- Today's gain was primarily a technical bounce after the sustained decline by Reliance Power share price sent it deep into oversold territory.

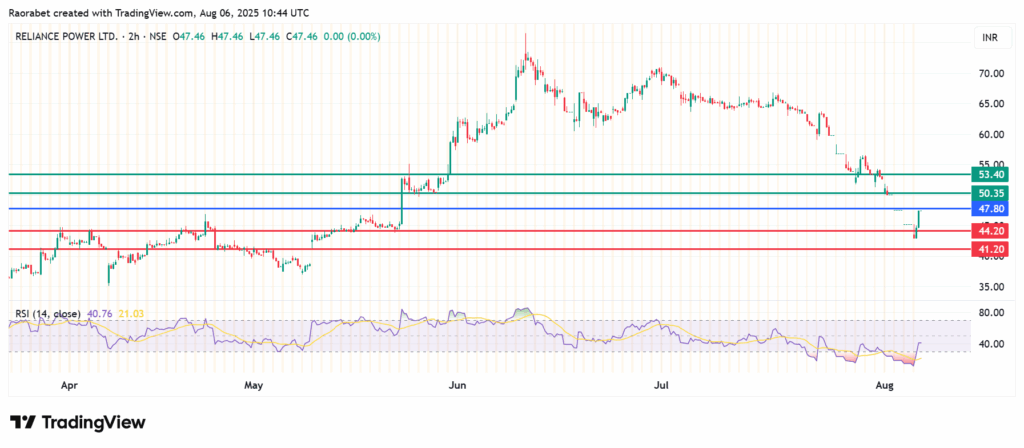

Regulatory pressures keep sending Reliance Power share price lower, with the stock on a six-session losing streak, during which it has triggered the lower circuit multiple times. The stock gained a substantial 5% in Wednesday’s trading session, triggering the upper circuit, but will need to build a stronger upside momentum to recover the 28% loss recorded in the last month. Reliance Power share price was at ₹47.46 when its trading session was brought to a stop.

Reliance Power (NSE: RPOWER) has been under investigations by India’s Enforcement Directorate (ED) for alleged bank loan fraud and money laundering amounting to ₹17,000 crore (approximately $1.937 billion). This has triggered a panic among investors and resulted in a FUD sentiment in the market. The ED has conducted raids against the company in 35 locations and summoned its top leadership, including Reliance Group Chairman, Anil Ambani. The Chairman was grilled for eight hours on Tuesday and requested for ten days to avail documentation critical to the ongoing investigations.

Today’s gain was primarily a technical bounce after the sustained decline by Reliance Power share price sent it deep into oversold territory. Notably, benchmark indices, Sensex and Nifty 50 declined by 0.2% and 0.3% successively, affirming today’s gains as company-specific. Reliance Power’s fundamentals remain weakened and hinged to the ongoing investigations. Therefore, the short-term gains are unlikely to be sustained in the absence of new and favourable developments in the case.

Reliance Power Share Price Prediction

Reliance Power share price pivots at ₹48.20 and action below that level will favour the sellers to be in control. The momentum will likely result in the first support being established at ₹47.00. However, an extended control by the sellers will break below that level and could send the stock lower and test ₹46.00.

On the other hand, action above ₹48.20 will indicate control by the buyers. In that case, the momentum will likely push the stock higher and encounter the first resistance at ₹48.50. Breaking above that level will invalidate the downside narrative, and that momentum could potentially send the stock higher and test ₹49.00 in extension.