- Analyse inflation and its impact on the economy. Learn how it affects corporate margins, currency value and consumption patterns.

Ever wonder why central banks care so much about keeping inflation around 2%? It all starts with something called the Consumer Price Index, or CPI. It basically watches how the price of everyday goods and services changes for urban households. But CPI is just one of the multiple ways of measuring CPI. Below, we discuss the different types of inflation gauges, what they tell us about price pressures and their impact on the economy.

Inflation Gauges

To gauge inflationary pressures, economists and policymakers rely on several key metrics. The Consumer Price Index (CPI), often cited by the Bureau of Labor Statistics (BLS) in the U.S. or similar agencies globally, measures the average price changes for a fixed basket of goods and services consumed by urban households. It gives you a quick look at how much it costs to live.

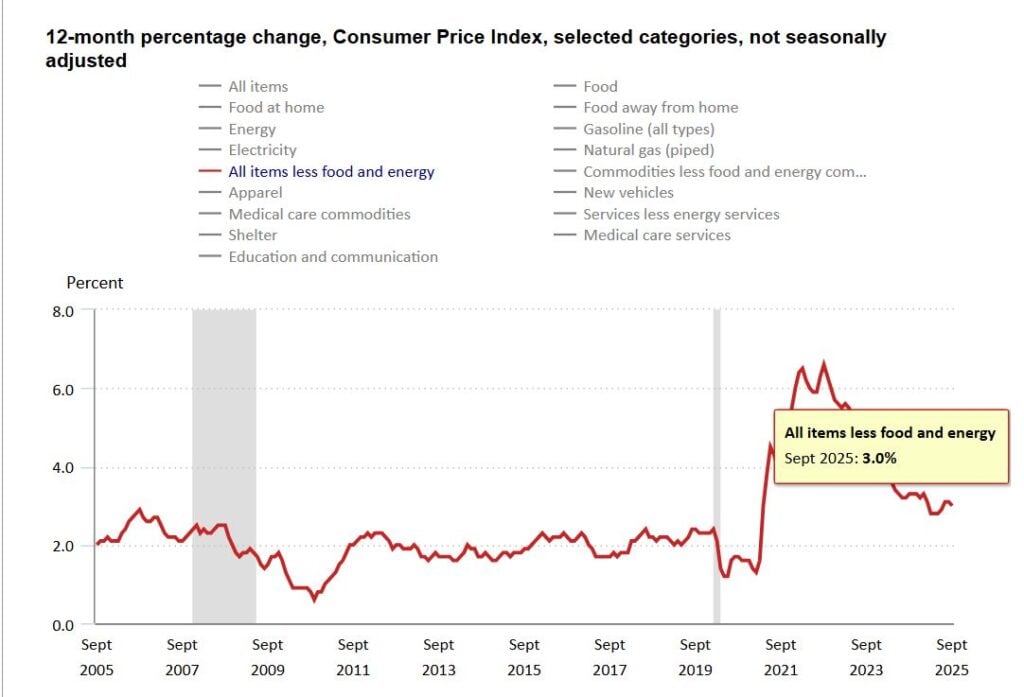

US Consumer Price Index (without food and energy prices) in the last 20 years up to September 2025. Source: Bureau of Labor Statistics

In contrast, the Producer Price Index (PPI) measures the average change in selling prices received by domestic producers for their output. Think of the PPI as an early warning signal: higher input costs for producers (a high PPI) often get passed on to consumers later, fueling the CPI.

Finally, Core Inflation strips out the most volatile components, typically food and energy prices, from the headline CPI or PPI. This measure is a favorite of central banks, such as the U.S. Federal Reserve, because it provides a clearer view of underlying, longer-term inflationary trends, helping them make informed monetary policy decisions.

In October 2025, the BLS reported that U.S. headline CPI was at 2.6% year-over-year, while the Producer Price Index (PPI) went down to 2.0%, showing that cost pressures were coming down. Core CPI, leaving out food and gas, was a bit higher at 3.3%, giving the central bank an easier view of what’s really happening, as they said in their November notes.

The Impact of Inflation on the Economy

Inflation isn’t just about what things cost right now. It’s also about what people think things will cost later. What people expect has a huge snowball on the economy.

For company margins, if businesses expect costs to go up, they might raise their prices early to protect their profits. But, such moves actually make inflation worse.

When it comes to consumer demand, high inflation expectations can lead to a buy now mentality. Here, consumers accelerate purchases to beat future price hikes, boosting demand in the short term. Conversely, stable expectations encourage saving and planned investment.

In the foreign exchange (forex) market, traders are always setting prices for currencies depending on what they think will happen with the economy, notably inflation. When the actual reported inflation number is very different from what the market thought it would be, this is called an inflation surprise.

Inflation in an economy depreciates the value of the local currency, and central banks often intervene through interest rate hikes to prevent things from spiraling out of control. A key disadvantage of a weaker currency is that it makes locally produced goods more expensive and less competitive in the international market.

The CPI measures price changes for a basket of goods and services bought by consumers, while the PPI tracks price changes for goods received by domestic producers.

Companies who think their costs will go up in the future may raise prices ahead of time to safeguard their profit margins. This, however, makes inflation worse.

Core inflation excludes volatile food and energy prices. This makes it clearer to measure the underlying, long-term trend in price levels, which is less affected by short-term supply shocks.