- Paytm share price declined by its largest since February 2024 and the absence of Merchant Discount Rate (MDR) could men more trouble.

Paytm share price closed Thursday’s trading session down by 6.77%, underlined by disappointment over Merchant Discount Rate amid a broader market slump across Indian equities. The stock has traded downwards for the last three successive sessions and is fast building traction for an extended decline.

India’s Finance Ministry on Thursday refuted rumours that it would introduce merchant fees on unified payment interface (UPI), describing the claims as false, baseless and misleading. The rumoured introduction of Merchant Discount Rate (MDR) was seen as a potential scalable revenue stream for Paytm (NSE: PYTM). However, the government’s latest statement means that’s gone up in smoke, with UBS estimating that it could cost more than % profit decline in 2026 and 2027.

At some point during the day, Paytm share price was down by about 10%, the single largest daily loss since February 2024. Notably, Thursday’s session saw losses across the broader Indian equities markets, with the benchmark Nifty 50 Index and Sensex Index both closing down by 1%.

News of the deterioration of nuclear talks between the United States and Iran has injected a risk sentiment in financial markets, with Iran threatening to bomb US bases in the Middle East. The two nations will engage in the sixth round of negotiations in Oman, but President Donald Trump has threatened military action if they fail to reach a deal. Also, Israel is reportedly preparing to attack Iran. A continuation of this sentiment will likely add downward pressure on Paytm stock price.

Paytm Share Price Prediction

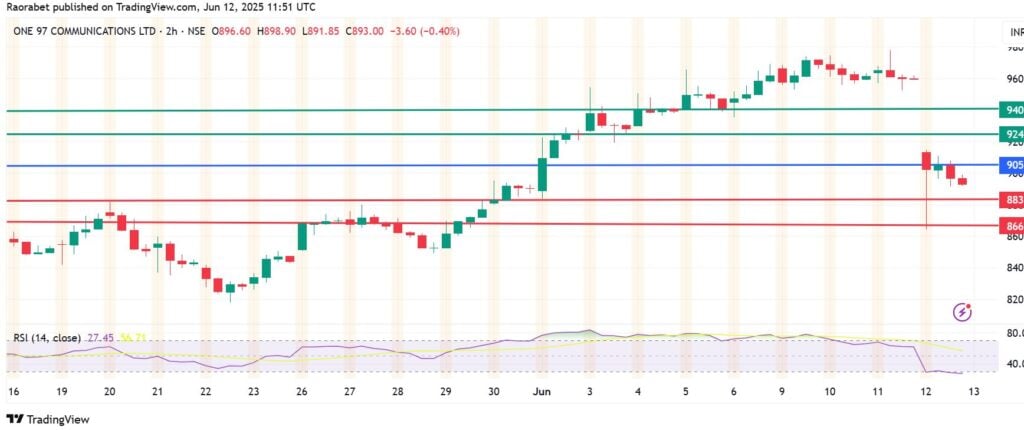

The momentum on Paytm share price favours the sellers to stay in control below the pivot mark at Rs 905. The stock will likely find the first support at Rs 883. However, an extended control by the buyers will strengthen the downward momentum and potentially test Rs 866.

Alternatively, going above Rs 905 will shift the momentum to the upside. In that case, Paytm share price will likely encounter the first resistance at Rs 924. Action above that level will invalidate the downside narrative. Also, a stronger upward momentum could extend gains and test Rs 940.