- An unwavering commitment to shareholder returns has provided support to HSBC share price in the absence of stronger catalysts.

HSBC Share Price share price saw modest gains in Tuesday’s trading session, closing at 954p after going up by 0.54%. Investors are currently weighing the complexity presented by a blend of strong shareholder returns, strong growth in Asia, and persistent concerns over the Chinese economy. The small gains realized in the London Stock Exchange and Hong Kong Stock Exchange reflect a cautiously optimistic sentiment from investors.

The market is currently digesting the bank’s fundamental strengths and strategic direction, while also taking cognizance of recent negative headlines. An unwavering commitment to shareholder returns has provided support to HSBC share price in the absence of stronger catalysts. Despite its stellar record in recent times, HSBC Holdings (LSE: HSBA) reported a $2.1 billion impairment on its stake in China’s Bank of Communications, and that could limit its medium-term cash position. However, that news was cushioned by a fresh $3 billion share buyback program.

Notably, HSBC’s performance is intrinsically linked to its strategic growth in its Asian market. While the market is a key revenue and growth front, it also carries substantial risk, as seen in the recent impairment loss. Nonetheless, that same market holds great promise for growth, particularly in wealth management. A recent report from the Hong Kong Monetary Authority highlighted a booming wealth and asset management sector in the first half of 2025 and HSBC’s dominant presence in the region and and strategic focus on serving affluent clients has given it an edge.

HSBC Share Price Prediction

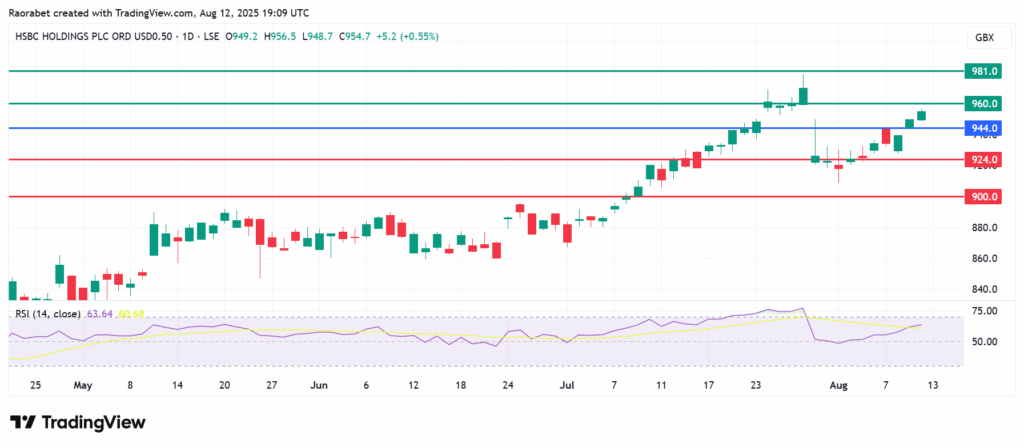

The momentum on HSBC share price signals control by the buyers above 944p. The stock will likely find initial resistance at 960p. Breaking above that level will signal a stronger momentum that could translate to further gains and test 981p.

On the other hand, going below 944p will shift the momentum to the downside. With that, the first support is likely to be at 924p. The upside narrative will be invalid below that level and the resulting momentum could clear the path to potentially test 900p.