- A blend of AI bubble fears, uncertainty regarding UK's tax plan and Fed Interest rate decision brought pressure on the FTSE 100 index last week.

- The UK Chancellor opted against higher taxes, bringing reprieve to UK financial markets.

- Fed rate cut hopes hang in the balance, with a high probability that they could stay unchanged

After a sharp tumble last week, the FTSE 100 is back on the rise this week. On November 26, it closed at 9,691.58, bouncing back from earlier losses. Let’s look into what caused the dip, what’s driving the current upswing, and if this recovery can last.

Diagnosing FTSE 100’s Decline Last Week

The FTSE 100 fell more than 1.2% last week, marking its steepest weekly loss since April 2025 and pushing the index to a five-week low near 9,552 according to data from London Stock Exchange. The primary triggers were external and domestic in nature.

Concerns over the value of stocks tied to artificial intelligence around the world resulted in a negative sentiment. A significant drop in key U.S. tech equities, especially Nvidia, fueled fears of a “AI bubble” correction that spread to European markets. At the same time, investors were less willing to take risks since they weren’t sure when or how big the next U.S. Federal Reserve rate cuts would be.

Domestically, Chancellor Rachel Reeves’ change of heart on a tax plan caused UK gilt yields to jump. Higher borrowing costs put pressure on financial stocks, with banks like HSBC and Standard Chartered seeing declines. These factors combined to cause widespread selling.

The Comeback: What’s Fueling the Current Recovery?

The momentum has decisively shifted this week, and the recovery is being fueled by an almost complete reversal of last week’s anxieties. The primary catalyst is the return of rate cut bets.

Market analysts at OANDA’s MarketPulse say that more Federal Reserve officials are talking about easing monetary policy, making investors optimistic about a rate cut soon. This belief has boosted stocks, which tend to do well with lower borrowing costs and plenty of cash available.

Domestically, the UK’s own political calendar provided an uplift. The recent UK Budget contained several measures that proved supportive of UK-focused firms, particularly reforms to ISA rules and a stamp duty holiday for newly-listed shares, which boosted sectors like wealth management and banking. Also, commodity prices stabilized, which helped major miners like Rio Tinto and Glencore.

FTSE 100 Near-Term Outlook

The recovery appears supported by improving global risk sentiment and expectations of looser monetary policy. Analysts at Morningstar project modest UK GDP growth of 1.2–1.5% in 2026, with inflation likely to remain above the 2% target, creating a generally constructive backdrop for equities.

Still, if U.S. economic data is too strong, or inflation proves stubborn, the rate cut bet could reverse quickly, leading to another downturn. For now, the index is doing well, but investors should be careful and watch U.S. jobs and inflation data closely.

FTSE 100 Index Prediction

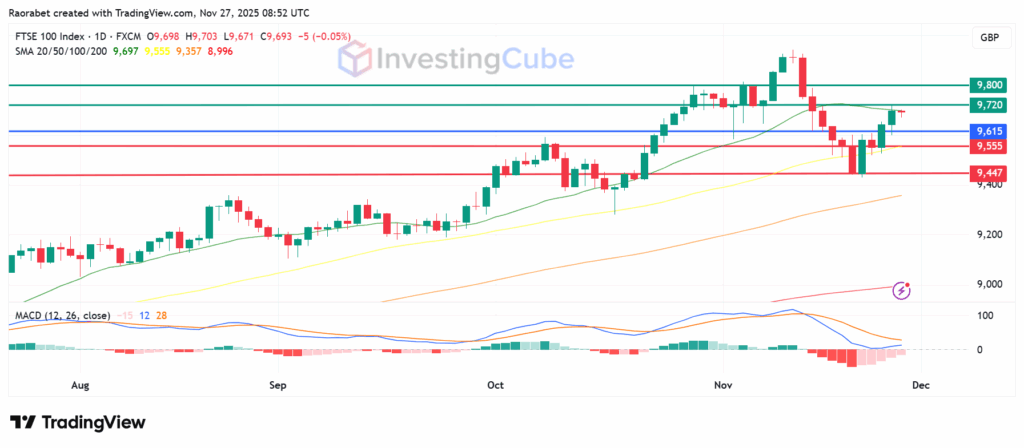

The FTSE 100 trades above all key moving averages. The 50-day SMA stands at approximately 9,555, which acts as the primary support. Below that level, the action could go lower to test 9,477 points, just above the monthly low. On the upside, initial resistance will likely be at 9,720, just above the 20-day SMA, beyond which the second one could come at 9,800. MACD (12,26) shows positive histogram expansion, supporting the upside narrative.

FTSE 100 Index daily chart on November 27, 2025, showing support and resistance levels. Created on TradingView

The Index mainly fell because people weren’t expecting the US Federal Reserve to cut interest rates anytime soon. This made investors nervous, which caused a lot of international tech stocks to be sold off.

Whether the FTSE 100 keeps going up mostly hinges on US economic numbers and what the Federal Reserve does in response. The index is very sensitive to global interest rates and what people expect monetary policy to be.