- NTPC Green share price has lacked the catalyst to decisively move above ₹112 but the coming days could see increased volatility.

NTPC Green Energy share price has failed to find traction above the ₹112 mark once again, with its performance mirroring the broader market lull. The renewable energy company’s stock gained 1.72% but closed Wednesday’s trading session at ₹111.98, on a day when both the Nifty 50 Index and Sensex Index each gained less than 0.1%. The absence of catalysts in the market is likely to keep NTPC Green share price subdued in the near-term, but the company’s fundamentals will likely help hold steady above ₹110.

Spending Limit Raise and Monsoon to Impact NTPC Share Price

That said, Prime Minister Naraendra Modi’s move to approve the raising of investment limit in renewable energy by NTPC Green Energy to ₹20,000 has injected some impetus that could help propel the stock.

While chairing the Cabinet Committee on Economic Affairs, Modi cleared the way to raise the ceiling from an initial ₹7,500, nearly tripling the amount the company can spend in solar, wind and other renewable energy. That means NTPC Green Energy (NSE: NTPCGREEN)now has more headroom to spend on large scale renewable energy infrastructure projects without waiting for fresh government approvals.

That move underscores the Indian government’s commitment to push the country to generate 60GW of renewable energy by 2032 and become net zero by 2070. Fundamentally, instead of fundraising primarily through the debt market, the company can now confidently leverage its balance sheet to get funding for its projects at competent rates and better borrowing terms.

Looking ahead, investors will also be keen on the progress of southwest monsoon winds. The winds usually result in reduced cooling demand, translating to lower energy consumption and reduced margins. That could bring downward pressure on NTPC share price.

NTPC Green Share Price Prediction

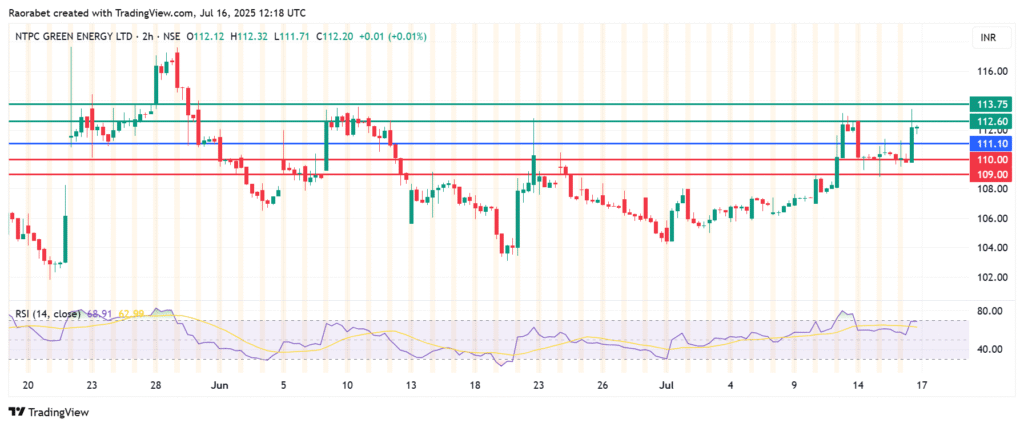

The momentum on NTPC Green share price calls for further upside above the ₹111.10 pivot mark. The stock will likely meet the first barrier at ₹112.60. Breaking above that level will signal a stronger momentum that could push the action higher to test ₹113.75.

Conversely, breaking below ₹111.10 will signal the onset of a downward action. That will likely see the first support come at ₹110.00. The upside narrative will be invalid if the price breaks below that level. A stronger momentum will push the action lower and test ₹109.