- The 10,000 mark is a key milestone and psychological boost for FTSE 100 stock investors

- Defense, Mining companies, and Banks are at the forefront of the current rally

- The Bank of England (BoE) could lower interest rates, boosting stocks further, but there are underlying risks

The UK’s FTSE 100 index, often seen as medieval with its focus on banks and miners, has proven its doubters wrong. It didn’t just reach 10,000 in early January 2026; it blew past it, continuing the strong performance from last year, where it jumped over 20%. We examine what’s driving this growth, what it needs to stay up and what could stop it.

What is Fueling the Fire?

The FTSE 100’s rise is due to multiple things. Mining and energy are doing well, with Glencore rising 8.5% on merger talks. Commodity stocks are up because copper and gold prices are high. Defense firms like BAE Systems and Rolls-Royce are also up as global defense spending increases due to rising geopolitical risks.

Banks are also doing well due to strong earnings. Expected rate cuts from the Bank of England could provide further support. AJ Bell analysts believe profits will grow by 14% in 2026, with total dividend payments reaching £85.6 billion.

Meanwhile, as AJ Bell’s Dividend Dashboard recently highlighted, the UK market is currently a “rich hunting ground” for dividends.

Will the FTSE Stay Above 10,000 Points?

The FTSE 100 looks set to keep rising, with experts predicting continued gains. AJ Bell projects a year-end target of 10,750, driven by 14% earnings growth. A survey by Morningstar shows most managers expect the index to stay above 10,000, helped by easing inflation and recovery in sectors like housebuilding. If global growth gets stronger and geopolitical tensions decrease, the index might do even better than it did in 2025.

Emerging Risks to Consider

Despite the positive outlook, there are risks. Geopolitical tensions and potential tariffs could harm trade. A weak UK economy could also create problems. Slowing consumer spending has hurt retail, as seen in Sainsbury’s declines. There are also concerns about overvaluation.

In summary, while sector strength and policy support suggest the momentum can continue, we need to be careful. The index’s strength offers chances, but it’s vital to spread investments around.

FTSE 100 Index Forecast

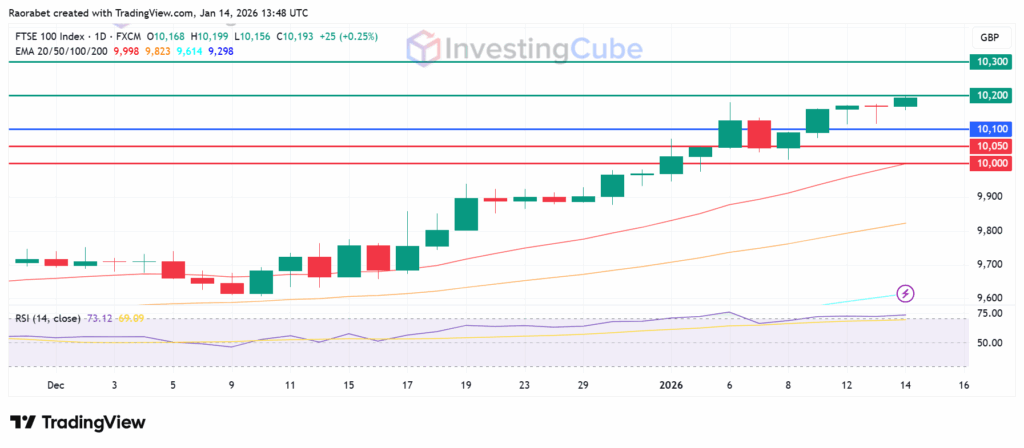

The FTSE 100 maintains a bullish structure on daily charts. The Relative Strength Index (RSI) is at 75, which means the market is doing well but carrying overbought risks. The upside will likely prevail if action stays above 10,100. Immediate resistance will likely be at 10,200, with potential further gains to 10,300 in the near-term. The first support is at 10,050, below which further losses could target testing the psychological level at 10,000 points.

FTSE 100 Index on January 14,2026 with support and resistance levels. Created on TradingView

Mining and energy sectors, fueled by high commodity prices, alongside banking resilience and global exposure, have propelled gains

It’s a big psychological milestone. For a long time, the UK market was seen as slow. Crossing 10,000 tells global investors that the old-economy sectors are growing and have the value to compete globally.

The main risks are commodity price swings and interest rate uncertainty. If copper or oil prices drop sharply, or if the Bank of England stops cutting rates because inflation is still high, the index’s momentum could stop quickly.