- Nvidia stock is down by more than 1% in early 2026 and rising competition from the likes of AMD adds pressure

- The momentum in 2025 was primarily driven by expectations but investors are looking for tangible payoff of massive AI capex in 2026

- Nvidia earnings call on February 2026 and China shipment data could set the stage for the 2026 momentum

Nvidia (NASDAQ: NVDA) had a record-breaking run in 2025, but it’s facing some challenges in early 2026. The stock is down just over 1% so far this year, which might not seem like much considering it went up over 1,100% in the past three years. What’s happening is that Nvidia hasn’t been able to break past the $195 mark since November 2025.

Why Nvidia Is Struggling to Replicate 2025 Magic

The slide by Nvidia stock appears rooted in concerns over an AI bubble and decelerating growth. In 2025, the market was driven by expectations. For Nvidia to get back to that level of momentum, it needs to do more than just have good numbers on earnings, February 25, 2026. It needs to that the AI boom isn’t just about building infrastructure. People in the market are paying attention to the Rubin platform release and if H200 shipments to China start up again, because those could give a boost.

Competition from AMD, which is closing the GPU market gap, adds pressure, as tech giants incorporate alternative chips, potentially slowing Nvidia’s share. This dynamic challenges the consensus that Nvidia remains recession-proof due to accelerating AI spending.

It’s important to question consensus here. Most experts, including Goldman Sachs, think revenue will stay above $67 billion each quarter. What’s often missed is the utility gap. Even though the hardware is ready, about 95% of company AI projects are having a hard time expanding because costs are too high. For Nvidia to go above $200, customers need to show that AI is giving them a return on investment, not just costing them money.

Is AI Bubble Risk Elevated In 2026?

A Deutsche Bank survey suggests 57% of investors now view a tech bubble as the top risk for 2026. Risks appear heightened, with comparisons to the 2000 tech bubble evident in Investing.com’s October 16, 2025 analysis, where Nvidia’s surge mirrors Nasdaq’s 101% YTD gain in 2000.

Back then, the dot-com era was based on getting views and clicks. Today, the leaders are making a lot of money. But when it takes $400 billion in capital expenses to generate $2 trillion in revenue , the numbers become difficult. This means investors should be cautious. A Finance Yahoo article from January 4, 2026, said that if capital expenses slow down, it could be a bad year, but if demand remains strong, it might not be so bad.

Nvidia Stock Price Prediction

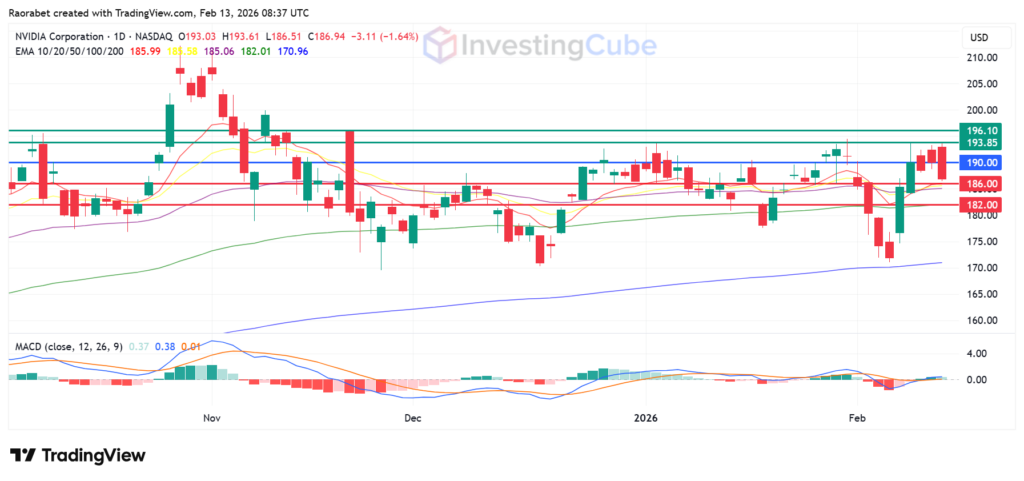

The MACD for Nvidia stock has turned positive, signaling less selling pressure. The buyers will likely be in control if action stays above $190. The first barrier will likely be at $193.85. Beyond that level, the stock will likely test $196.10. On the other hand, failure to go above $190 favours the sellers, with the primary support at $186.00 near the 10-day EMA. A break below that level could send NVDA stock lower to test $182.00.

Nvidia stock daily chart on February 13, 2026 with key support and resistance levels. Created on TradingView

Yes, overinvestment without productivity, IMF warnings of tech bubble; challenges recession-proof consensus, as hyperscaler shifts could burst hype.

The utility gap refers to companies spending millions on AI chips but failing to turn those tools into profitable business processes. If this gap isn’t bridged by late 2026, Nvidia’s hardware demand could face a temporary “air pocket.”

Things that could cause a breakout include the successful launch of the Rubin platform and the official restart of advanced chip exports to China in mid-February.