- The strong gains by NSDL share price is supported by better fundamentals and its stronger standing against its duopoly competitor CSDL.

NSDL stock price’s fairy tale debut at the BSE continued on Friday as it surged more than 17% during early afternoon trading to hit ₹1,321. The gains saw the company’s market capitalisation rise past ₹25,000 crore, with 60% of those gains realised post-IPO. NSDL raised ₹40 billion crore (approximately $457 million) during the IPO, which ended up being oversubscribed 41x.

The strong IPO performance was a precursor to the strong stock market launch and investors took it as a cue to fight for a piece of the company. Analysts see the company’s valuation of 47 times FY 2025 earnings as fair, considering its strong foothold in the market infrastructure and successful expansion strategy.

Also, compared to its main competitor, CSDL, NSDL (BSE:NSDL) has a higher of high-value accounts, including foreign portfolio investors. Also, NSDL has historically stronger exposure to institutional clients. However, the strong spike in a short time span has an underlying risk because of an implied profit taking that awaits.

Nonetheless, NSDL controls 87% of the Indian market’s demat value, with 39.4 million demat accounts serviced in FY 2025. Also, the company is investing ₹100 crore in FY 2026, with a focus on automation and strengthening cyber security. This is central to actualizing tech-driven scaling , deepening retail reach and offering a rich diversity of services in a market with ever-expanding needs.

NSDL Share Price Prediction

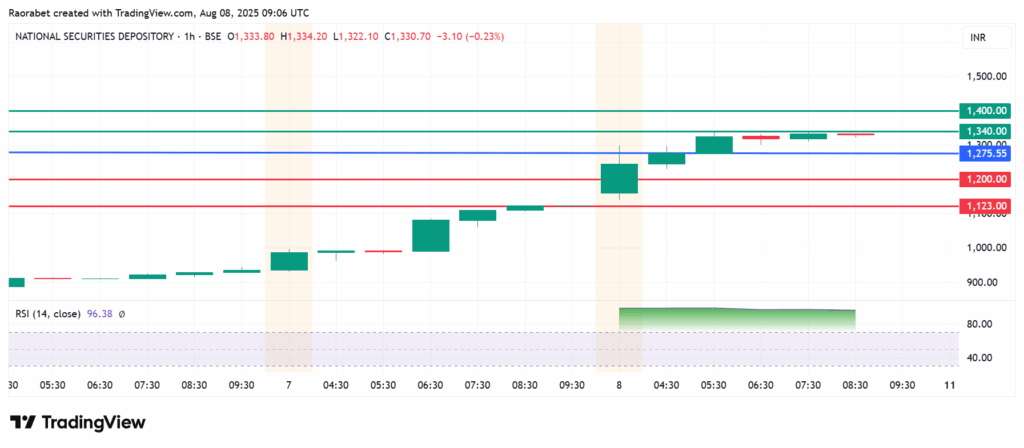

NSDL share price pivot mark is at ₹1,275 and the momentum will favour the upside to prevail above that level. The stock will likely rise and meet initial resistance at ₹1,340. Breaking above that level will signal a stronger momentum that could push the stock higher and test the second barrier at ₹1,400.

On the other hand, the momentum will shift to the downside if the stock breaks below ₹

1,275. In that case, the stock will likely find the first support at ₹1,200. The upside narrative will be invalid below that level. In addition, an extended control by the sellers could take the action lower and potentially test ₹1,123.