- Intel stock price has risen by over 40% YTD, with peers like Nvidia, Palantir and Broadcom each registering single-digit negative returns

- The company has strong government support, with Donald Trump's administration acquiring 10% stake

- The 18A processing project is central to Nvidia's long-term success and competitiveness

Intel (NASDAQ: INTC) has come back strong in 2026, after years of NVIDIA and Palantir leading the AI world. The stock is up over 40% this year, reaching levels not seen in four years and doing better than the semiconductor market overall. For context, Nvidia is down by -3.4%, Palantir is at -8.8% and Broadcom’s returns in 2026 stand at – 6.8% as of this writing. So what’s going on?

What’s Propelling Intel Stock Rally?

First, Intel’s story is bigger than just personal computers now. The market is reacting to CEO Lip-Bu Tan’s successful turnaround plan. This plan, which focuses on managing costs and improving operations, has boosted the company’s market value to over $250 billion. Positive comments from President Trump after meeting with Tan also helped, as reported by Nasdaq.

Another major catalyst has been the massive capital infusion from unexpected corners. Major investments from NVIDIA ($5 billion) and SoftBank ($2 billion) show they believe in Intel’s strategy to make chips for other companies, known as IDM 2.0. On top of that, government support and partnerships are boosting confidence. With money from the U.S. government and NVIDIA’s investment, Intel’s plan to compete with TSMC in the chip-making business looks more achievable.

Government support and partnerships further bolster sentiment. A substantial U.S. investment last year, coupled with Nvidia’s stake, has enhanced confidence in Intel’s foundry ambitions, aiming to challenge TSMC. CNBC highlights these factors as key to the stock’s 11% jump to highs above $54.

Why Intel Is Rallying While Peers Are Struggling

Intel is succeeding while other companies struggle, mainly because investors are shifting their focus. While companies like NVIDIA, Palantir, and Broadcom are not doing as well, NVIDIA’s stock has stayed around $180 since August, facing competition from AMD, and companies like Microsoft and Amazon that are creating their own chips. Broadcom also faces challenges with its AI partnerships.

As NVIDIA and Broadcom deal with high valuations and expectations, Intel is benefiting from being seen as an underdog with potential for growth. The U.S. government owns almost 10% of the company, and recent support from Washington has solidifed Intel’s position as a key national asset.

If you’re looking for the reason behind this rally, it’s the 18A process node. This is Intel’s 1.8nm manufacturing technology, and it’s creating buzz. Intel has begun high-volume production of its “Panther Lake” chips on this node, reportedly putting it weeks ahead of TSMC’s competing 2nm timeline. This isn’t just a win for Intel’s own chips, it’s a siren call to external customers like Microsoft and Apple, who are reportedly exploring Intel’s foundry services as a backup to TSMC.

Is the Momentum Sustainable?

To keep this going, Intel needs to report good earnings report today, with strong server demand and better profit margins. Analysts project the Data Center and AI (DCAI) segment will do well, with a 30% increase in demand.

UBS has a “buy” rating on the stock, because of tight supply and potential, while Barchart says good Q4 results could lead to even more growth. If Intel does well with the 18A, it could get orders from companies like Apple, which would bring in more money. However, Intel still faces challenges. It has strong competition from AMD in the PC market, and keeping the 18A node running well will be a capital-intensive marathon.

Intel Stock

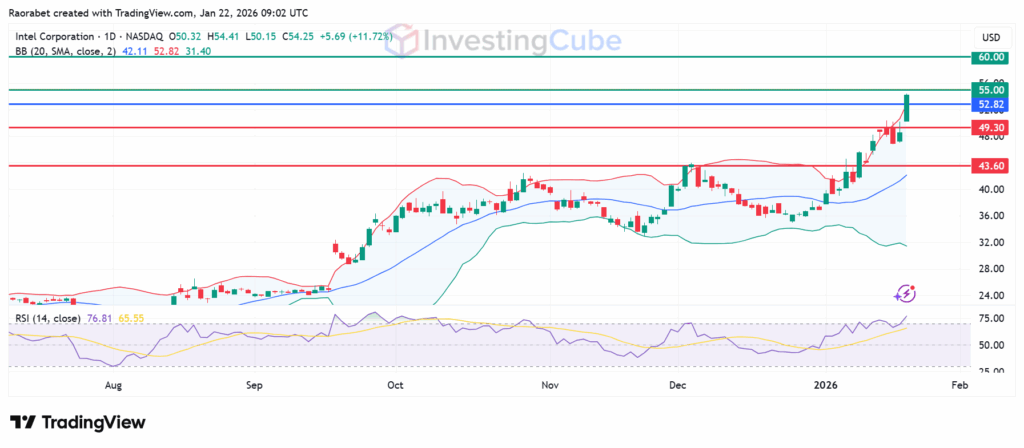

Intel stock currently exhibiting strong bullish characteristics, trading well above its upper Bollinger Band on the daily chart. From a momentum perspective, the RSI is hovering near 76, indicating the stock is technically overbought. The pivot is at 52.82, aligning with the Middle Bollinger Band. Looking upward, the next major resistance zones are pegged at $55 and the next one could potentially be at $60, depending on the outcome of the earnings report. Support levels include the primary one at $49.30, with a deeper one at $43.60.

Intel Stock daily chart on January 22 with key support and resistance levels. Created on TradingView

Because these companies have high valuations and high expectations, Intel looks like the better deal. With investments from NVIDIA/SoftBank and a lower P/E ratio, Intel is an attractive option for investors interested in AI.

The 18A node is Intel’s most advanced manufacturing process. If Intel can make it work, it can become a leader in chip-making, attracting big customers like Microsoft and Apple to build their AI chips in Intel’s factories.

The main risks include potential yield issues with the 18A node and continued market share pressure from AMD in the PC space. If the upcoming earnings report shows a margin squeeze, the rally could temporarily stall.