- The momentum on Nvidia stock price will depend on the extent to which the two companies manage to meet or pass analysts' forecast figures.

Nvidia stock price edged up in Wednesday’s pre-market session, staying on course to register its tenth successive weekly gain. The stock hit a post-split record high of $179 at this week and was up by 0.6% to trade at $176 at the time of writing. The current momentum is tethered to the upcoming release of Q2 earnings results by two of its biggest AI chip customers, Meta and Microsoft.

The company’s stock has been on weeks of upside movement propelled by the calming of trade tariff tensions between the US and China, underlined by the lowering of export barriers for its high performance AI chips. Nvidia (NASDAQ: NVDA) investors are waiting for China export figures to start streaming in in the third quarter of the year, and that could propel the stock further up.

Meanwhile, Meta will release its Q2 earnings on Wednesday, with analysts’ median revenue forecasts at $44.83 billion, equivalent to a 15% year-on-year growth. In addition, software giant, Microsoft will also release its Fiscal Q4 2025 earnings, and the upbeat sentiment around it already sent its stock price to all-time highs of $518 last Friday. Analysts forecast Meta to bring $78.89 billion in revenue, up from $64.72 reported in the corresponding quarter a year ago.

The momentum on Nvidia stock price will depend on the extent to which the two companies manage to meet or pass the forecast figures. Both of them have invested heavily in AI infrastructure and investors will be keen to see if that has paid off. Furthermore, they will look out for cues on the two companies’ AI capex plans, which have a direct impact on Nvidia’s revenue.

Nvidia Stock Price Prediction

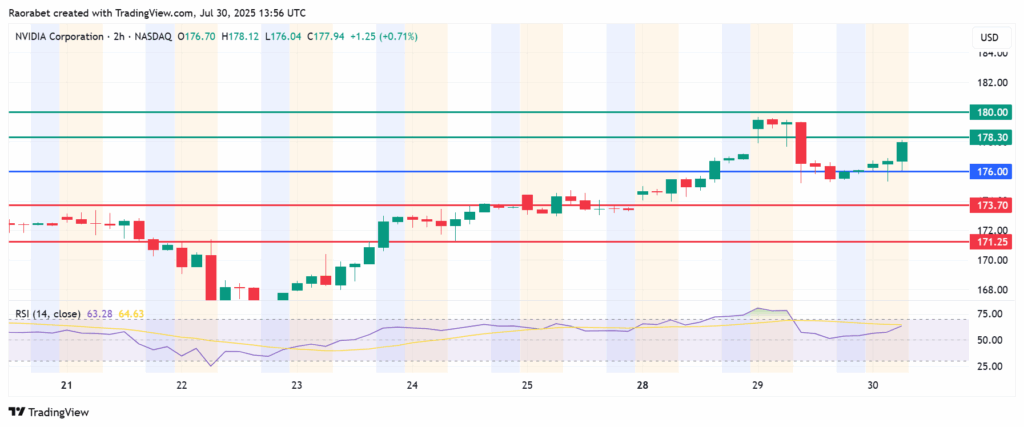

The momentum on Nvidia stock price calls for further upside above $176. With the buyers in control, the stock will likely meet initial resistance at $178.30. Also, an extended control by the buyers will break above that level and potentially test $180.

On the other hand, going below $176 will signal control by the sellers. That will likely see the first support established at $173.70. The upside narrative will be invalid if the price breaks below that level. Moreover, a stronger momentum could push NVDA lower and test $171.25.