- Lloyds Bank stock was within touching distance of the psychological £1mark days ago, but a sudden shift in sentiment has sent it sliding.

Lloyds Banking Group stock (LSE: LLOY) took a tumble on November 14, closing at 91.50 pence (p), down from 94.12 pence. That’s a 2.78% drop with high volume, over 148 million shares traded. The stock started at 90.28 pence, hit a low of 90.12 pence, then recovered a bit. This comes just shy of the 52-week high of 95.86 pence, leaving many wondering if the coveted march toward the £1 mark this year has ended.

Why Lloyds Bank Share Price Dropped

It is important to put this single trading session in context. Lloyds Bank stock has generally been doing well this year, mostly because high interest rates are helping its Net Interest Margin (NIM), along with a share buyback plan. Yet, broader headwinds in the UK economy could be weighing heavier than anticipated.

The UK economy, as outlined in the Bank of England’s November Monetary Policy Report, faces a delicate balance in sustaining 2% inflation while averting stagnation. The economy grew just 0.1% in the last quarter, according to the Office for National Statistics.

What Are the Risks?

Capital Economics warns that risks are tilting towards a larger GDP hit from these measures, possibly echoing the marginal quarterly rise seen in Q3. Meanwhile, the Trades Union Congress (TUC) critiques the Office for Budget Responsibility (OBR) for its “hardwired” austerity bias, which they argue acts as a straitjacket on growth, per recent commentary.

Higher borrowing costs, flagged by Bank of England (BoE) official Catherine Taylor in October, amplify recession fears. Meanwhile, inflation persists at sticky levels, complicating the BoE’s dilemma on whether to cut to spur activity or hold firm against wage-price spirals. While inflation has eased from its peaks, core inflation and persistent cost-of-living pressures continue to affect consumer spending and business investment.

This is especially important for Lloyds. As a big player in UK retail banking, it could face mortgage defaults if house prices go down because of financial issues. Furthermore, the uncertainty surrounding interest rate policy is a double-edged sword.

The high rates that boosted Lloyds’ profits are now expected to be reversed, with the BoE potentially making multiple cuts in 2025. This might help the economy by making mortgages cheaper and encouraging spending, but it will probably hurt the bank’s profits.

Lloyds Bank Share Price Forecast

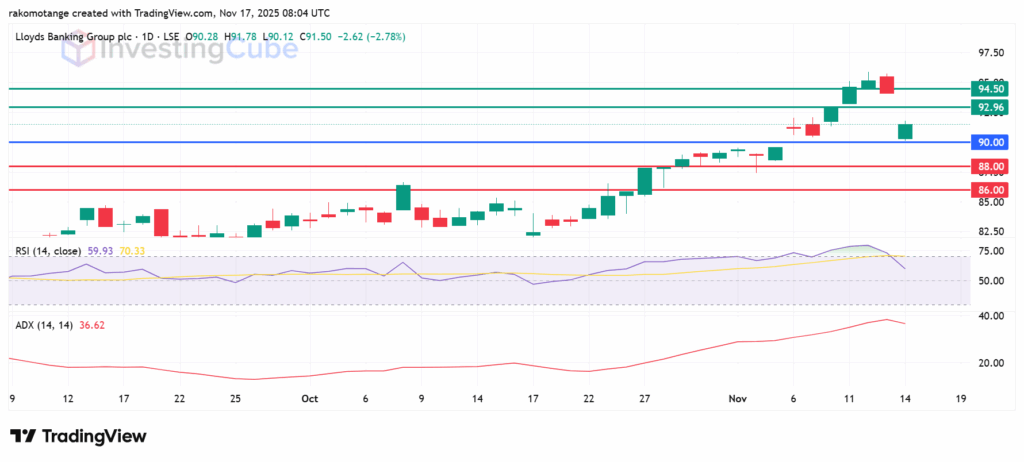

Examining the technical indicators, the 14-day Relative Strength Index (RSI) has dropped from 79 to 59 in the last three sessions, signaling a weakening upside momentum. The ADX reading at 36 affirms the strong downward momentum.

Nonetheless, the upside will likely prevail if action stays above the psychological 90p mark. With the buyers in control, immediate resistance could come at 92.96p. A break above that level will signal a stronger momentum that could push the action higher to test 94.50p.

On the downside, primary support is likely to be at 88.00p. Breaking below that level will invalidate the upside narrative, with the second support likely at 86.00p.

Lloyds Bank share price daily chart as of November 17, 2025. Created on TradingView

The drop was largely fueled by a market-wide sell-off in the FTSE 100, sparked by fresh concerns over the UK’s fiscal outlook.

The £1 mark is a major psychological and technical resistance level. Lloyds hasn’t been able to stay that high since before the 2008 financial crisis.

If interest rates go down, Lloyds will probably make less money on the difference between what they charge for loans and what they pay on deposits. This will cut into how profitable they are.