- The Bybit DeFi report assesses DeFi with sector highlights from all aspects, demonstrating DeFi’s transition toward utility-focused apps.

DUBAI, United Arab Emirates, Jul. 23, 2025 — Bybit, the world’s second-largest cryptocurrency exchange by trading volume, released a new decentralized finance (DeFi) report, encapsulating significant shifts in the sector with real-world assets (RWA) and decentralized exchanges (DEXs) as new drivers. Unlike the frenzy of DeFi Summer of 2020, institutional adoption and utility-focused applications are fueling today’s market.

Key Insights

- DeFi’s Institutional Play: Regulatory clarity stemming from events such as the GENIUS Act and Circle’s IPO has spurred institutional interest in DeFi lending and tokenized assets. Backed by the mainstreaming of stablecoins, DeFi’s integration with traditional finance has been driven by institutional interest. Total DeFi lending deposits reached $67.8 billion across platforms including Aave, Morpho, and Maple Finance. RWA platforms like Securitize, Ondo Finance, and Franklin Templeton are enabling yield opportunities backed by US Treasuries, bridging crypto and mainstream investing.

- DEXs Challenge Centralized Players: Hyperliquid leads perpetual futures trading with $1.27 trillion in year-to-date volume, showing DEXs can play in the same league as CEXs. This has encouraged hybrid platforms like Byreal, which combine CEX liquidity with DeFi transparency.

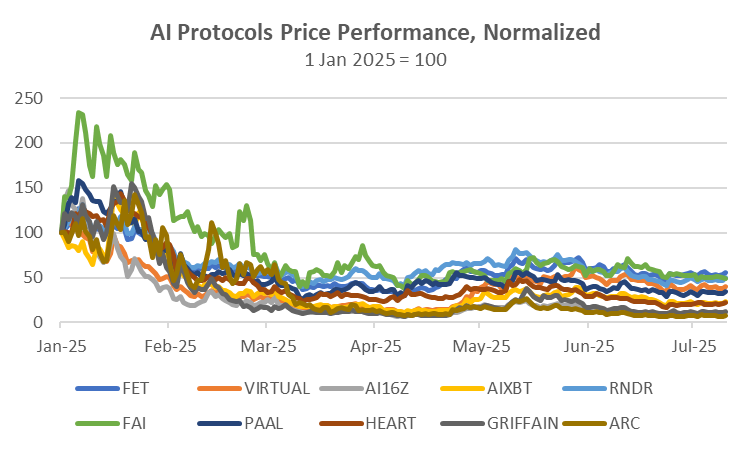

- Divergent Performance: While RWA and DEX sectors flourish, AI-related DeFi (DeFAI) tokens face declining interest and liquid staking growth remains constrained by token volatility.

Source: Bybit, CoinGecko

The report approaches the state of play in DeFi with sector highlights from all aspects, demonstrating DeFi’s transition toward utility-focused applications anchored in real-world use cases. As institutional RWA adoption accelerates and hybrid solutions emerge, DeFi positions itself as on-chain financial infrastructure, combining centralized finance performance with decentralized transparency.