- Get the latest updates on S&P 500 trends and the Fed's monetary policies. Learn how these developments affect global markets.

After the Federal Reserve cut the interest rate, the major stock indices ended Wednesday mixed. The S&P 500 closed lower by 0.10%, the Nasdaq 100 closed lower by 0.21%, the Nasdaq Composite slipped by 0.3% while the Dow Jones advanced by 0.57%.

The U.S. stock index futures were choppy on Wednesday evening, initially rising after the Federal Reserve announced a 25-basis-point cut in interest rates, and then finishing the session lower.

S&P 500 News | The Fed’s Decision and Its Impact on Global Markets

- The Federal Reserve meeting held yesterday came with a 25 basis point cut in interest rates.

- The Fed’s economic projections signaled that another 50-basis-point rate cut is a possibility for the rest of the year.

- The Fed Chair Jerome Powell described this step as “risk management” amid a cooling labor market.

- Stephen Miran, the new governor, favored a larger 50 bps cut.

- The US stock futures rise ahead of the opening of the United states regular session.

- The S&P futures gain 0.74% or 50 points to move above 6,700.

- The Dow Jones futures gain 0.61 or 277 points to move above 46,600.

- The Nasdaq futures gain 0.96% or 237 points to move to 24,700.

- Following the Federal Reserve, the Bank of Canada also cut its interest rates by 25 basis points, while the Bank of England and the Bank of Japan are expected to keep their rates unchanged.

- JPMorgan Chase, Citigroup, Wells Fargo, and Bank of America lowered their lending costs from 7.50% to 7.25% after yesterday’s Fed cut. In a move to remain competitive and make rates cheaper for borrowers.

- However, markets were choppy with mixed reactions on the equities front, but the positive scenario for the U.S. benchmark indices remains intact.

- Although the S&P 500 slipped 0.10% by yesterday’s close, it still managed its third-highest close on record. This came along with a rally in the S&P 500 futures on Thursday.

- According to the CME FedWatch tool, market participants are pricing in an 87.7% probability of another 25 basis points cut at the Fed’s next meeting in October.

Currency Market Reaction:

- Initially, the U.S. dollar dropped to 96.22 against its peers, which is the lowest price since 2022, and then rallied back by 0.3%.

- Following the decision, the Euro’s immediate reaction was a rally to the highest level since June 2021, reaching 1.19185. However, it corrected today, slipping 0.2% as traders absorbed the full impact of the decision.

- China‘s Central Bank refused to follow the Fed and kept its rates unchanged. The Chinese Yuan gains 0.1% at 7.1060.

- The Bank of England Policy holds interest rate unchanged at 4% as expected.

- The Sterling, after racing to a high of 1.37 on Wednesday, dropped and closed lower at $1.3606.

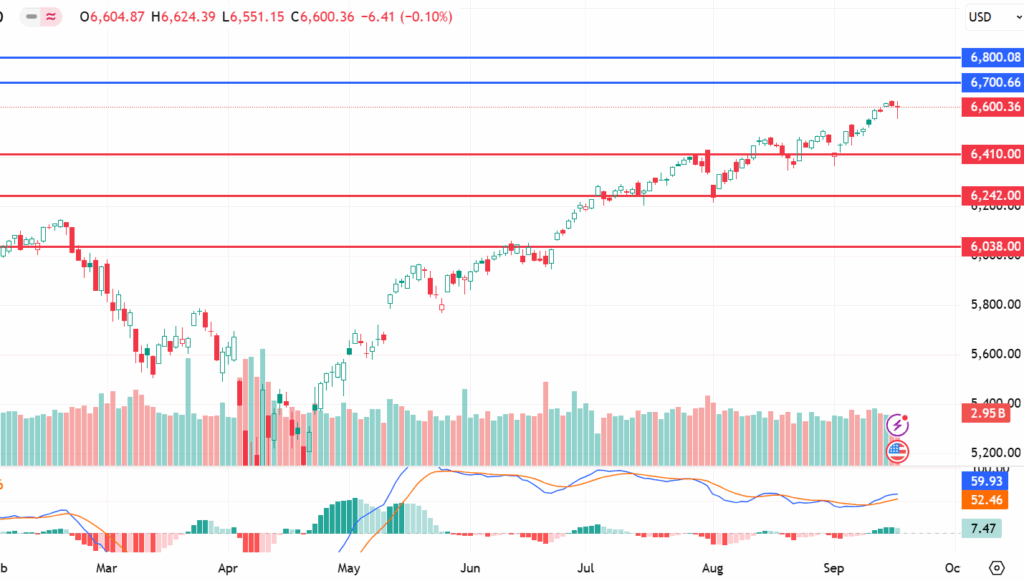

The Technical Outlook for the S&P 500 Index:

From a technical perspective, the S&P 500 has been consolidating above the 50-day, 100-day, and 200-day moving averages, at 6038, 6242, and 641,0, respectively.

These levels are considered key support levels on the bearish side. However, as long as the S&P 500 future opens higher, reaching 6707, we can anticipate that the index will also open higher during the US trading session.

With a consolidation above the strong support levels of 6550- 6600. This opens the door to reach higher levels toward 6700 and 6800.

The S&P 500 is a stock market index that tracks the performance of 500 of the largest and most significant publicly traded companies in the United States. It stands for Standard & Poor’s 500; it’s a market capitalization-weighted index. This means that larger companies have a greater impact on the index’s value.

NVIDIA weighs 7.14%, Microsoft 6.35%, Apple Inc., 5.95%, Amazon 4.15%, Meta Platforms 3.27%, Broadcom 2.76%, Alphabet (class A) 2.64%, Alphabet (class C) 2.47%, Tesla 2.32% and Berkshire Hathaway 1.77%