- Meta and Microsoft will release their earnings on July 30 and their figures will likely inject a fresh impetus into Nvidia stock price.

Nvidia stock price momentum has returned near its recent record highs as upbeat sentiment builds around favourable US government policy and increased AI infrastructure expenditure. The AI chips giant gained 1.73% on Thursday, riding on news of Google’s parent company Alphabet’s 13% capex rise in 2025 to $85 billion. Also, there was an inherent upbeat sentiment built around CEO Jensen Huang’s highly publicised sojourn in China earlier this month.

Alphabet has cemented its position as one of the leading buyers of Nvidia’s high performance GPU chips and the new capex figure will almost certainly include setting up more data centers. Meanwhile, US President Donald Trump’s administration launched a 90-point policy plan on Wednesday, aiming to propel the country’s lead in AI technology. Dubbed “Winning the Race: America’s AI Action Plan”, it aims to streamline the industry and create an enabling environment for expanded growth.

Measures to be implemented include reducing approval times for data centers, coordinating chip exports to US allies, and creating a suitable environment for high-demand tech jobs. Looking forward, two of the top AI chips consumers, Meta and Microsoft will release their earnings on July 30. Specifically, greater focus will likely be on be on cloud revenue, AI infrastructure capex and guidance, and their figures will likely inject fresh impetus into Nvidia stock price.

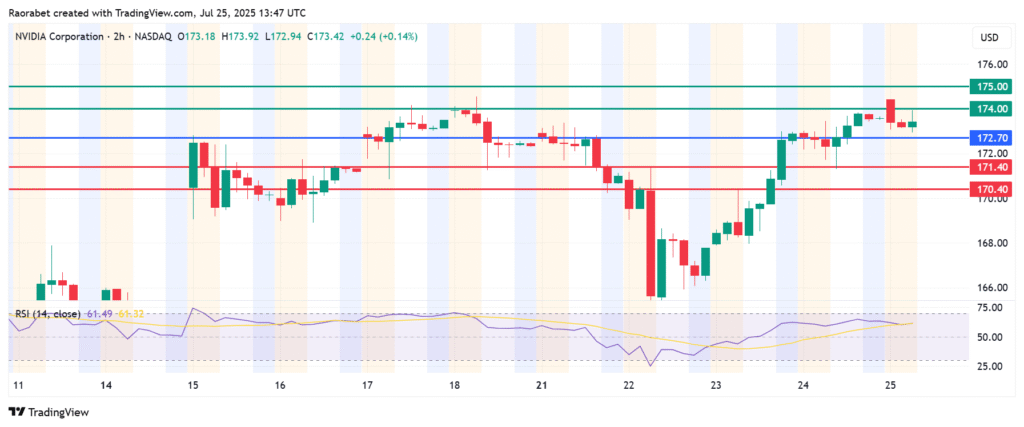

Nvidia Stock Price Prediction

The momentum on Nvidia stock price calls for further upside action above $172.70. It will likely meet initial resistance at $174. However, a stronger momentum will break above that level and potentially clear the path to test $175.

Conversely, going below $172.70 will invite the sellers to take control. In that case, primary support will likely be established at $171.40. The upside will be invalid if the price breaks below that level. In addition, a stronger momentum will extend the decline and could push the stock lower to test $170.40.