- Max jet deliveries are of substantially greater importance, but an uptick in July does not tell the whole Boeing stock price story.

Boeing Stock price gained more than 2% on Tuesday, propelled by strong operational indicators. Specifically, the market responded positively to strong delivery figures in July, which showed that the aircraft maker delivered 48 aircraft last month, with the figure inclusive of 38 Boeing 737 Max jets, up by 7 planes from the June numbers.

A blend of issues including manufacturing quality issues, supply chain constraints and regulatory scrutiny saw Boeing (NYSE: BA) struggle to meet delivery targets. Regulatory pressures were a great concern, with the Federal Aviation Administration (FAA) restricting it to delivering a maximum of 31 planes per month for the better part of the first half of the year. Therefore, the resumption of stronger delivery momentum above 45 jets per month augurs well for the company’s performance and clearing of its existing customer backlog.

Max jet deliveries are of substantially greater importance due to their high order volumes and some analysts say that the FAA could soon approve the company to deliver 42 of those jets per month. Boeing has struggled for financial strength since the pandemic era and a return to full-scale delivery is crucial to its recovery.

The company is unlikely to return to profitability in 2025, but a strong delivery pipeline could see it achieve positive free cash flow by 2026. That said, the recent delivery news will likely keep Boeing stock price on the ascending trajectory in the near-term.

Boeing Stock Price Prediction

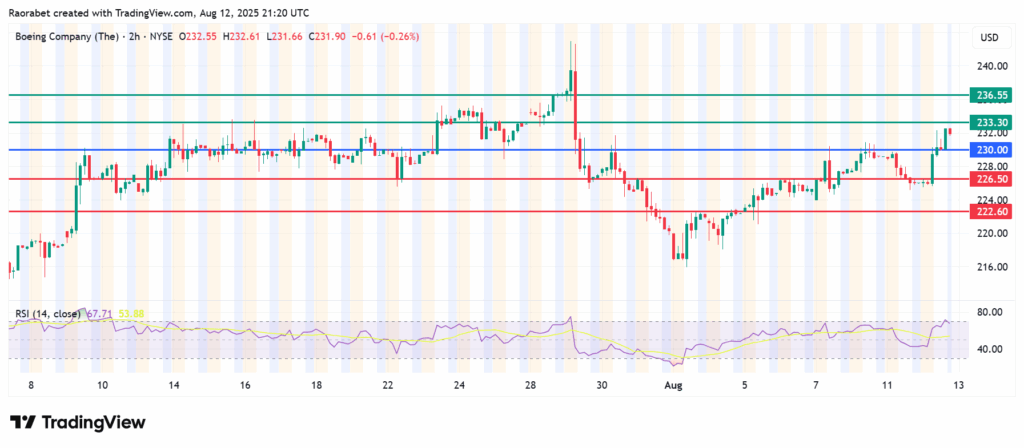

The momentum on Boeing stock price signals control by the buyers above the pivot mark at $230. It will likely meet initial resistance at $233.30. However, a stronger momentum will enable it to breach that barrier and potentially test $236.55.

Conversely, action below $230 will put the sellers in control. That will likely see the first support come at $226.50. The upside narrative will be invalid below that level. In addition, an extended control by the sellers could send the action lower and test $222.60.