- Discover how the US futures, such as the Dow Jones, are reacting to the ongoing tensions between Iran and Israel.

Wall Street’s future continues to trade with losses in response to the unconfirmed reports of potential ceasefire talks between the US and Iran. The Dow Jones futures closed yesterday, losing 0.70%. The markets are waiting for a potential meeting between the US and Iran later this week; however, this meeting is not confirmed yet.

The markets are on edge due to the unexpected request from the US president, Donald Trump, to evacuate Iran’s capital because of the ongoing tensions between Iran and Israel. These geopolitical tensions make investors less confident in the market and lower their risk appetite toward trading the equity market.

The US president, Donald Trump, decided to exit the G7 summit, and this also increased the fears of an escalation. However, Trump denied that his early leave was related to a cease-fire in the Middle East, affirmed that it was due to a “much bigger” reason. His answer does not support the market sentiment

On the other hand, the US Dollar Index is struggling in response to the escalating war between Israel and Iran; the index remains close to the multi-year lows at 98.55. Additionally, the larger decline than expected in the manufacturing activity was seen on Monday, raising hopes of cutting the interest rate by the Federal Reserve after summer. All of these factors affect the whole market sentiment and the pricing of the Dow Jones.

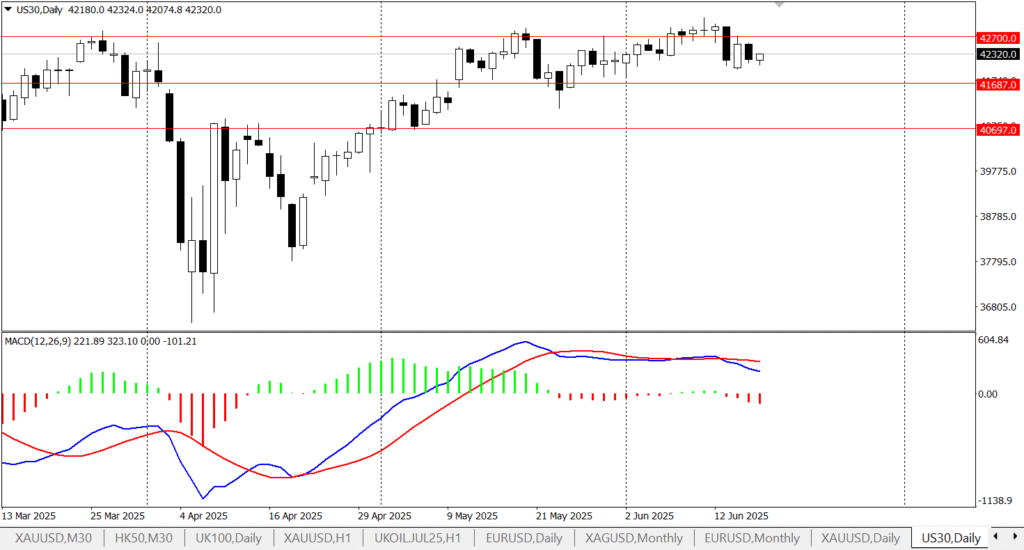

The technical outlook for the Dow Jones (US30):

The Dow Jones has fallen back down below the 42500 mark and can not keep its momentum and impressive run earlier in the week. The Dow Jones has been in a sort of sideways trading range, or what might be referred to as a consolidation zone, since mid-May, indicating that its price has gone back and forth without a definable change in direction either upwards or downwards.

Last week, the Dow Jones rose to a new all-time high, even trading above the psychological level of 43000. However, the escalating tensions in the Middle East caused investors to turn a little more risk-averse, which resulted in investors pulling back their investments after a little confidence.

As investors changed their risk appetite, the Dow Jones’ prices began moving lower. However, there is a bit of technical support below the 200-day exponential moving average at 41,800. This level acts like a floor that the price tends very rarely to drop under.

If the price can not make a clear day close above the $42700 level, this may expose it to reach lower levels toward another support level, $41687, and $40697, respectively. While the traditional MACD supports the bearish trend on the daily time frame, due to its histogram creating signs of selling momentum.