- The ₹17,000 crore fraud investigation has immense pressure on Reliance Power Share price despite relatively strong financial standing.

Reliance Power share price edged up on Monday, gaining 1.84% at the closing bell, as investors continued to weigh the impact of the financial scandal overcasting it. Investors are at a crossroads as they asses a stream of regulatory headlines and a recent return to profitability. Also, the stock’s technical show that it is oversold, with the daily RSI at 27. This is seen as a buying opportunity by some investors, who remain optimistic of a favourable outcome in the ongoing investigations.

India’s Enforcement Directorate has been investigating Reliance Power on in a ₹17,000 crore loan fraud which has also roped in multiple subsidiaries of the broader Reliance Group. Chairman Anil Ambani was questioned last week in connection with the that also has claims of money laundering, triggering significant selling pressure on Reliance Power share price and erasing 32% of its market value in the last month.

The company has been adamant that it is innocent and argues that the ongoing inquiry pertains to historical transactions that have been fully settled. This has injected confidence among some investors, hence the mixed signals seen in the stock market in recent days.

Reliance Power (NSE: RPOWER) earnings figures in the first quarter of the fiscal year 2025-26, ending June 30, 2025, had an uptick in consolidated net profit to ₹44.68 crore from the net loss of ₹97.85 crore recorded in the corresponding quarter of the previous year. Also, its stable delivery has ensured reliable cash flow, buttressing its financial outlook for the foreseeable future. Nonetheless, the current controversy positions the company in a see-saw moment, which will likely see its stock continue to be volatile.

Reliance Power Share Price Prediction

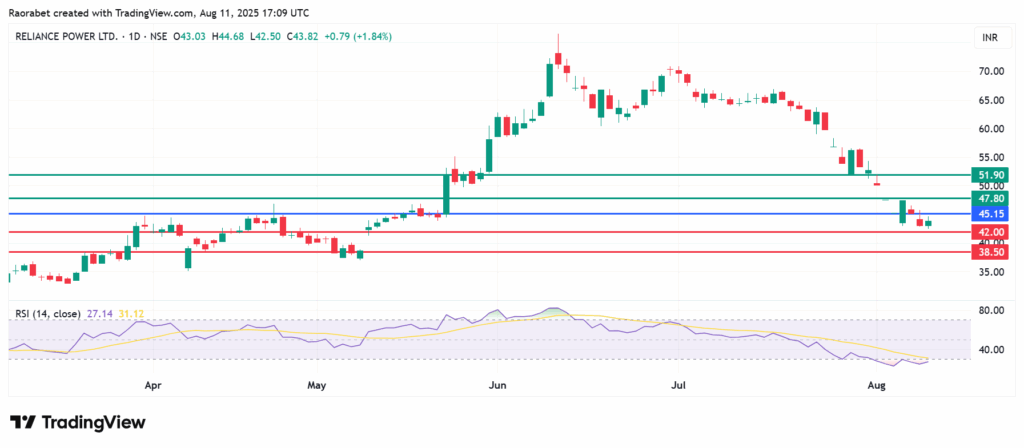

Reliance Power share price has its pivot at ₹ 45.15 and the RSI indicator reading favours the downside to prevail. That will likely see primary support established at ₹ 42. However, an extended control by the sellers will break below that level and could potentially test ₹38.50.

Alternatively, going below ₹45.15 will put the buyers in control. With that momentum in play, the stock will likely register further gains and meet the first barrier at ₹47.80. Breaking above that level will invalidate the downside narrative, and the price could go higher and potentially test ₹51.90.