- IMF COFER data shows the dollar’s reserve share rose to 57.80% in Q4 2024.

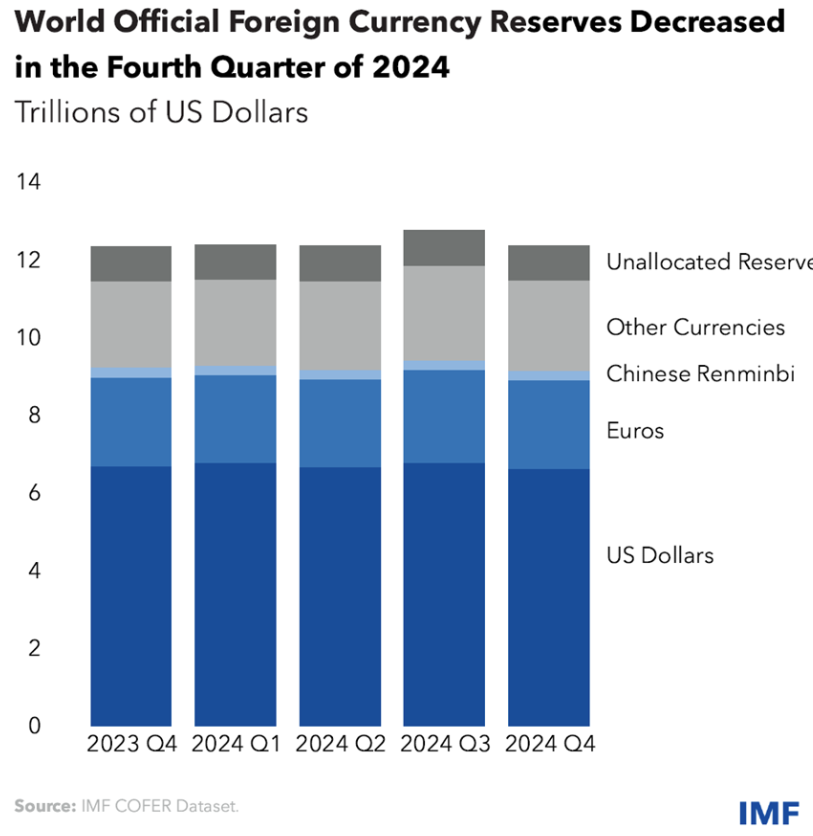

- Global reserves declined from $12.75T to $12.36T due to valuation effects.

- Dollar dominance persists despite geopolitical fragmentation and diversification.

- BIS data confirms USD remains central in trade invoicing and cross-border finance.

- Structural drivers — liquidity, trust, and network effects — support the dollar-led system.

- Future shifts will be slow and evolutionary, not abrupt or destabilizing.

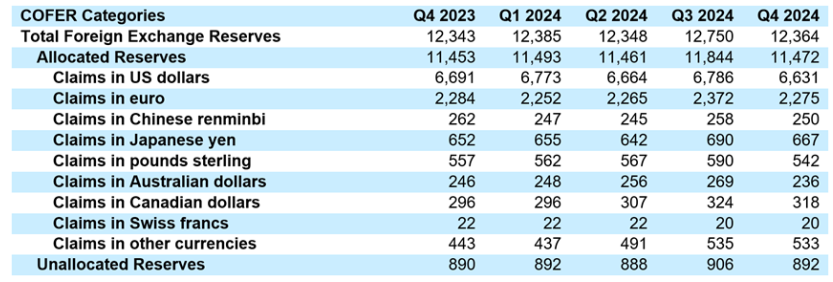

For global finance, the question of whether the dollar can continue to dominant as the leading reserve currency has remained crucial. As per the International Monetary Fund (IMF) Currency Composition of Official Foreign Exchange Reserve (COFER) statistics for Q4 2024, the global official reserves were around $12.36 trillion at that time, and thus the greenback’s share in allocated reserves advanced 57.80% from 57.30% in Q3 2024.

Against this backdrop of a muted 0.5% gain in share, questions about structural shifts in reserve currency arrangements are more pertinent.

Core Concept & Current Market Context

A reserve currency is essential for the settlement of international trade, cross-border credit operations, commodities pricing, and safe heavens for investors. The dollar’s primacy has been anchored on the size of the U.S. economy, the depth and liquidity of America’s capital markets and institutional trust.

Critics have claimed that the dollar may face challenges from growing geopolitical fragmentation, or competing currency blocs, but data reflected only incremental change. For instance, despite only accounting for around a quarter of global GDP (using World Bank indicators), the reserve share of the dollar remains close to 60% — representing very high persistence in the existing order.

Data Analysis & Evidence

Key pieces of evidence:

- Global reserves, such as winter sales of swimsuits at the beach, evaporated to US$12.36 trillion in Q4 2024 from US$12.75 trillion the previous quarter – mostly in response to evaluation effects on currency counts. The dollar’s share of allocated reserves jumped to 57.80%.

- During the same period, the euro’s share was 19.83%.

- According to the Bank of International Settlements (BIS), the dollar is still king on all international financial dimensions — trade invoicing, cross-border funding, and debt issuance — even if some regional measurements differ.

These numbers indicate that the reserve-currency status quo is being chipped away at rather than overturned. The dollar is still very much enmeshed in the global financial structure.

Comparative Status

Scenario A – Continued Dollar Dominance

In this case, the dollar survives as the primary currency if

- The U.S. economy is still relatively more dynamic than major peers.

- The U.S. Treasury market remains the largest and most liquid safe asset pool in the world.

- For liquidity and/or reserve, international institutions and central banks still need to hold and deal in U.S. dollar.

In such an environment, the “dollar-flavor” being present continues to dominate (structural obstacles to other currencies are high, though)

Scenario B – Gradual Erosion of Dollar Dominance

Under this scenario, the dollar’s share could slowly diminish if:

- Other large economists, deepen their capital markets put out more safe and liquid local-currency assets.

- Trade and goods move towards non-dollar distorting trades (eg, more renminbi or euro invoicing).

- Central banks slowly reduce their gradual reserve allocation to the dollar for diversification or geopolitical reasons.

But based on existing data, this will be an evolution, not a sudden turnaround.

Broader Implications

- Global markets: A strong dollar is a supportive factor for global liquidity, but also means that when the greenback flexes its muscles, it tends to put financial conditions globally — particularly in developing economies burdened with dollar liabilities — into a more hawkish setup.

- Investors: Dollar dominance is driving asset-allocation decisions, which in turn affects sought-after commodity exposure, U.S. vs non-U.S. Equity weighting, and currency hedging strategies.

- Sectors:

-Energy and commodities: Many contracts are priced in U.S. Dollars, so the strong dollar tends to limit upside for commodities.

-Export-oriented industries: Dollar strength represents competition for export-exposed areas, affect affecting margin or volume. - Currencies & Commodities: The dollar’s trajectory against other currencies, remains one of the biggest drivers for gold, oil and other commodities denominated in dollars — a strong dollar tends to weigh on these prices; a weak dollar can provide some support.

Expert Insight

Looking at it from the perspective of a professional practitioner, effort it’s not all that makes up this dominance; there are also network effects and institutional lock-in — deep dollar liquidity and settlement system, reserve-asset status, and global trust. The newest data – there has been little to moderate shift in composition — further buttress impressions that any reshaping may come not suddenly, but structurally and overtime.

Analysts read current trends of diversification (like the growing share of euro or renminbi in some corridors) as complementary rather than substitutive, and thus reinforcing, rather than replacement, to a dollar centric order.

Reference and Sources

- IMF, Currency Composition of Official Foreign Exchange Reserves (COFER), Q4 2024.

- BIS, International finance through the lens of BIS statistics: the global role of the dollar (2024).

- IMF, The International Role of the U.S. Dollar – Blog, Oct 1 2025 Edition.

Frequently Asked Questions

For the simple reason that the U.S. dollar enjoy powerful structural strengths: the size of its economy, the depth and liquidity of its financial markets — particularly its Treasury market — as well as global confidence in U.S. Institutions and established network effects. All of these factors help create a “lock-in” effect that cements the dollar in its vast role across global trade, financing, and reserves.

The numbers tell only a small story: reserves fell to US$12.36 trillion worldwide, and the share of the U.S. Dollar increased slightly from 57.30% to 57.80%. That would suggest the process of diversification is underway, even if it remains slow and evolutionary rather than revolutionary, as we have heard many times before a few years, backing up the dollar’s structural dominance.

The dollar share remains in large parts unchallenged while the dollar share might slowly erode if some of the world’s largest economies (e.g., euro or China) further develop their financial system, there is more issuance of safe and liquid assets and more invoicing of non-dollar trade, or/and global central banks diversify reserves away from the dollar for geopolitical or strategic reasons. Even so, the article adds, this would still be a slow and gradual transition, not an “overnight collapse”.