A drop in the value of IT shares on the Nifty 50 index is responsible for the initial decline in Wednesday’s trading. However, the latest US consumer price index and its impact in lifting the US markets early in the NY session has allowed the bulls to push off from session lows. Currently, the Nifty 50 index is up 0.06% on a day with light volume trading.

The index that measures the performance of India’s technology stocks listed on the Nifty 50 fell for the second straight session by 1.7%, tracking the weakness seen in the previous session in the Nasdaq 100. Before this blip along the way, the Nifty 50 had been on a roll, recently hitting 4-month highs as foreign portfolio investors took advantage of cooling oil prices and rising metal prices to pour into the index.

Tech stocks slipped on the Nifty 50 due to market caution resulting from last week’s upbeat NFP report. However, the index closed shortly before the US consumer data was released, meaning the market would probably have a more robust performance in Thursday’s trading.

Nifty 50 Index Forecast

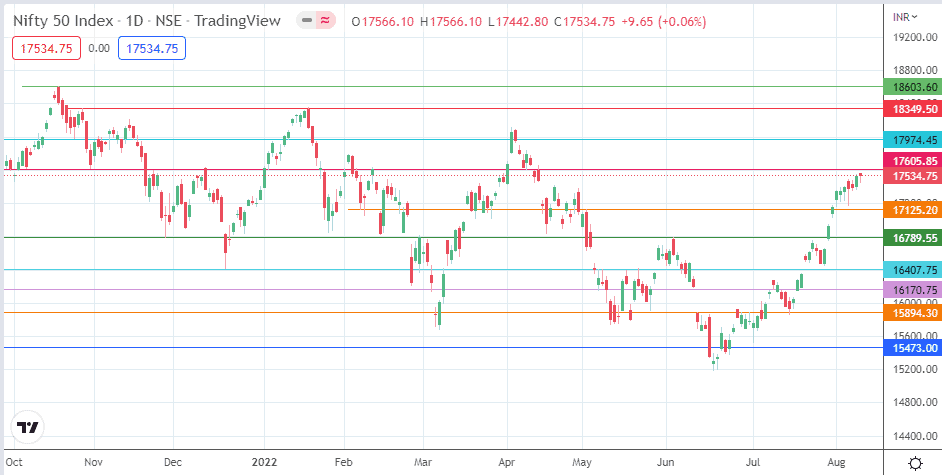

The 17605 price mark is the resistance to beat for the bulls. A break of this level clears the way for a move that targets 17974 (27 September and 2 November 2021 highs). 18349 (18 January high) and 18603 (19 October 2021 high) are additional upside targets that become viable following clearance of 17974.

On the flip side, a correction follows a rejection from 17605. This would target 17125 initially, before the 28 July low at 16789 forms an additional barrier to the south. If the bulls fail to defend this pivot, 16407 (10 May and 23 May highs) and 16170 (4 March and 9 May lows) come into the picture as downside targets.

Nifty 50: Daily Chart