- Nvidia's market dominance faces increasing competition, with the latest major threat coming from one of its biggest customers, Google.

- There's also an underlying fear of overvaluation amid concerns that the "AI bubble" threat has not really gone away.

- Nonetheless, Nvidia's innovation and strong order book offers reprieve and substantial cushion.

Recently, stocks have generally bounced back, and the S&P 500 hit 6,766 on November 25, going up a little over 2.47% in the last week. In addition, the Dow Jones Index has risen by 1.87% in the lame period. The underlying factor is the renewed belief that Federal Reserve will lower rates in its FOMC meeting in December.

But Nvidia stock price is acting differently. It went down to about $174.35 before the market opened on November 25, which is more than 4% lower than the $182.55 it closed at on November 24.

Nvidia’s drop is quite different from how the rest of the market is doing. In the last five trading days ending November 25, the S&P 500 rose by about 2.5%, helped by good economic news and tech companies other than semiconductor firms doing well.

However, Nvidia stock price has fallen by over 6% in the same time. This extends a downturn that started after its earnings report, where the stock fell 3% on November 21, even though the company announced record quarterly revenue of $35.1 billion. So, what’s going on?

Why Nvidia is Declining

Several intertwined elements explain Nvidia stock’s underperformance. Foremost is escalating competition in the AI hardware space. First, there’s more competition in the AI hardware business.

The news that Meta Platforms plans to use Google’s AI chips along with Nvidia’s has made investors worry that the company might lose market share, which led to the recent 4.25% drop. This comes after talk of an AI bubble, which was made louder by Ray Dalio’s warnings that Nvidia (NASDAQ: NVDA) is overvalued, as its forward P/E ratio is over 50, even though demand is still strong.

Also, profit-taking after the earnings beat has also played a role, as investors reassess sustainability amid U.S.-China export curbs tightening supply chains. Reuters reports highlight how these factors decoupled Nvidia from the Nasdaq’s 1.8% weekly gain, driven instead by non-AI tech recoveries. It’s noteworthy how external validations, like Meta’s diversification, can swiftly temper enthusiasm for even dominant players.

Rebound Potential Amid Risks

While the overall market recovery might help Nvidia, its situation is still uncertain. Big risks include more companies using rival chips and interest rate cuts being delayed, which would strengthen the dollar and could hurt exports. Investors might want to consider these issues. Nvidia still has an edge in innovation, but its stock’s recent moves suggest caution.

Also, geopolitical risks related to export controls, especially those aimed at the huge Chinese market, are still limiting its growth potential. Analysts at firms like Citi have stated that custom chips will take up a bigger share of the AI accelerator market by 2028, which would directly challenge Nvidia’s leading position.

The stock’s future trajectory will depend on its ability to quickly monetize its software ecosystem, such as the CUDA platform, and prove that its “generation ahead” technology can outpace the increasing speed of competition and customer cost-cutting efforts.

Nvidia Stock Price Forecast

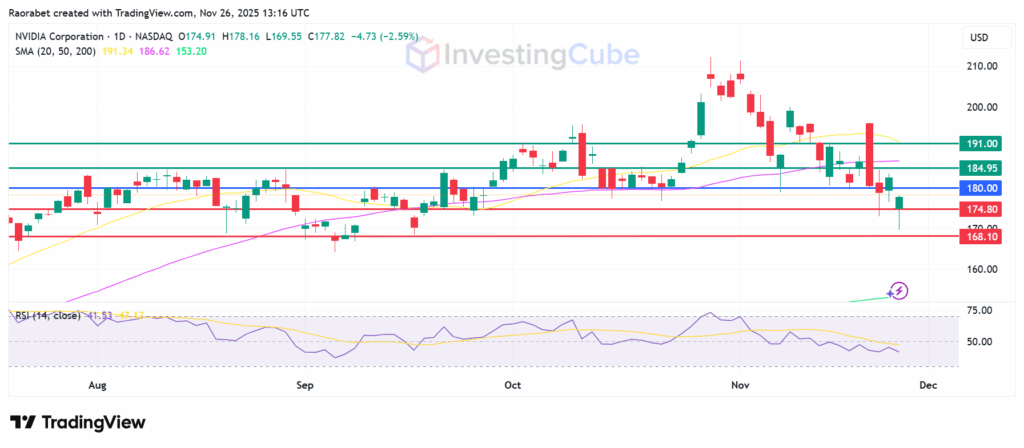

Nvidia stock chart signals caution. The stock is trading below the 50-day simple moving average of $186.62 and the 20-day exponential moving average of $191.34. The pivot is at $180, while primary support is likely to be at $174.80. Action below that level could send NVDA lower to test $168.10, confirming a negative short-term trend despite the golden cross still being intact. Resistance starts at $184.95 and could potentially go higher up to $191.00.

Nvidia stock price in the pre-market session on November 26,2025, with key support and resistance levels. Created on TradingView

Nvidia stock fell due to concerns over its extremely high valuation, which triggered profit-taking. There’s also new fears about intensifying competition, specifically the possibility of major clients diversifying their chip suppliers.

One major threat is that companies like Meta might start using their own AI chips, or chips from places like Google. This move toward making their own tech could hurt Nvidia’s dominance in the market.

Yes, it’s possible. After earnings, people taking profits can make things jumpy. This could hold back any big recovery, even if Nvidia’s income is good.