- Nvidia stock price is on an upbeat mode and CEO Jensen Huang's statement in China today could bring fresh impetus.

Nvidia stock price continued with its upsurge in the pre-market session on Wednesday, hitting a new record high of at $171.40 after gaining 0.4%. The company’s fortunes have an attractive outlook after a major roadblock to its exports to China was removed. Analysts have raised their forecasts of Nvidia stock price to $200, with a strong bullish sentiment currently in play.

The US Government confirmed on Monday that it will allow Nvidia (NASDAQ: NVDA) to resume its AI chips exports to China. The exports will be done through the licensing framework and will see the company modify its high performance chips including the H20. Furthermore, the company has been building Blackwell chips customised for the Chinese market.

Nvidia revealed earlier in the year that barriers to entry in China would cost it $8 billion in Q2 revenues. Therefore, the easing of restrictions potentially opens up a market that could see the revenue stream top that figure as data centre and cloud-driven demand grows. Furthermore, the company could raise its Q3 guidance in the face of the new development, which could pump the momentum up farther.

However, the underlying risk is the potential reversal in US trade policy. President Donald Trump’s administration has developed a reputation for flip-flopping on its trade policies, even those relating to its closest allies. Therefore, one should not rule out a potential reversal of the China export stand. Such a move could bring headwinds to Nvidia stock price.

Meanwhile, Nvidia CEO Jensen Huang will speak in media briefing in Beijing, China on Wednesday, and his comments could broaden the perspective on the demand figures in the world’s second-largest economy. That could inject fresh impetus into Nvidia stock price.

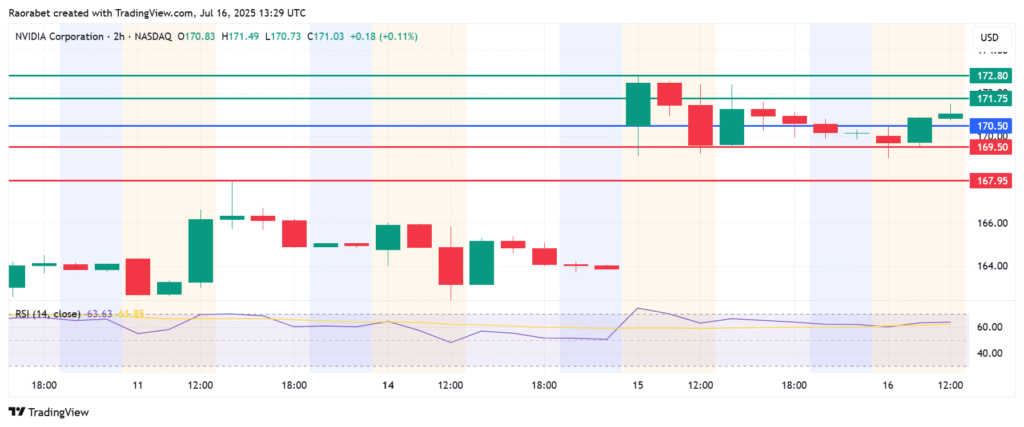

Nvidia Stock Price Prediction

Nvidia stock price pivot mark is at $170.50 and the momentum calls for further upside. With the buyers in control, immediate resistance will likely be at $171.75. However, a stronger momentum will break above that level and potentially test $172.80.

On the other hand, breaking below $170.50 will favour the downside to prevail. In that case, primary support is likely to be at $169.50. Breaking below that level will invalidate the upside narrative. Furthermore, the resulting momentum could take the action lower and test $167.95 in extension.