- Dow Jones Index rose marginally in the aftermath of Fed rate announcement but has been declining since

- Fed officials sounded cautious in their recent decision making, raising the prospect of hawkishness in 2026

- Strong Q4 earnings could still provide the spark for a rebound

The Federal Reserve’s move to lower interest rates usually gets the stock market going, leading to more buying. Cheaper borrowing usually helps company profits, makes stocks look better than bonds, and generally helps the economy. But, the market’s quiet, sometimes even cautious, reaction to the latest rate cut has investors wondering: What does this mean for the Dow Jones Industrial Average (DJIA) if there’s less buying?

Making Sense of the Dow’s Unexpected Path

The Dow Jones Industrial Average (DJIA), initially jumped on the heels of the Fed decision, gaining almost 500 points and closing around 48,058. But, trading volumes have been lower than earlier in the year, suggesting a change in how people feel about the market.

Normally, lower rates encourage borrowing and investment, which pushes up stock prices. But with the Fed hinting at a possible pause, many wonder if the usual year-end boost will happen.

Another worry is that the central bank may be seeing signs of a weak economy, making them step in to prevent a bigger downturn. Fed officials have said that the December rate cut was partly to address a weakening job market and worries about global growth, as stated in the December FOMC statement.

The Case for a Santa Claus Rally

Historically, the Santa Claus Rally which includes the last five trading days of the year and the first two of January, has brought average gains of about 1.3% for the S&P 500 since 1950. If we get good news, like a solid November jobs report in mid-December that shows stable employment without causing inflation fears, it could spark buying interest again. A classic Santa Rally could then push the Dow toward or past its recent peak near 48,900.

While history suggests that the market tends to do well during this time, some recent analysis suggests that this pattern has become less reliable over the past two decades. Things like international tensions and changes in government policy add to the uncertainty. Meanwhile, Fed’s predictions of limited rate cuts have shifted the focus to the potential risks if the economy slows down more than expected.

Dow Jones Index Forecast

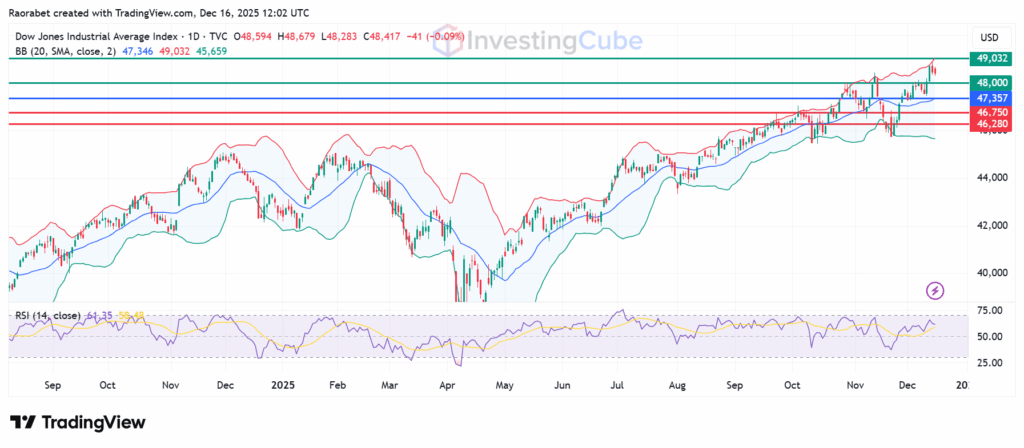

The daily Relative Strength Index (RSI) is flattening near the 50 level, failing to confirm the recent slight price gains, which suggests buying pressure is waning. Key support is around 47,700-47,800, aligning with recent points of change and the 50-day moving average. A drop below this level could lead to a fall to 47,000. On the other hand, resistance is capped at 48,800-49,000, close to all-time highs. A solid close above this area would signal renewed strength, potentially targeting 50,000.

Dow Jones Index daily chart on December 16, 2025 with Resistance and Support levels created on TradingView

Less buying might mean investors see the rate cut as the Fed trying to prevent something bad happening in the economy, instead of something to be happy about. This makes people worry more about the economy not growing than about lower loan costs.

For the Dow to really recover, something big needs to happen, such as companies earning way more than expected in the fourth quarter.

The biggest danger is bad news about the economy, like inflation suddenly rising a lot or people losing faith in the economy.