- BP share price has risen for two successive months, while Brent crude is on a four-month losing streak.

- The company's share buyback and dividend programs have proven a hit with investors, numbing the pain in the broader oil and gas industry.

- However, crude oil oversupply is an existential risk to sustained gains.

BP p.l.c. shares (LSE: BP) have been climbing steadily since early October 2025, bucking the trend of softening Brent crude prices. As of this writing, the stock trades at 454 pence, up roughly 5% from late October’s 435p. Meanwhile, Brent has slipped from around 70 dollars per barrel in October to 62.99 dollars on November 25. This contrarian move prompts curiosity on what drives BP’s resilience, and whether it can hold through year’s end.

BP Share Price Contrarian Climb

BP share price started to rise as the energy sector shifted. At the beginning of October, shares were around 420 pence. After the Q3 results came out, they started to gain ground. By November 11, they had hit a 52-week high of 476.25 pence. This rise continued despite a 10%+ drop in oil prices, which was caused by worries about supply and weak demand predictions from the IEA’s October report.

It might seem strange, but the main reason BP share price has been rising since October is because of careful money management and increased returns for shareholders. This has overshadowed the usual influence of oil market prices.

The most significant catalyst was the release of BP’s Q3 2025 results in early November, which showed underlying replacement cost profit of $2.21 billion, comfortably beating the $2.02 billion company-compiled consensus. While the headline profit was slightly down year-on-year, the focus shifted entirely to the cash generation and distribution plan.

BP also said they would start a new $750 million share buyback program for the fourth quarter, keeping their word to give extra cash back to investors. This program, along with the completion of the previous buyback, lowers the number of outstanding shares, which increases earnings per share and helps the stock price. This continuous capital allocation is a massive signal to the market.

The company also confirmed that they would keep paying a good dividend, announcing a new dividend per share of 8.320 cents and expecting to increase it by at least 4% each year for the foreseeable future, according to their investor reports.

In essence, investors are no longer valuing BP purely on the daily price of Brent Crude, but rather on its ability to generate significant free cash flow and consistently return that capital to shareholders.

Is the Momentum Sustainable for the rest of Q4 2025?

Whether this upward trend continues depends less on oil prices going back up and more on BP keeping its promises about cash returns and achieving its strategic goals. For the momentum to continue through the end of the year, investors will want to see the buyback program continue and no bad surprises in its trading operations.

Unless there is a sudden collapse in refining margins or a big geopolitical event, the technical support from the buybacks and the strong cash flow should keep the stock stable, even if crude oil prices keep falling.

BP Share Price Forecast

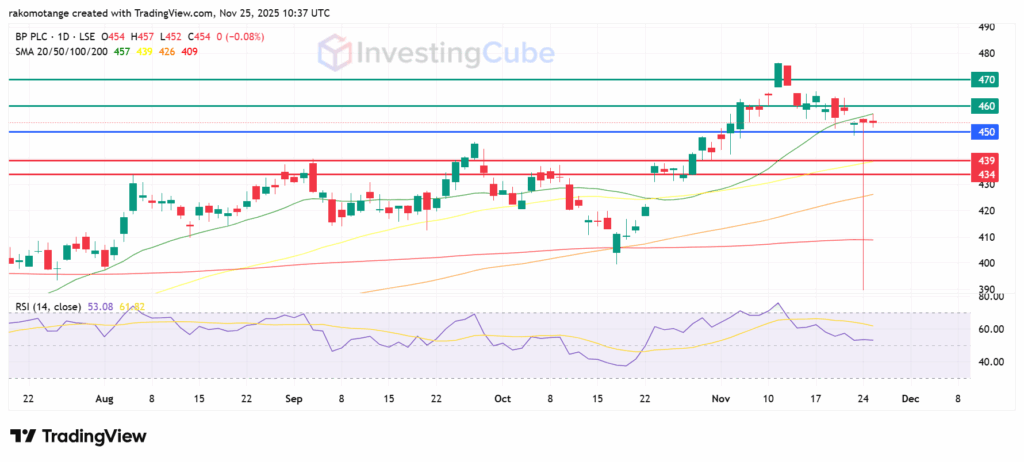

BP share price has its RSI at 52, which is neutral-to-bullish signal. The stock is trading above its 50-day Simple Moving Average (SMA) which is at 439p, which confirms the upward trend that started in October. This 50-day SMA is now a key support level. Below that level, the stock could go lower to test 434p. On the upside, BP share price will probably meet the first resistance at 460p. If buyers keep control, the momentum could push the price higher and test 470p.

Key levels of support and resistance on BP share price daily chart as of November 25, 2025. Created on TradingView

The most significant action was BP’s announcement of a new $750 million share buyback program for Q4 2025, which signals strong cash flow and increases EPS.

Investors are now primarily valuing BP based on its ability to generate high free cash flow and its disciplined approach to shareholder returns.

Prolonged oil supply gluts and demand weaknesses might cap gains by the company and add pressure to its stock.