- Discover FTSE 100 technical analysis, covering long and short-term insights. The latest updates on companies affecting the index performance.

FTSE 100 ended a five-day winning streak in yesterday’s session. While it’s expected for the London blue-chip index to be higher by 38 points on the futures market this morning, after having dropped almost 56 points to close at 9,256.8 yesterday.

Moreover, the rise in UK energy costs could help the FTSE 100 outperform, given the heavy weighting of energy companies in the index and the global nature of its constituents.

In this article, we will explore news related to the UK market and FTSE 100 companies that could affect the index’s pricing, along with the technical outlook for both the long and short term, highlighting key levels traders should watch. Finally, we will address important related questions.

UK Energy Costs Surge: Impact on FTSE 100 Performance

Ofgem, the UK regulator, announced that the new energy price cap of £ 1,755 will take effect from October in Great Britain. The previous cap of £1,720 in July through September, which means it rose by 2.0%. The figures exceed last week’s Cornwall Insight forecast, which projected a £17 rise in annual energy bills to £1,737.

Rising UK energy bills could benefit the FTSE 100 because the index has a heavy weighting in energy companies. Higher energy prices can boost their revenues and profits, potentially pushing the overall index higher, especially compared to other European markets with less energy sector exposure.

FTSE 100 Companies | JD Sports shares on the Rise

- JD Sports improved its sales trend in its US business during the second quarter, which pushed its shares up by as much as 5.5%. JD Sports Fashion announced a GBP 100 million share buyback, signaling confidence in medium-term industry growth, sustained market share gains, and strong execution.

- Prudential shares rose 8.6p to 983.2p, after announcing a 12% rise in half-year new business profit and setting out plans for improved shareholder returns over the next two years.

FTSE 100 is getting ready to return to form, ending a five-day winning streak in yesterday’s session. It’s expected to rise by 38 points in the futures market at today’s opening bell. Yesterday, it dropped almost 56 points to close at 9,256.8.

FTSE 100 Technical Outlook:

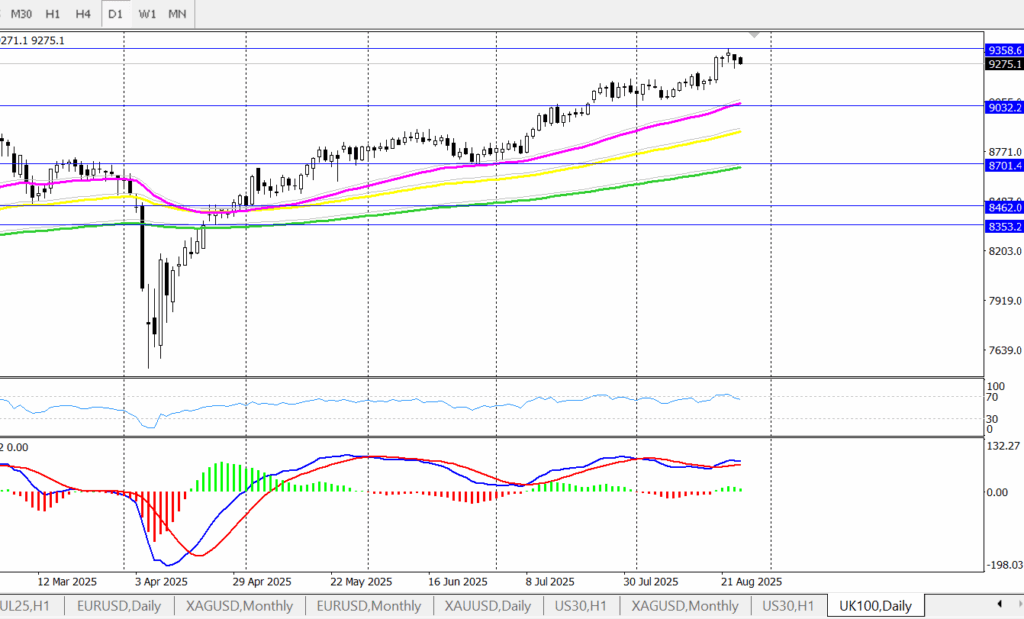

From the technical perspective, on the daily chart, the FTSE 100 represents a continued uptrend. The price corrected from its yesterday’s high at $ 9323.6 and is trading at the time of writing around $9278.6.

The index has remained in long-term consolidation since May 2025, staying above the 100-day moving average level of 8,459.6. Since July 2025, it has also stayed above the 50-day moving average at 8,701. It has continued its uptrend, reaching another level above the 50-day moving average at 9,032. The 9,032 level is considered a strong support for the index. These levels have not been tested since May 2025, confirming a strong long-term bullish trend.

On the daily timeframe, the RSI is showing an overbought signal, indicating a possible correction in the intraday. At the same time, the MACD is signaling an uptrend momentum.

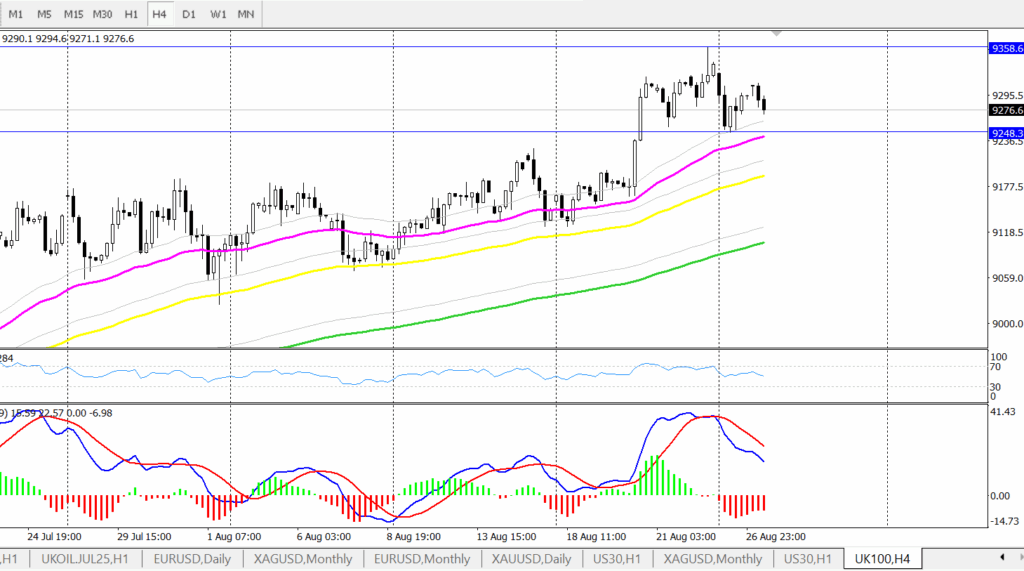

Thus, on the 4-hour timeframe, the correction is confirmed, with the MACD giving a signal for selling momentum through bearish crosses. The RSI is at mid-level, indicating that the correction may continue until the indicator signals oversold conditions or until the price reaches the resistance level at $9,248.

FTSE 100 | Daily Time Frame:

FTSE 100 | 4-Hour Time Frame:

FTSE 100 is also known as Footsie, stands for Financial Times Stock Exchange 100 Index. It’s an index of the largest 100 UK companies listed on the London Stock Exchange.

You can invest in the FTSE 100 through a CFD broker. You can easily trade in both directions, profiting from both rising and falling markets. You can access the market from anywhere, and there’s no need for large capital thanks to leverage, which allows you to control larger positions with relatively less capital.