The Invesco QQQ stock price is hovering near its all-time high as investors reflect on the Omicron variant and the Federal Reserve. The fear and greed index has also moved from the extreme fear zone of 25 to the current 33. The VIX index, on the other hand, has dropped from about 35 to the current $21.

A closer look at the Invesco QQQ ETF shows that many big-tech companies like Apple, Microsoft, Facebook, and Google have been in a strong bullish trend. Indeed, analysts now expect that Apple’s market capitalization will jump to more than $3.5 trillion in the coming months.

However, many smaller momentum stocks like Zoom Video, Teladoc, DocuSign, and Roku have all struggled as investors remain concerned about the Federal Reserve. A hawkish Fed tends to be bearish for small momentum stocks.

Later today, the QQQ stock price will react to the latest US inflation numbers. Analysts expect the data will show that the headline CPI jumped to more than 6.7% in November. These numbers will come a few days ahead of the latest FOMC meeting.

QQQ stock price forecast

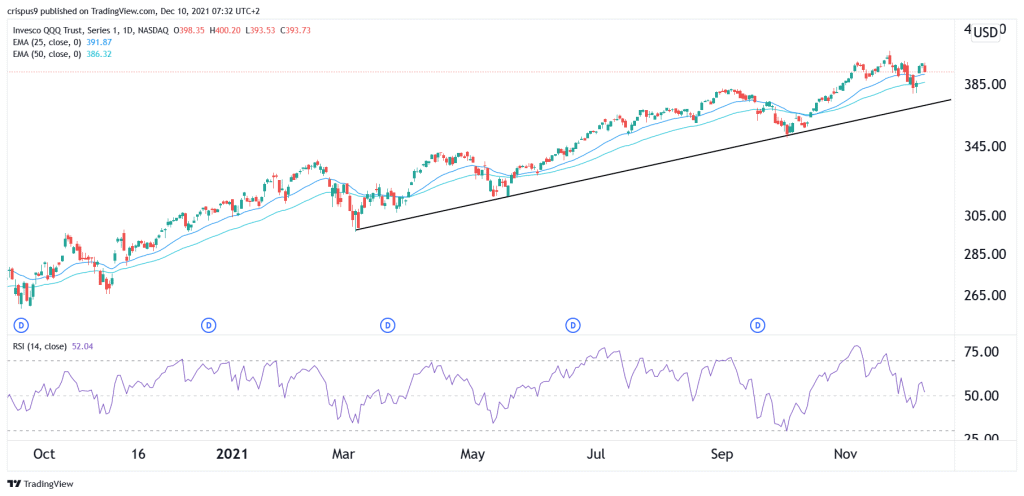

The daily chart shows that the QQQ stock price has been in a strong bullish trend in the past few months. Each dip has proven to be a good place to buy. The fund is above the ascending trendline that is shown in black. It has also moved slightly above the 25-day and 50-day moving average.

Therefore, while the fund could have some declines after the inflation data, there is a likelihood that the momentum will continue in the near term. A drop below the ascending trendline will invalidate the bullish view.