The fear and greed index is nearing its extreme fear zone as America’s consumer confidence data dives. It is trading at 26, which is a few points above the extreme level of 20. This happened as American stocks erased earlier gains and dropped for the second straight day on Wednesday. Dow Jones crashed by almost 500 points while the Nasdaq 100 and Russell 2000 fell by over 1.8%.

Fear and greed index retreats

The fear and greed index by CNN Money declined sharply as investors became afraid of the falling American consumer confidence. Data published by Conference Board revealed that the country’s confidence dropped to a 9-year low of 98. The data came a day after another report by JP Morgan revealed that confidence among small businesses slumped to a multi-year low.

Reduced consumer and business confidence usually leads to lower spending, which are the most important ingredients for a recession. At the same time, results by companies like Nike and General Mills showed that businesses are suffering as inflation rises. Therefore, the Dow Jones and S&P 500 indices dropped because of recession fears amid a hawkish Fed cycle.

Market momentum, stock price breadth, and junk bond demand have all moved to the extreme fear zone. At the same time, the safe-haven demand, put and call options, and stock price strength have crashed to the fear level. The only positive data is the volatility index, with the VIX currently at the neutral point.

Meanwhile, Bitcoin’s fear and greed index has tumbled to the extreme fear level of 30. This performance is mostly because the correlation between Bitcoin and American stocks has continued in the past few months.

Russell 2000 forecast as fear returns

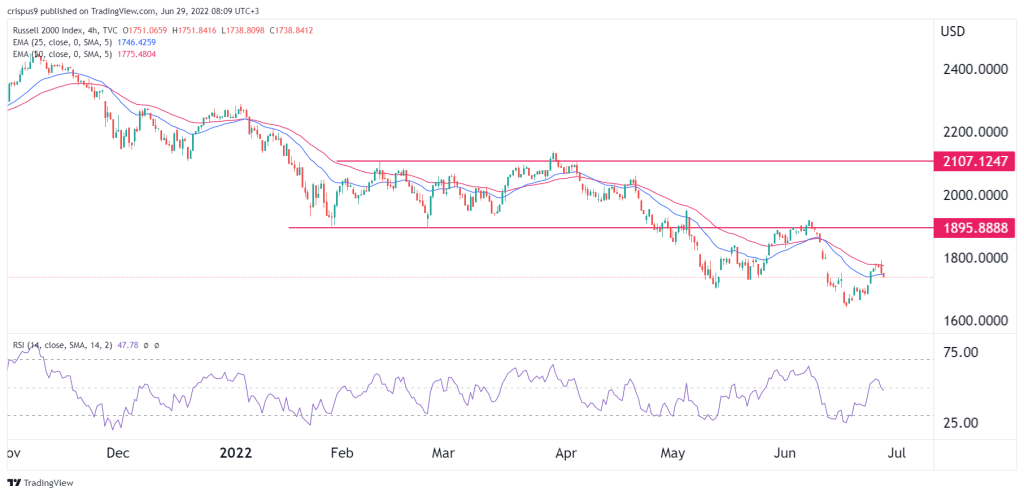

The four-hour chart shows that the Russell 2000 index has erased some of the gains it made last week. The index is trading at $1,738, which is slightly below last week’s high of $1,791. On the four-hour chart, the small-cap index has crashed below the 25-period and 50-period moving averages. It has also moved below the horizontal channel shown in red.

Therefore, the outlook for the index is still bearish as the fear and greed index moves to the extreme fear level. The next key level to watch will be this month’s low of $1,650. A move above the resistance at $1,792 will invalidate the bearish view.