- Many investors are upbeat that the stock will hit £1 before the year ends, based on strong financials and accommodative environment.

- Lloyds Bank was among the major US banks that recently passed the BoE stress test, signaling stability.

- Share buyback supports positive outlook but overvaluation concerns linger.

Lloyds Banking Group plc (LSE: LLOY) shares have been doing well, gaining almost 9% in the past month to trade at about 97 pence as of this writing. This uptick builds on a broader 75% year-to-date surge, outpacing even some U.S. tech giants. You might wonder what has fueled this resilience in a volatile market. We unpack the drivers, potential pitfalls, and whether that elusive £1 mark is within reach.

What Propelled the Rise?

The primary catalyst for Lloyds’ accelerated performance lies not just in its operations, but in its commitment to capital returns and supportive regulatory clarity.

On December 2nd, the Bank of England said that the UK’s biggest banks, including Lloyds, passed their yearly stress test with no problems. This test checks if banks have enough money to handle tough economic situations. Matt Britzman from Hargreaves Lansdown mentioned that this good result calmed some worries and helped push the stock up by over 1% that day, according to Proactive Investors.

It’s not just about regulations, though. Lloyds has also been making smart choices. With interest rates being high, they’re making more money on their loans. Plus, they’re buying back £2 billion of their own shares, which is a good sign for investors, as detailed in Lloyds’ Q3 update.

Also, the bank mainly focuses on the UK, so its profits depend a lot on UK interest rates. Even though rate cuts are expected, the market has seen good signs short-term. Analysts checking the bank’s Net Interest Margin (NIM) note that the bank’s structural hedge keeps producing income. This has balanced out some of the market competition in mortgages and deposits, says recent analysis from brokers like Hargreaves Lansdown.

Storm Clouds on the Horizon For Lloyds Stock

For all the optimism, challenges lurk. Falling interest rates pose the biggest threat. The biggest fear is that interest rates will go down. Interactive Investors analysts expect two cuts by the middle of 2026, which may lower margins by 20 basis points. This is made worse by Lloyds’ large exposure to UK mortgages. If the property market slows down, bad debt provisions could go up, which are currently at £912 million for nine months because of motor finance mis-selling, according to The Guardian.

Overvaluation whispers too: Trading at a forward P/E of 9, shares may be priced for perfection, risking a pullback if earnings disappoint.

£1 Feasible, But Not Guaranteed

Whether Lloyds Bank share price can reach £1 (100p) is mostly about psychology, showing a return to its former high. Currently, most analysts believe it’s doable. But for the share price to really pass and stay at this level, the UK’s economy needs to get better to justify a higher value for the bank’s book value.

Lloyds Bank Share Price Prediction

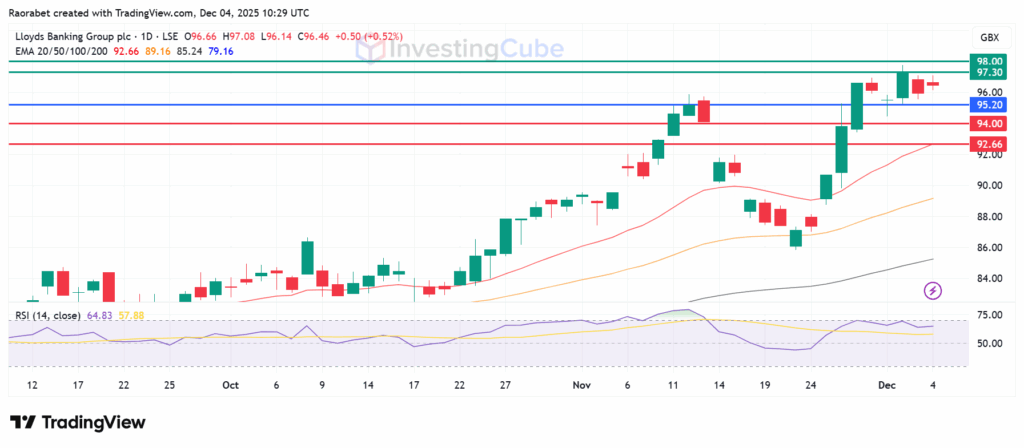

Lloyds Bank share price is showing strong positive signals. At 96.46p, it’s above all major simple moving averages (SMAs), suggesting a Strong Buy signal. The RSI at 64.83 is bullish, and the upside will likely stay on the upside above the 95.20p pivot. Primary resistance will likely be at 97.30p, beyond which an extended control by the buyers could push the action higher to test 98.00p. If it breaches that barrier, and flips it into a support, it could target £1.

However, the high RSI could also trigger consolidation. The stock will likely have its primary support at 94.00p. A break below that level could send the action lower to 92.66p.

Lloyds share price daily chart with key support and resistance levels on December 4, 2025. Created on TradingView