The USD is picking up pace against the Euro as the CB Consumer Confidence figure came in at 135.7; far better than the consensus figure of 125.1. Previous results came in at 124.3. EURUSD is presently edging lower and testing the lower border of the rising wedge pattern. Though not a major market mover, US Pending Home Sales also surprised to the upside, with a healthy figure of 2.8%. The markets had actually expected a 0.5% figure, which would have been a drop from the previous figure of 1.1.

These two releases continue the winning streak for the US Dollar, which has benefitted from some good news in the last four trading days.

Technical Plays on EURUSD

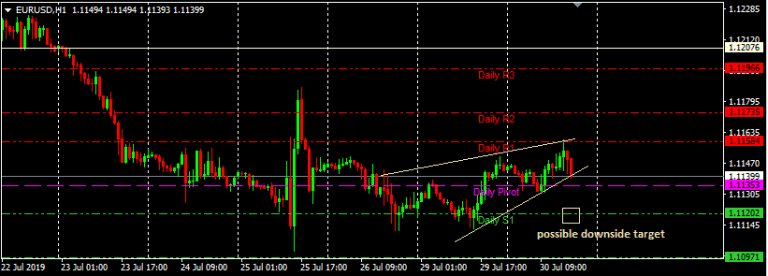

The Fibre’s response to this news release is expected to be muted, as there are bigger fish to fry in terms of data from the US. We may only see a little selling, and even if the EURUSD were to break below the rising wedge pattern, I would expect the central pivot or the S1 support area to come in strongly to resist further downside.

Technically speaking, it is better to wait for the FOMC decision in setting up trades on the EURUSD. This is what will actually determine how far any downside moves will go, or whether the pattern will completely negated. The chart shown is an hourly chart, therefore the daily pivot points will remain the intraday reference points for support and resistance.Don’t miss a beat! Follow us on Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.

Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.