 billion share buyback program-the first such move since the Covid 19 pandemic. This set up has strengthened investor confidence in the company’s performance, amid strong growth in its order book in the last year.

Glittering Outlook But…

The crown jewel of Rolls Royce’s glittering outlook is a £9 billion contract with the UK’s Ministry of Defence for the building of reactors for its nuclear submarines. Meanwhile, CEO Tufan Erginbilgiç’s tenure has proven effective in as far as financial discipline goes, marked with significant cost reductions and stable growth. Tufan targets £2.8 billion in operating profit and £3.1 billion in free cash flow by 2027, a figure that Rolls Royce (LON: RR.) could be on course to surpass going by its recent growth figures and bulging order book. Furthermore, strong growth by both civil aviation and defence industries underlines this outlook.

However, on the downside, Rolls Royce share price rally this year means it is currently at 38x forward earnings. This is considered an overvaluation in relative terms and leaves little room for error by the management while exerting rising pressure to deliver impressive earnings. That set-up could bring medium and long-term headwinds against the stock.

Rolls Royce Share Price Prediction

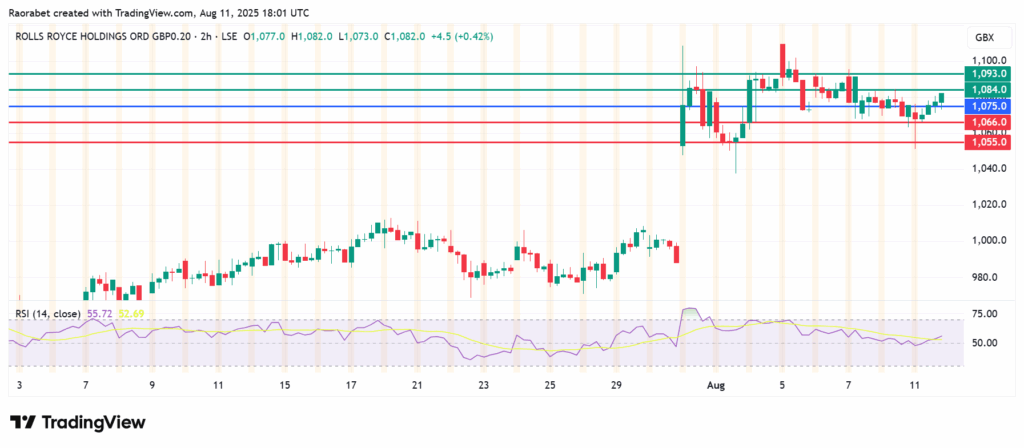

The momentum on Rolls Royce share price calls for further upside above the pivot map at 1,075p. With the buyers in control, the stock will likely meet initial resistance at 1,084p. However, a stronger momentum will breach that barrier and likely test 1,093p.

Alternatively, the momentum could shift to the downside following a break below 1,075p. If that happens, Rolls Royce share price could go lower and find its initial support at 1,066p. Breaking below that level will invalidate the upside narrative and potentially clear the path to test 1,055p.