- IAG share price gapped down on Friday as weak earnings spooked investors. However, there's more to expect in the winter travel season.

International Consolidated Airlines (LSE: IAG) stock had been doing great for most of the year, and was up by 21% year-to-date, going into Friday’s trading session. But then, the stock suddenly dropped by 11.57%, closing at 366.20 pence, way down from the previous day’s 414.10 pence.

The drop comes from the sentiment created by IAG’s third-quarter earnings report, which showed weaker demand on transatlantic routes, mainly to North America. As per The Wall Street Journal, the company’s profit went down because there weren’t as many people flying between Europe and the U.S., even though overall operating profits were up a bit to €1.87 billion.

This dip in the usually profitable U.S. market was because of tougher competition and some economic issues, like a weaker pound and U.S. trade uncertainty, which ate into profitability. The Group saw a 7.1% decrease in passenger unit revenue in the North Atlantic market, according to the Q3 2025 results.

Even though IAG’s CEO, Luis Gallego, told everyone not to worry about the transatlantic problem lasting into next year and said that Q4 bookings were looking good, people were still bummed out in the short term, which caused the big price drop.

Can IAG Stock Rebound?

It’s possible that IAG share price will recover, but a few things need to happen. First off, if people start traveling more for the holidays and U.S. consumers spend more money, transatlantic bookings could get a boost. IAG’s bosses said they’re keeping a lid on capacity and controlling costs, which should keep revenues steady. If they do something smart, like buy back shares or improve their planes, that could also make investors feel better. Plus, if the market gets a bit of help, like inflation going down, that could lift the whole FTSE 100, where IAG is listed.

The good news is that IAG is a leader in the market, especially with British Airways owning most of the slots at London Heathrow, which enables them to charge more. This advantage, along with cheaper fuel, keeps analysts feeling good about the long term.

IAG Share Price Forecast

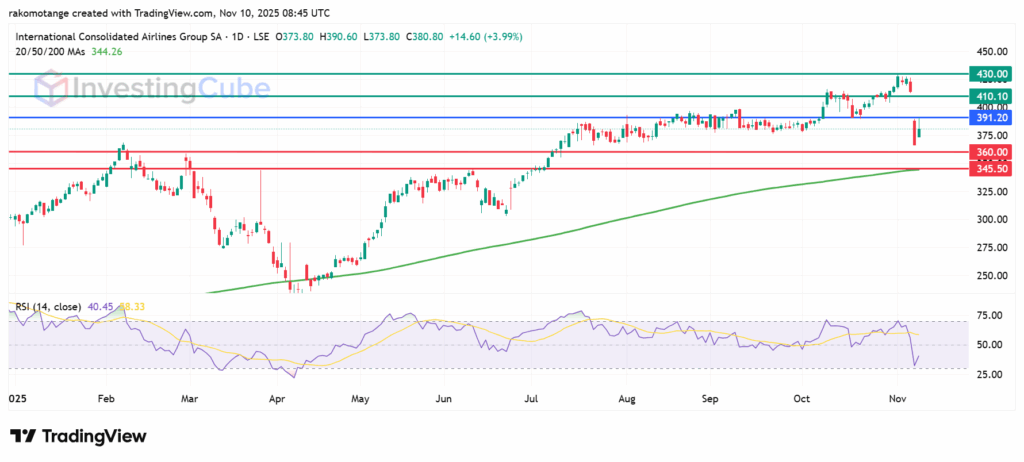

The 14-day IAG stock RSI is at 40, having climbed from a low of 15.05, showing that the buying momentum is strengthening. The stock will likely have its initial support at 360p in the near-term. However, if it breaks below that level, it will likely find the next support at 345.50 pence, lining up with the 200-day moving average.

The upside momentum will likely encounter primary resistance at 391.20p. Action above that level will signal a bullish takeover with the next challenge likely within the 410.10p-430p range. However, traders should watch the volume of shares that change hands.

IAG share price daily chart on November 10,2025 with key levels of support and resistance. Source: TradingView

The sell-off was due to the market’s disappointment with IAG’s Q3 financial results. Although the company maintained its full-year guidance, its earnings showed unexpected “softness” in North Atlantic leisure demand and adverse foreign exchange movements.

The most immediate and critical technical support level for IAG’s stock is around 360 pence (p). This level is highly significant as it aligns with previous consolidation highs.

Holidays often spark a surge in transatlantic bookings. If U.S. spending holds firm, winter demand could refill premium cabins, resulting in covering of revenue lost in Q3 and staying in line with full-year guidance.