- Intel stock price is up by 42% YTD, a major turnaround in fortunes for a company that has struggled to keep up in the AI race.

Intel stock price has recently been riding on multibillion investments from the United States Government and Nvidia. Intel (NASDAQ: INTC) stock is up by 42% year-to-date, with the company at a pivotal point right now. However, it still struggles with manufacturing delays and also faces strong competition from TSMC and AMD.

Unpacking US Government and Nvidia Investments

In a groundbreaking deal announced on August 22, 2025, the Trump administration acquired a 9.9% interest in Intel for $8.9 billion, making the government the company’s biggest stakeholder. Notably, the government owns the company passively, without representation in the board of directors. However, the investment gives the company a substantial amount of money, which is also a clear symbol of support.

Meanwhile, Nvidia is buying Intel stock at a premium, but the most significant thing is that the two companies will work together to design and build custom processors. Intel will make a significant change by designing x86 central processing units (CPUs) specifically for Nvidia’s data center platforms and incorporating Nvidia’s GPU technology into its consumer chips.

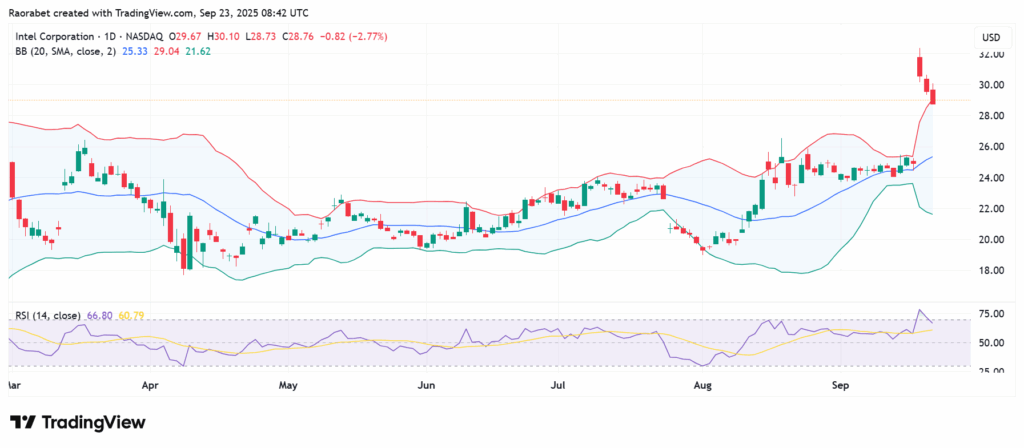

Intel stock price has recently broken above the upper Bollinger Band and the RSI at 66.80 calls for further upside.

Intel has had a hard time competing in Nvidia’s AI environment, but this deal gives them access to it. The partnership also gives Nvidia a powerful CPU partner to compete with its main rival, AMD. It also improves Nvidia’s ties to a company that the US government supports, which fits with Washington’s goal for more domestic manufacture.

What Does this Mean for Intel?

This has significant implications for Intel. The capital infusion helps the company with liquidity issues after a poor Q2 2025 earnings report that showed revenue falling 1% year-over-year to $12.8 billion and a $1.6 billion net loss.

On a strategic level, Intel’s onboarding of Nvidia and the government establish the company as a formidable leader in the US AI ecosystem, which could lead to joint research and contracts with the government. However, there still exists some challenges: Intel’s foundry business isn’t making money, and it isn’t leading in AI accelerators.

Is Intel Stock A Good Buy Now?

Following the recent investments made by both the US government and Nvidia, Intel’s stock price has experienced a significant surge. The two companies’ stocks have gone up significantly, which shows that investors are hopeful that these investments will lead to a turnaround. Intel stock could be a smart investment or not, depending on the level of risk you are willing to take.

Bulls believe that the dip is a good time to buy because the stock is undervalued, with a forward P/E of 25x compared to Nvidia’s 40x, the strong government supports and steady AI growth. Recent cost reductions may have increased margins, and investments have reduced downside. Bears, on the other hand, see it as a value trap because of high multiples despite the company losing money, delayed product launches, and the chance of more dilution if the company needs additional funding.

In Summary

These investments are not mere financial transactions; they are strategic lifelines with profound implications for Intel’s stock and its position in the global semiconductor industry. Therefore, Intel stock looks promising as a buy for those willing to bet on its turnaround and stay invested long enough. However, there may be better alternatives for those who desire safer or faster returns.

Intel’s stock price is up 42% this year because the U.S. government and Nvidia each put in $8.9 billion and $5 billion, respectively, for AI and chip development.

The multi-billion investment from U.S. and Nvidia boosts Intel’s foundry expansion, AI innovation, and financial stability for U.S. chip leadership.

The investments are a good thing, but there are still risks. Intel still needs to show that it can follow through on its turnaround plan, meet product deadlines, and get its technological edge back to be a good long-term investment.