- As the US and global economies continue to navigate uncertainties, the S&P 500 Index keeps rising. Find out why and whether it will stay up.

The S&P 500 Index (INDEXSP: .INX) has reached all-time highs in 2025, defying worries about inflation and geopolitical risks. As of this writing, the index has hit several new highs in its recent closing prices. It has risen more than 12% year-to-date and about 30% since April’s lows. Seasonal declines and overextended valuations may cause temporary pauses, although historical patterns indicate that rallies following rate decreases typically last.

Why Is the S&P 500 Rallying?

The S&P 500 is going higher because of a number of interconnected things. First, the tech sector is doing well because of the excitement around AI growth prospects. Tech-heavy companies, including those in the Nasdaq, have led the way in the growth. Investments are also coming in fast, like Nvidia’s $5 billion stake in Intel and the US Government’s $8.9 billion investment in the chipmaker. The narrative of how AI will lead to more growth and productivity in the future is a strong one that has the market’s attention.

Second, a substantial rise in corporate profits have made investors more confident. Companies in the S&P 500 have repeatedly reported results that beat analysts’ projections, despite the weak economic data. Analysts expect earnings per share to expand by 7–10% in 2025, driven by a resilient GDP and consumer spending.

Third, monetary policy has played a critical role. Many are feeling hopeful because they believe the Federal Reserve will cut rates, in addition to the 25 basis point cut in September. Lower rates make borrowing cheaper and encourage high-risk investments.

The Fed has recently cut interest rates by 25 basis points, making its first cut since Donald Trump came into office for his second term. Lower rates help businesses generate more revenue due to increased spending and makes stocks more appealing than other assets like bonds. A more dovish Federal Reserve is already priced in, and that will likely continue to support the market’s surge.

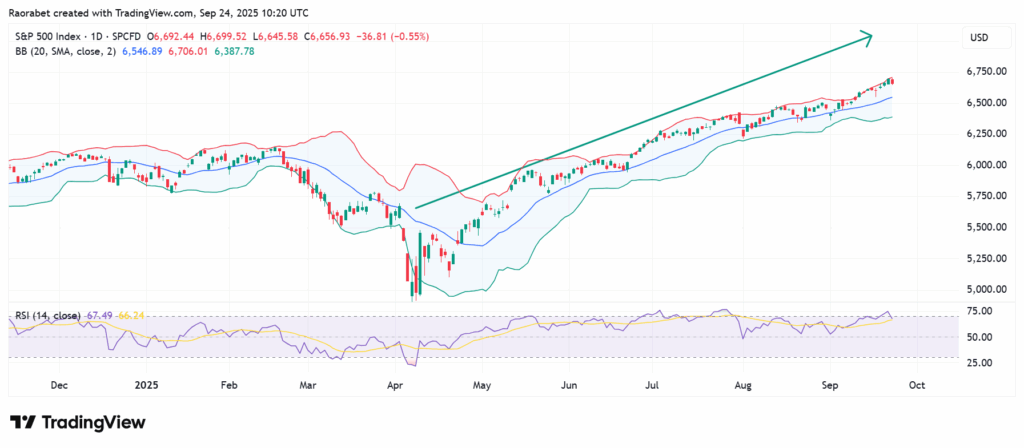

The S&P 500 Index has risen sharply since its April lows and is recently near the upper Bollinger Band on the daily chart. Source: TradingView

What Are the Risks?

Although things are looking good, there are significant risks ahead. The extreme concentration in the index is one of the key factors. The top 10 stocks now make up 35–40% of the index, which makes it more sensitive to shocks in the IT sector. If the AI enthusiasm cools down or earnings don’t meet expectations, this “hidden risk” could trigger major corrections.

Also, high stock prices, especially outside of the tech industry, don’t always mean that the company is growing at a fundamental level. The S&P 500’s price-to-earnings ratio is high, and if profits growth doesn’t meet expectations, it could trigger a major drop.

New trade barriers or rising geopolitical disputes could cause uncertainty and break supply chains, which can hurt businesses and make investors less confident. Also, if inflation stays higher for longer than expected, the Fed may have to reverse its recent dovish stance. This might pop the market’s bubble. If rates go up, it will cost more to borrow money and stocks would be less appealing.

In Summary

In summary, the S&P 500’s rise in 2025 shows that the economy is resilient and innovative, but it might not last because of the risk of over-concentration in a few stocks as well as external forces. Investors should be optimistic and cautious to shield themselves from such risks.

The AI boom, strong performance from big tech companies, and optimism that the Federal Reserve will cut interest rates are all helping the S&P 500 go up.

There is contention over how long the index will go up. Many analysts have reservations about its restricted focus on a few stocks and high valuations.

If the Fed does not cut rates, there is a risk of reduced investor confidence. Other big risks include a wider economic slowdown and a possible correction if prices stay too high.