- Intel stock price had a stellar performance last week, but recent comments by its new CEO and forthcoming earnings might trigger a storm.

Intel stock price looks set to open the week on a weak footing, trading at $23.43 after declining by 1.63% in the pre-market session. The stock closed Friday’s session on a backpedal after gaining almost 6% in the previous five sessions. While many investors view the Intel (NASDAQ: INTC) as undervalued, the sentiment surrounding its fundamentals are an existential limiting factor. Also, the manufacturing process for its 18A business has struggled to return a profit, underlined by prolonged delays despite the company having invested billions of dollars in it.

The company aims to start volume production of the 18A chips in late 2025, and is currently under risk production. However, a failure to prove readiness could force it to fold up one of its most promising innovation fronts and write off billions of dollars. Furthermore, that could see it fall further behind in the AI chips race.

New CEO, Lip-Bu Tan, who joined Intel in March is currently weighing the viability of 18A foundry strategy and there’s a good chance that a discontinuation of that business could be on the cards. Lip-Bu recently admitted that the company has fallen outside the top ten semiconductor companies in the world.

Furthermore, he said that its “too late ” to catch up with market leaders in large scale AI training, and the company will now focus on edge AI and agentic AI deployments. That picture has added a sour condiment to Intel stock price and will likely subdue its upside for the foreseeable future.

However, on a positive node, the company’s cost-cutting measures could save it $10 billion by the end of 2025. The downside to that is that it includes the loss of over 10,000 jobs. The company will release its Q2 earnings on July 24 and the figures together with business execution strategy could inject fresh impetus into Intel stock price.

Intel Stock Price Prediction

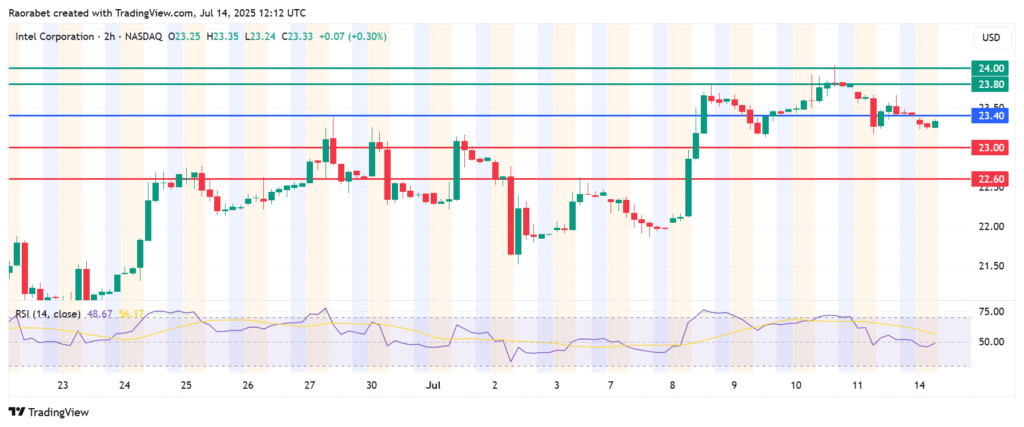

Intel stock price pivots at $23.40 and the downside will prevail if action stays below that level. The stock will likely find initial support at $23.00. If the price breaks below that level, the momentum could send the action lower and test the second support at $22.60.

Conversely, going above $23.40 will shift the momentum to the upside. In that case, the resulting gains will likely meet the first resistance at $23.80. Breaking above that level will invalidate the downside narrative, and the resulting momentum could push INTC price higher to test $24.00.