- The S&P 500 has risen 0,6% since the year began, but forthcoming leadership change at the Federal Reserve and geopolitics could bring new disruptions

The S&P 500 has achieved a new all-time high, closing at 6,965.65 on January 7, 2026. The index is up by 0.6% year-to-date, but many investors are asking whether this a sustainable productivity upsurge or if we just watching the AI bubble get bigger.

Beyond the AI Bubble Fears

The S&P 500’s forward Price-to-Earnings (P/E) ratio is currently hovering around 22x, which is notably higher than the 10-year average of 18.6x.

But just because something is pricey doesn’t mean it’s about to burst. Even though everyone was talking about AI fatigue in 2025, the market’s recent moves suggest people are less caught up in the hype and more interested in seeing actual results. Reports from Goldman Sachs and Morgan Stanley signal that this isn’t just guesswork. Unlike the dot-com days, today’s tech leaders, like Nvidia and Microsoft, are making a lot of profit.

Still, there are risks. The top 10 companies make up about 40% of the index. This can be a problem because a handful of these big tech companies have issues, the whole S&P 500 could suffer.

What Awaits the S&P In 2026?

Experts on Wall Street are generally positive about the end of 2026, with predictions ranging from 7,100 to as high as 8,100. There are three things that will really matter. First, the Fed will be getting a new leader. Jerome Powell’s time is up in May 2026, and any questions about who will replace him could make things shaky. Secondly there’s the trajectory of industrial AI Adoption.

Futurism says that investors are ready for a correction, but JPMorgan expects AI stocks to do well, with spending exceeding what they expect. This hints that the growth in this area is real, not just based on hype. A few things will shape the results. Monetary policy, including what the Federal Reserve does with rates, is still key. Also, profit growth, available capital, and geopolitics need to fall in place.

S&P 500 Forecast

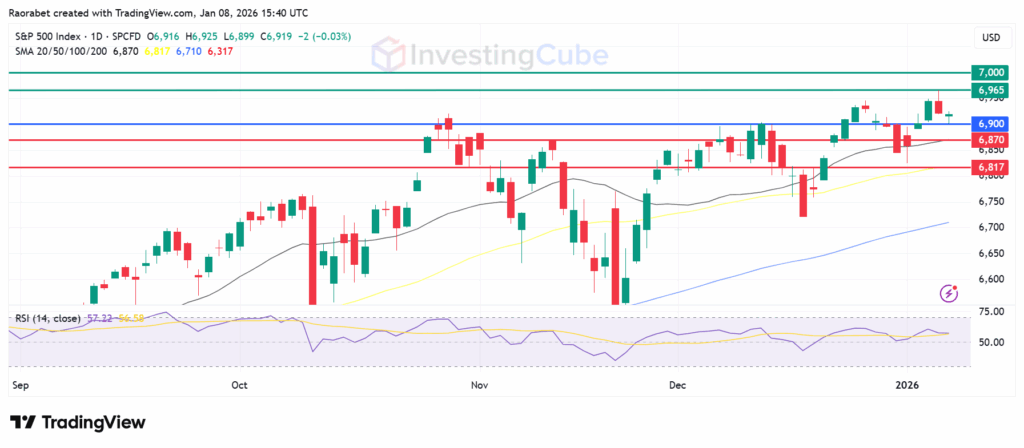

The S&P 500 is currently in a strong medium-term rising channel. It recently broke through resistance at 6,900, which now acts as the pivot. Immediate resistance is at the all-time highs of 6,965 points. If the index can clear this on high volume, the next target is 7,000. On the downside, the first support will likely be at the 20-day EMA at 6,870. A break below that level would be the first signal of a deeper correction toward 6,817.

S&P 500 Index on January 8, 2026 with key support and resistance levels. Created on TradingView

Not entirely, but the focus has shifted. Investors are now demanding “proof of profit.” While bubble fears exist, the rally is supported by actual double-digit earnings growth rather than just the hype.

Immediate support is at 6,900 the level where the market should find support, and 6,870 is a strong floor. There’s likely to be resistance around the 6,965 mark. If it can break past 7,000, that would mean the market’s about to go on another big run.

Fed policy, earnings, liquidity, geopolitics, and AI developments, with potential market splintering