- FTSE 100 hovered near 9,756, extending its two week rally as investors await the Bank of England’s rate decision

- Energy majors outperformed on firm oil prices above $84 bbl, offsetting weakness in banks

- The pound weakened 0.3% vs USD, boosting exporter and multinational earnings

(InvestingCube, 6 Nov 2025) In today’s session, the FTSE 100 index traded just below the 9,780 level, continuing a solid two week rally as investors digested updates on corporate earnings; gains in the energy sector and the markets expectations of the forthcoming Bank of England policy decisions. The index continues to probe record levels and the questions being posed to traders is whether London’s benchmark is preparing for a breakout after the 10,000 point psychological level.

The Fuel Behind FTSE 100 Momentum

A number of features have recently been providing the FTSE 100 with its robustness. Corporate earnings have been generally good across the major sectors, with energy titans, BP and Shell benefiting from recovering oil prices of the reports suggest suggesting that OPEC+ could delay its increased output cycles into early 2026, sending Brent Crude above $84 a barrel. The momentum from this results has helped see off the weakness experienced in banking and financial sector stocks.

Barclays and Standard Chartered in the financial sector both gave away around 1% of their respective values, reflecting the softly approach that investors are taking into their considerations of the forthcoming BoE rate announcement. The companies recently announced latest quarterly numbers are nevertheless resplendent with a good balance sheet positions and dividend commitments — distributors of financial sentiment that helped trend the overall index values higher.

The retailers have been in the spotlight today as Marks & Spencer (M&S), one of the heavyweight stocks in that sector, has reported it has sustained a very damaging cyber attack that has disrupted working patterns and sent its first half profit before tax plunging 99% year on year. The companies CEO has also cautioned that the recent fiscal initiatives of Chancellor Rachel Reeves could lead to a downturn in consumer confidence and add to the market caution as regards to stocks in the discretionary spending category.

Meanwhile, the pound this week had weaken against the much stronger US dollar by around 0.3%, and that too, has had the effect of indirectly supporting the stocks in the index that otherwise do well if they have exposure to earnings from abroad. A weaker Sterling enhances the value of the overseas profits when taken back into their pound equivalent, which is another quietly supporting wind for the index.

When Could FTSE 100 Reach 10,000 Points?

The 10,000 mark remains the next psychological target for the market, and optimism is firmly expected to build towards achieving that level. The FTSE 100 has already climbed by around 7% this year so far, and on also looking at the respective timing of the breakout as opposed to the prospect of it, the analysts are beginning to add uncertainty about the time that could elapse before it successfully breaks through.

Some strategist at Fidelity international now are saying that if energy prices remain buoyant, and the pound continues to suffer light topical pressure, that then the index could touch the 10,000 level before year end. Others such as Citygroup think in a more cautious fashion as regards FTSE 100 prospects, thinking that it could average about the 9700 level through to mid 2026 before eventually moving higher as a result of the anticipated cuts in interest rates.

Investor sentiment on the other hand is also being helped by expectation of the Bank of England not altering rates at its upcoming meeting and probably with some easing processes coming into play in 2026. A stable policy pace by the respective authorities, together with a good dividend yield of about 4.1% makes the FTSE 100 look in great favor with its rival international investment locations. Much will depend however upon the continued weakness of the consumer sectors, which could yet postpone a breakthrough or five figure levels.

FTSE 100 Price Forecast & Technical Analysis

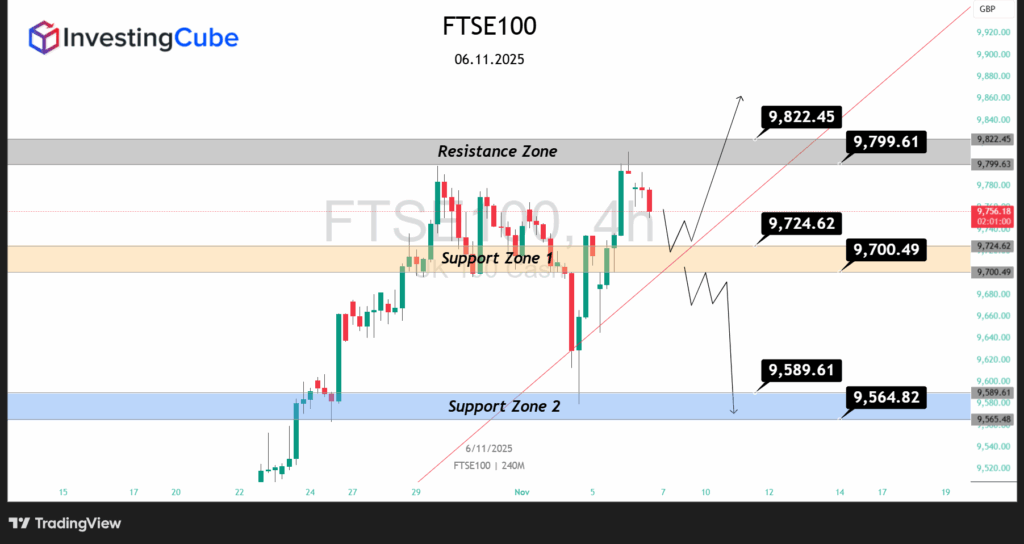

As per the latest 4-hour chart shown above, the FTSE 100 is continuing in a defined bullish structure, with the close support and resistance levels shaping short-term direction.

- Resistance Level: 9,799,61 – 9,822.45

This upper resistance area has been tested, creating short-term rejection wicks against that zone, reflecting moderate selling. A confirmed break above that zone would then open the route to 9,900 and ultimately 10,000 if the bullish momentum picks up. - Support Level: 9,724.62 – 9,700.49

This zone has acted as a strong pivot area. A rebound here would indicate that buyers remain in control, thus preserving the bullish trend. - Support Level 2: 9,589.61 – 9,564.82

Should price breakthrough Support Level 1, there would then be pressured within sellers to drive the index to deeper Support Level 2. I confirmed close below the figure of 9,564.82 would invalidate this bullish structure and force the index to focus on consolidation or corrective movements.

From a technical perspective, as long as the index remains above 9,700, the bullish structure remains in play, with a longer-term trend indicating continuance to 10,000. Confirmed close below 9,564.82 will, however, indicate a longer lasting pullback phase.

Frequently Asked Questions

The surged has stemmed from strong corporate earnings from key oil, companies and major exporters, a weaker pound, helping earnings overseas as well as general optimism over the likely outcome of the BoE decision.

It’s possible. It is a market showing strong momentum, and some analysts belief there could be a sharp gain of some substance by late 2025, assuming earnings hold up an oil prices remain strong.

With some three quarters of FTSE 100 earnings coming from overseas. If Sterling weakens those earnings will translate into stronger profits in GPT terms, and that is one of the great benefits of being a multinational.