- Micron Tech stock price has risen by more than 50% in the last month and is up by 16% in 2026, barely a week into the new year

- The company has raised its 2026 capex to $20 billion, underlying confidence in the demand for high performance its memory chips

- Primary risks include potential oversupply from competitors in the coming months and geopolitics-related tariff barriers

Micron Technology’s shares have experienced a notable upswing in recent weeks, expanding the market’s understanding of the impact of the AI industry. As of this writing, the stock is up over 16% this year and about 50% in the last month, hitting a new high of $343.70 recently.

Why Micron is Surging

The main reason for the rally by Micron Technology stock (NASDAQ: MU) increase is a huge need for High-Bandwidth Memory (HBM). Leading tech companies like Nvidia and Google are putting Micron’s HBM3E and next-generation HBM4 into their AI products. Data from Bernstein shows that AI servers are using way more memory. For example, Nvidia’s B300 chips use over 3.5 times more memory than the older H100. This has made Micron a key player with pricing power.

Strong Financials Signal Stability

During the company’s fiscal first-quarter 2026 earnings call, management emphasized that demand continues to outstrip supply, leading to favorable pricing dynamics. Micron reported record revenue of $13.64 billion for the quarter, with non-GAAP earnings per share at $4.78, surpassing expectations.

Can the Momentum Hold?

The odds of this rally sustaining through 2026 appear favorable, primarily due to a supply-demand imbalance. One analyst at Bernstein raised their price target to $330, saying that increasing supply takes time because there’s not enough cleanroom space. Notably, the stock has already cleared that barrier, underlining its strong bullish momentum.

The company’s decision to increase capital expenditures to $20 billion for 2026 signals confidence in sustained growth, particularly in data centers. As Yahoo Finance reports, this capex hike underscores management’s belief in ongoing AI memory needs. Meanwhile, in recent earnings calls, CEO Sanjay Mehrotra confirmed that Micron’s HBM capacity for the entirety of 2026 is already fully booked.

Potential Risks

However, no stock climbs forever without headwinds. The most immediate risk is cyclicality. Even though AI demand is steady, the memory industry tends to overproduce when things are good, which can cause problems later.

If AI growth slows down or competitors flood the market with HBM4 sooner than expected, profits could fall. Geopolitical issues, like tariffs, are also risks. Also, technical indicators suggest the stock is overbought territory, which often invites short-term profit-taking. Investors should monitor these elements closely, as they could introduce volatility.

Micron Technology Stock Forecast

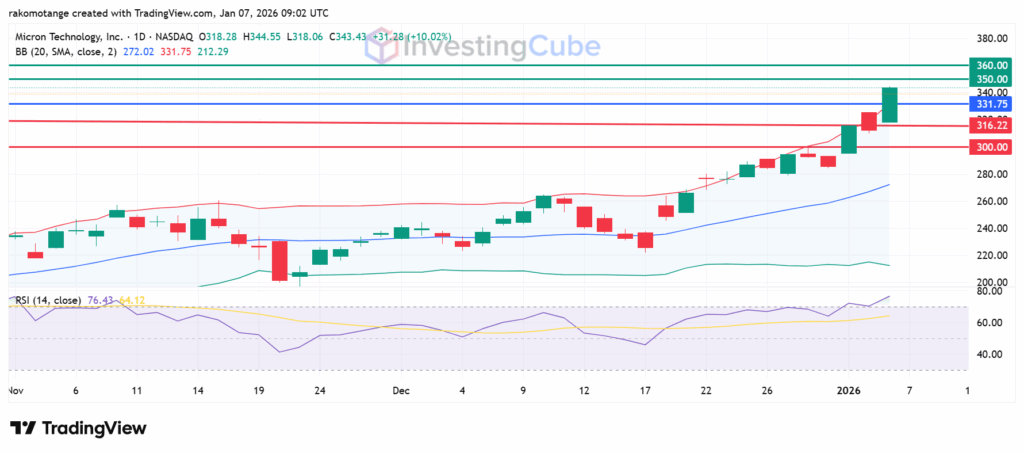

Micron Technology stock is currently displaying parabolic characteristics. The Relative Strength Index (RSI) is at 76, a clear signal that the stock is technically overbought in the short term. The next resistance zone is psychological at the $350-$360 level, while firm support sits at $316 at the previous breakout point and more substantially at the psychological $300 mark.

Micron Technology stock daily chart with key support and resistance levels created on TradingView on January 7, 2026

The surge is primarily fueled by strong demand for high-bandwidth memory in AI applications, with 2026 capacity fully sold out, leading to higher prices and earnings

The odds of a continuation are favorable if AI demand persists, with analysts forecasting significant earnings growth. However, it depends on supply discipline and market conditions, potentially sustaining upward momentum

The main risks include industry cyclicality, potential oversupply if competitors ramp up production too quickly, and the heavy $20 billion capital expenditure burden required to maintain their lead in the HBM4 market.