- AMD stock price is cracking under pressure despite beating revenue forecasts and giving a strong guidance for the current quarter.

AMD stock price is on the downtrend for the second successive day as investors ignore its forecast-beating earnings released on Tuesday. The chipmaker’s stock was down by more than 8% at 11.20 EST, with the mixed results triggering a selloff that could wipe out a significant portion of the 17% gains registered in the last month.

Advanced Micro Devices (NASDAQ: AMD) reported revenues of $7.68 billion in the second quarter of the year, translating to a 32% year-on-year growth and comfortably consensus Wall Street analysts median forecast of $7.43 billion. However, a 12% QoQ decline in its data center to $3.24 billion triggered fears that AI growth might not be as strong as previously thought, despite a 14% YoY growth in that segment. Many investors view this as a potential precursor to reduced margins, adding downward pressure on the stock. Meanwhile, the company’s adjusted EPS came in at $0.48, slightly below the median forecast figure of $0.49.

AMD gave a strong guidance for the current quarter, estimating that it could earn $8.7 billion in revenue, beating analysts forecast figure of $8.4 billion, but leaving out expected inflows from China. Export restrictions have forced the company to develop MI308 processors specifically targeting the Chinese market. However, it has had to write off $800 worth of inventory related to that market as a result of the trade barriers. This has dampened investors expectations of income from a strong market, and the resulting sentiment will likely keep AMD stock price subdued in the near-term.

AMD Stock Price Prediction

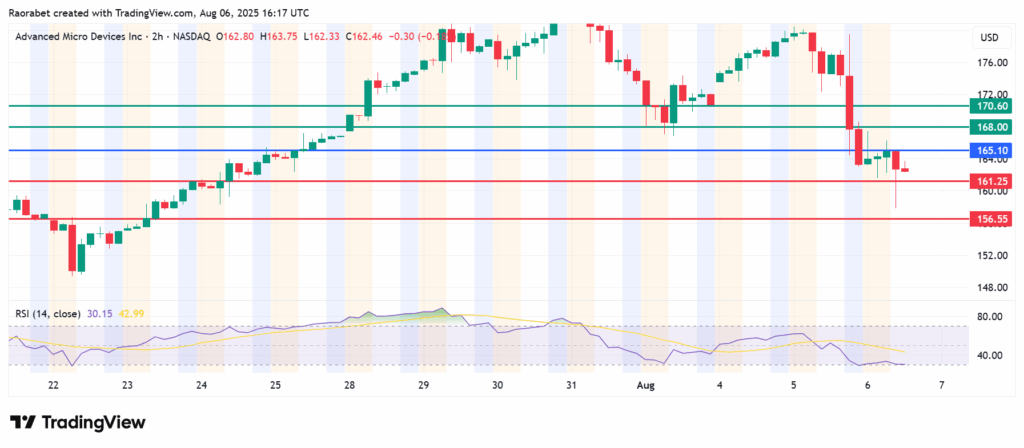

The momentum on AMD stock price calls for further downside if action stays below $165.10. Initial support will likely be at $161.25. However, if the sellers extend their control, the stock will break below that level and could test $156.55 in extension.

On the other hand, going above $165.10 will shift the momentum to the upside, with primary resistance likely to be at $168. Action above that level will invalidate the downside narrative, and a stronger momentum could result in further gains that could test $170 in extension.