- After gaining more than 11 percent on Tuesday, Happiest Minds share price printed red on Wednesday, but that isn't about to stall its rise.

Happiest Minds share price has eased down on Wednesday, trading at ₹648 at the time of writing and down by 2.9% on the daily chart. The stock closed Tuesday’s session with 11.12% gains as investors bought into news that brokerage firm Anand Rathi had began covering it and given it a BUY recommendation. According to the brokerage, Happiest Minds share price could rise to ₹790 in the next twelve months, inferring a potential 21% upside from the current level.

The Arand Rathi coverage has boosted investor confidence in the stock, bringing in new inflows. In addition, the IT company’s strategic creation of a dedicated AI business points to its likely expansion into new growth fronts. Furthermore, Arand Rathi stated in its analysis that Happiest Minds’ shift to healthcare and Banking Financial Services and Insurance (BFSI)is already proving to be the right move. These fronts accounted for 42% of revenues in the last quarter, up from 27.5% a year ago.

BFSI and Healthcare are seen as a high-margin, high demand growth vertical that can easily integrate AI and trigger widespread digital transformation in the sector. Primary customers in that market include banks, insurance companies, cybersecurity companies and fintech firms.

Meanwhile, Happiest Minds share price also has support from recently appointed CFO Anand Balakrishnan, who is expected to improve financial discipline and operational efficiency at the company. Today’s decline by Happiest Minds is largely a correction that largely reflects happenings in the broader IT industry. The Nifty IT index was down by 0.85% at the time of writing, snapping a three-day winning streak.

Happiest Minds Share Price Prediction

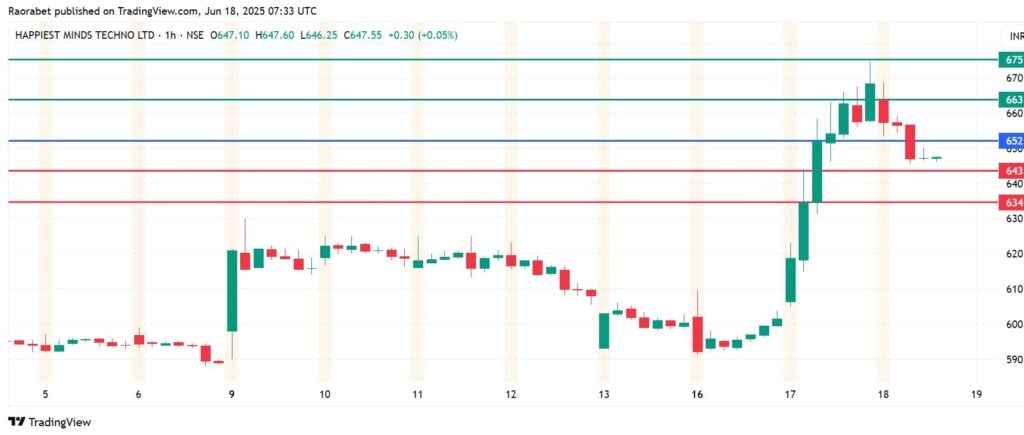

Happiest Minds share price pivots at ₹652 and action below that level hints that sellers are likely to stay in control. The stock will likely find initial support at ₹643. However, an extended control by the sellers could break below that level and send the action lower to test ₹634.

Conversely, the buyers will likely take control if the price goes above ₹652. That could see the upside momentum meet initial resistance at ₹663. Breaking above that level will invalidate the downside narrative. In addition, further control by the bulls could push the price higher and test ₹675.